Pakistan is struggling to avoid a default. The country is in a desperate need of an economic lifeline through bailout funds from the IMF and has an urgent need to repay approximately $3 billion of debt by June, with an expected rollover of $4 billion.

However, what stands between Pakistan and the $1.1 billion loan tranche is IMF’s new demand of seeking written guarantees from bilateral partners to provide financing subsequent to the fund’s disbursement.

These countries include Saudi Arabia, the United Arab Emirates and Qatar. They have already provided assistance in recent months by rolling over debts, providing dollar deposits, and granting oil on credit.

The Industrial and Commercial Bank of China has also released $500 million to Pakistan as the first installment of a $1.3 billion loan.

Despite the possibility of a successful IMF program, Pakistan's financial situation remains precarious, as the country's external debt exceeds $130 billion, making it increasingly challenging to meet payment obligations.

Mounting Debt

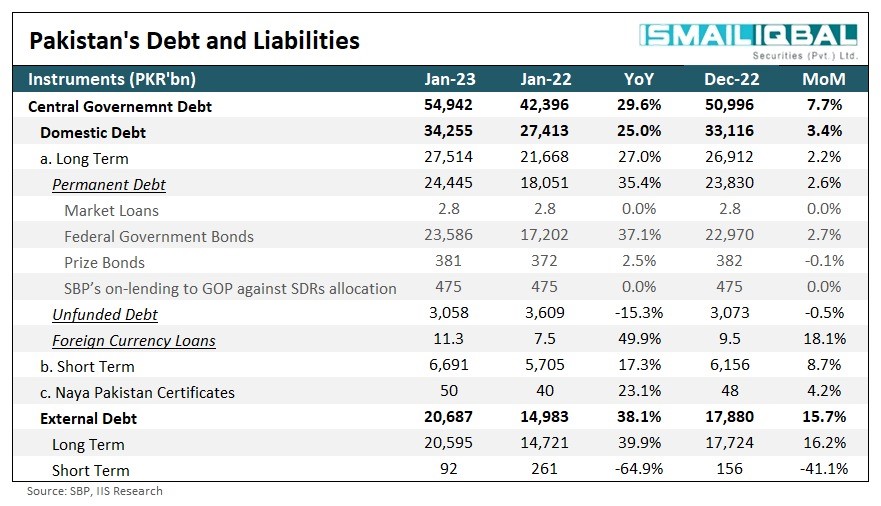

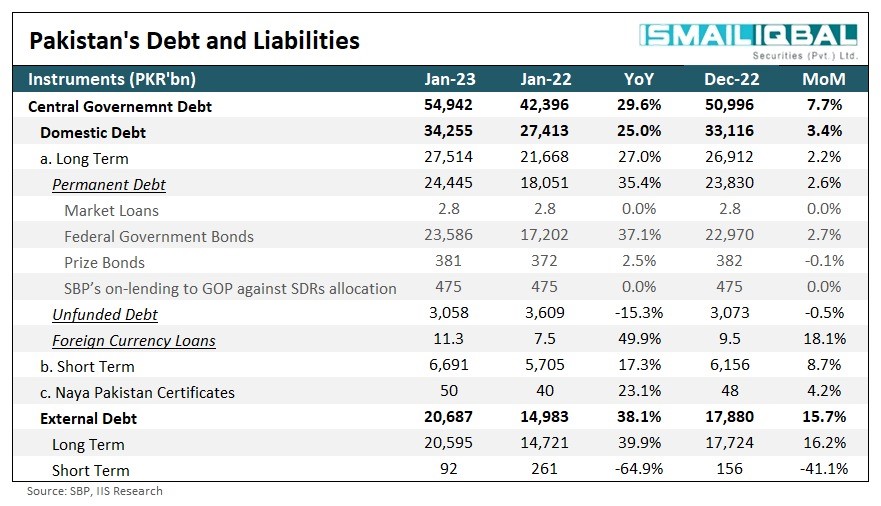

According to the recent data published by the State Bank of Pakistan, the central government's debt rose to approximately Rs55 trillion in January 2023, showing a 30 percent increase from the previous year.

The external debt liabilities alone increased by 38 percent year on year to close at around Rs20.7 trillion. In comparison, the domestic debt liabilities, primarily consisting of Pakistan Investment Bonds (PIBs) and Market Treasury Bills, grew by 25 percent.

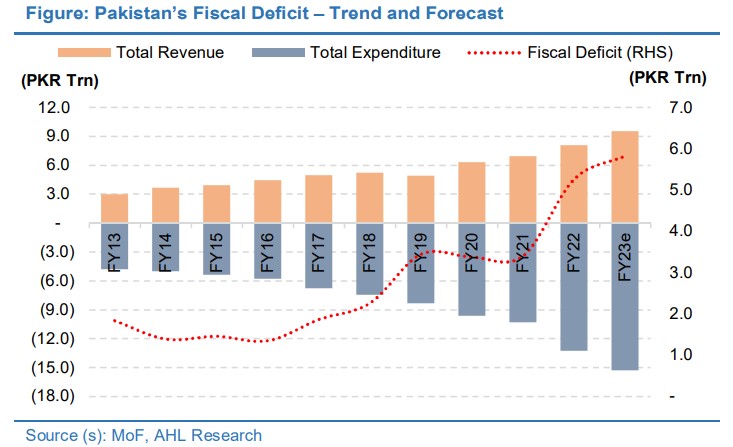

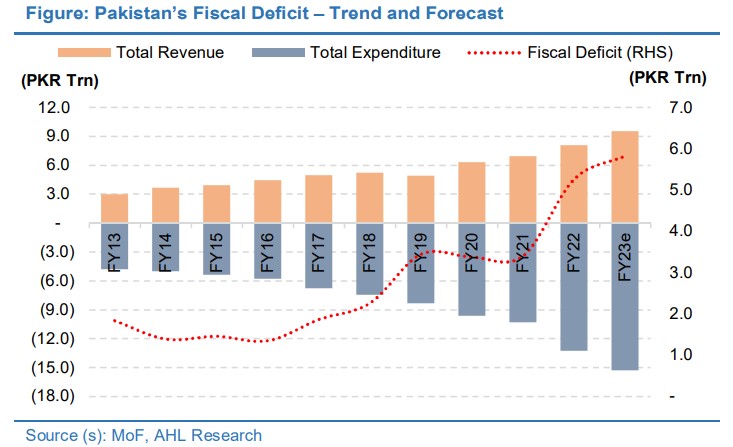

Due to the massive rupee devaluation over the past few months, the government’s external debt has soared. The successive interest rate hikes will cause a surge in interest servicing costs in the coming months. This would place an incremental burden on the federation and the fiscal deficit could expand. Debt servicing cost in the current fiscal year stands at Rs5.4 trillion which is around 54 percent of the total budget. Coupled with defence expenditure, it constitutes around 70 percent of the country’s budget.

Source: ARHL

The Consequence

Former Governor of State Bank of Pakistan, Murtaza Syed, in a panel discussion arranged by Tabadlab, opined that the country desperately needs debt relief as most of its revenues are exhausted in servicing the debt costs and leaves behind little room for development spending which would result in even tougher austerity measures in the coming days and could have a massive social cost.

It appears unlikely that the mounting pressures on Pakistan will ease any time soon, given that the country has repayment commitments of more than $70 billion over the next three fiscal years, including 2023.

“Crisis-hit Pakistan will need to pause debt repayments if it isn’t able to secure funding from the International Monetary Fund quickly enough,” reported the Bloomberg.

Pointing Fingers?

Amid all the chaos, some political analysts were quick to call out “friendly” countries on not cooperating with Pakistan in its difficult time. The countries being referred to primarily are China and Saudi Arabia.

Former Finance Minister Miftah Ismail stated that Pakistan owes around $30 billion, which constitutes approximately 30% of its foreign debt, to China. This amount can be broken down into $4 billion in deposits with the SBP, $5-6 billion in loans from Chinese state-owned commercial banks, and roughly $20 billion in project loans owed to China.

This time around, the Saudis are also not enthusiastic about providing any freebies to Pakistan. “Saudi Arabia's decision to refuse to provide any further bailouts or interest-free loans to Pakistan has left the government in Islamabad in shock and has prompted the finance minister to complain that even friendly countries aren’t keen on helping Pakistan out of its economic emergency,” reported the Middle East Eye.

Earlier, the Saudi Finance Minister in his recent address at the World Economic Forum stated that the Kingdom would now be more cautious while extending debt support to developing countries and would seek economic reforms in the recipient nation for a sustainable debt profile.

The Bank of America team and many analysts believe that China holds the key to rescuing Pakistan from its financial crisis. However, it's worth questioning the likelihood of China providing preferential treatment to Pakistan, as they have also lent to other developing countries. Granting special privileges to Pakistan could create problems with other countries that seek similar concessions from China.

“A rapidly deteriorating economy, with limited support from countries like the United States, is likely to increase Chinese leverage over Pakistan, forcing the latter to yield to Chinese requests that both expand Chinese influence in the Arabian Sea and also in the Himalayas, where the Chinese have built significant infrastructure to connect Gilgit-Baltistan to Xinjiang,” wrote Economist Uzair Younus, in an article for the Atlantic Council.

Hence, it appears that the country has no alternative, and the only solution is a massive reform-driven course correction.

However, what stands between Pakistan and the $1.1 billion loan tranche is IMF’s new demand of seeking written guarantees from bilateral partners to provide financing subsequent to the fund’s disbursement.

These countries include Saudi Arabia, the United Arab Emirates and Qatar. They have already provided assistance in recent months by rolling over debts, providing dollar deposits, and granting oil on credit.

The Industrial and Commercial Bank of China has also released $500 million to Pakistan as the first installment of a $1.3 billion loan.

Despite the possibility of a successful IMF program, Pakistan's financial situation remains precarious, as the country's external debt exceeds $130 billion, making it increasingly challenging to meet payment obligations.

Mounting Debt

According to the recent data published by the State Bank of Pakistan, the central government's debt rose to approximately Rs55 trillion in January 2023, showing a 30 percent increase from the previous year.

The external debt liabilities alone increased by 38 percent year on year to close at around Rs20.7 trillion. In comparison, the domestic debt liabilities, primarily consisting of Pakistan Investment Bonds (PIBs) and Market Treasury Bills, grew by 25 percent.

Due to the massive rupee devaluation over the past few months, the government’s external debt has soared. The successive interest rate hikes will cause a surge in interest servicing costs in the coming months. This would place an incremental burden on the federation and the fiscal deficit could expand. Debt servicing cost in the current fiscal year stands at Rs5.4 trillion which is around 54 percent of the total budget. Coupled with defence expenditure, it constitutes around 70 percent of the country’s budget.

Source: ARHL

The Consequence

Former Governor of State Bank of Pakistan, Murtaza Syed, in a panel discussion arranged by Tabadlab, opined that the country desperately needs debt relief as most of its revenues are exhausted in servicing the debt costs and leaves behind little room for development spending which would result in even tougher austerity measures in the coming days and could have a massive social cost.

It appears unlikely that the mounting pressures on Pakistan will ease any time soon, given that the country has repayment commitments of more than $70 billion over the next three fiscal years, including 2023.

“Crisis-hit Pakistan will need to pause debt repayments if it isn’t able to secure funding from the International Monetary Fund quickly enough,” reported the Bloomberg.

Pointing Fingers?

Amid all the chaos, some political analysts were quick to call out “friendly” countries on not cooperating with Pakistan in its difficult time. The countries being referred to primarily are China and Saudi Arabia.

Former Finance Minister Miftah Ismail stated that Pakistan owes around $30 billion, which constitutes approximately 30% of its foreign debt, to China. This amount can be broken down into $4 billion in deposits with the SBP, $5-6 billion in loans from Chinese state-owned commercial banks, and roughly $20 billion in project loans owed to China.

This time around, the Saudis are also not enthusiastic about providing any freebies to Pakistan. “Saudi Arabia's decision to refuse to provide any further bailouts or interest-free loans to Pakistan has left the government in Islamabad in shock and has prompted the finance minister to complain that even friendly countries aren’t keen on helping Pakistan out of its economic emergency,” reported the Middle East Eye.

Earlier, the Saudi Finance Minister in his recent address at the World Economic Forum stated that the Kingdom would now be more cautious while extending debt support to developing countries and would seek economic reforms in the recipient nation for a sustainable debt profile.

The Bank of America team and many analysts believe that China holds the key to rescuing Pakistan from its financial crisis. However, it's worth questioning the likelihood of China providing preferential treatment to Pakistan, as they have also lent to other developing countries. Granting special privileges to Pakistan could create problems with other countries that seek similar concessions from China.

“A rapidly deteriorating economy, with limited support from countries like the United States, is likely to increase Chinese leverage over Pakistan, forcing the latter to yield to Chinese requests that both expand Chinese influence in the Arabian Sea and also in the Himalayas, where the Chinese have built significant infrastructure to connect Gilgit-Baltistan to Xinjiang,” wrote Economist Uzair Younus, in an article for the Atlantic Council.

Hence, it appears that the country has no alternative, and the only solution is a massive reform-driven course correction.