The ongoing spring meetings of the World Bank Group and International Monetary Fund (IMF) in Washington D.C. have on their agenda a crucial subject: addressing the rapidly developing global economic crisis, particularly the escalating cost of living and debt woes faced by developing nations in the global South. The outcome of these meetings is of paramount significance for Pakistan and other developing countries that are grappling with unprecedented economic pressures due to exogenous shocks and escalating external debt levels.

While it looks like Pakistan is nearing the resumption of the IMF program, this does not mean that the country is out of hot water. If anything, the problem has just begun, and, much like our history, we need to look elsewhere for developments that can pull us out of this mess.

The Debt Problem

If one starts to list the economic challenges faced by the country, the high level of debt should be at the top of the list.

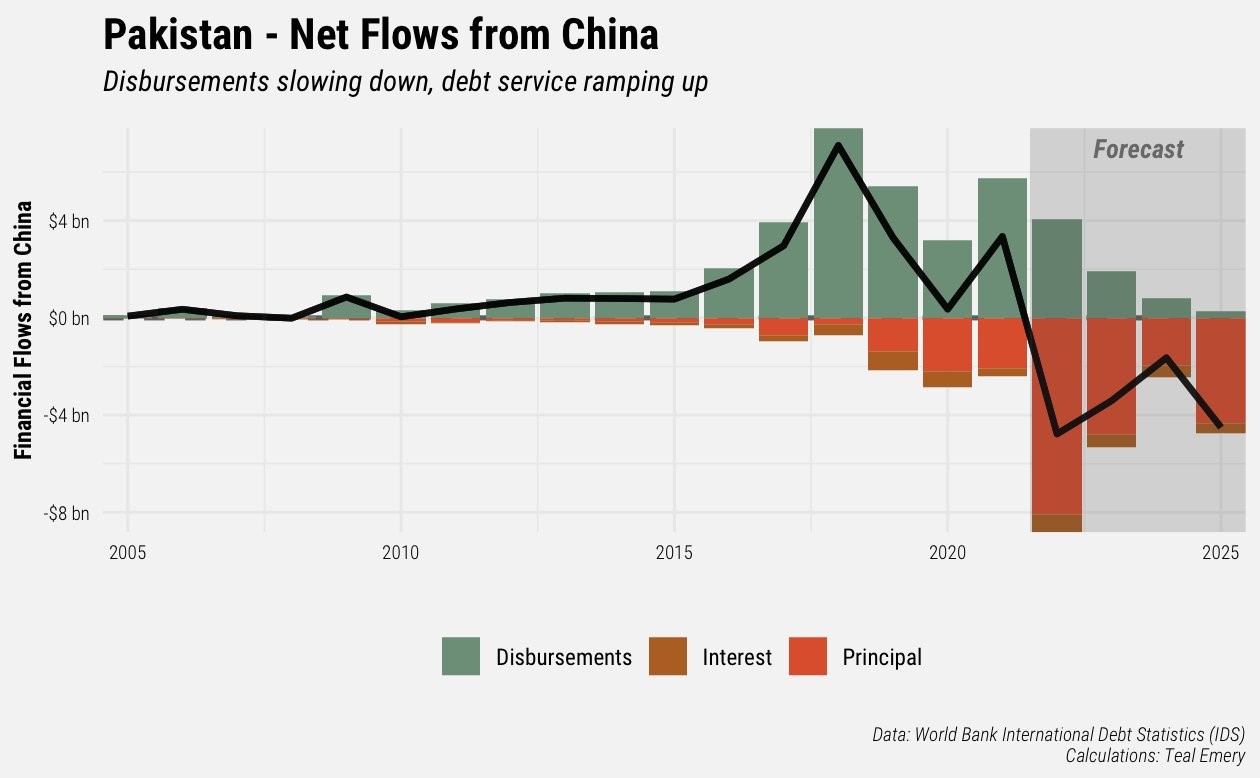

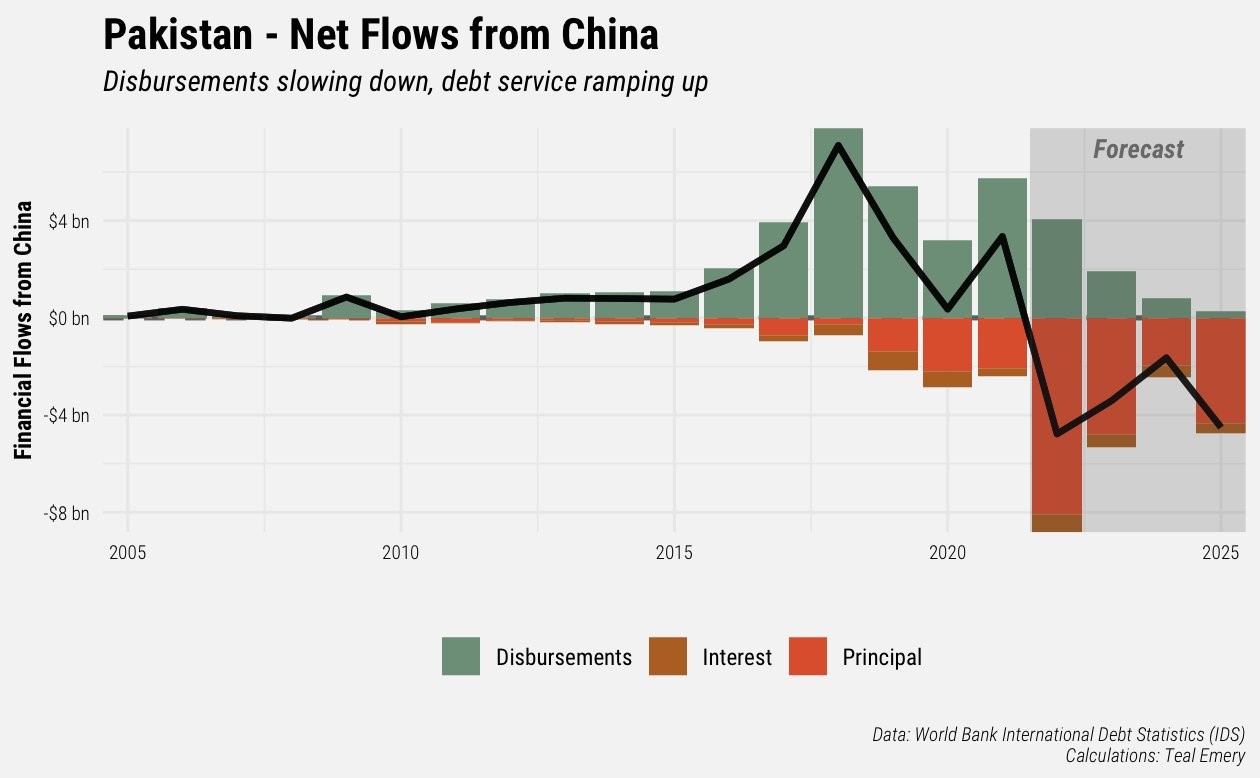

Pakistan's total external debt and liabilities stood at $126.3 billion in December 2022, with the central government accumulating $97.5 billion of it. Multilateral institutions, including the World Bank, the Asian Development Bank, and the IMF, account for a significant portion of the debt, amounting to around $45 billion. The Paris Club countries are owed $8.5 billion, while Euro bonds and Sukuks account for $7.8 billion of the debt. Commercial loans make up around $7 billion of the total debt. Chinese lending, both private and bilateral, contributes approximately 30% to the central government's total debt profile.

These are significant numbers for a country that has a GDP of around $350 billion. Further, it creates a massive external financing need for the country in the near term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

The Consequences

As per a recent report by the IMF, “Many countries will need a tight fiscal stance to support the ongoing disinflation process—especially if high inflation proves more persistent. Tighter fiscal policy would allow central banks to increase interest rates by less than they otherwise would, which would help contain borrowing costs for governments and keep financial vulnerabilities in check.”

“Tighter fiscal policies require better targeted safety nets to protect the most vulnerable households, including addressing food insecurity, while containing overall spending growth, as governments are likely to confront social pressures to compensate for past increases in the cost of living,” the report further added.

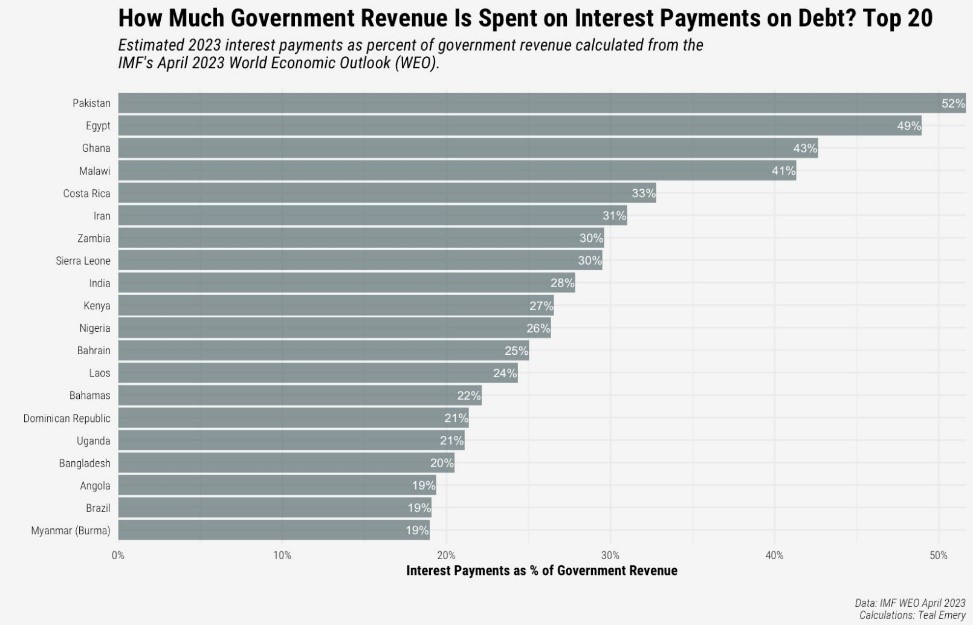

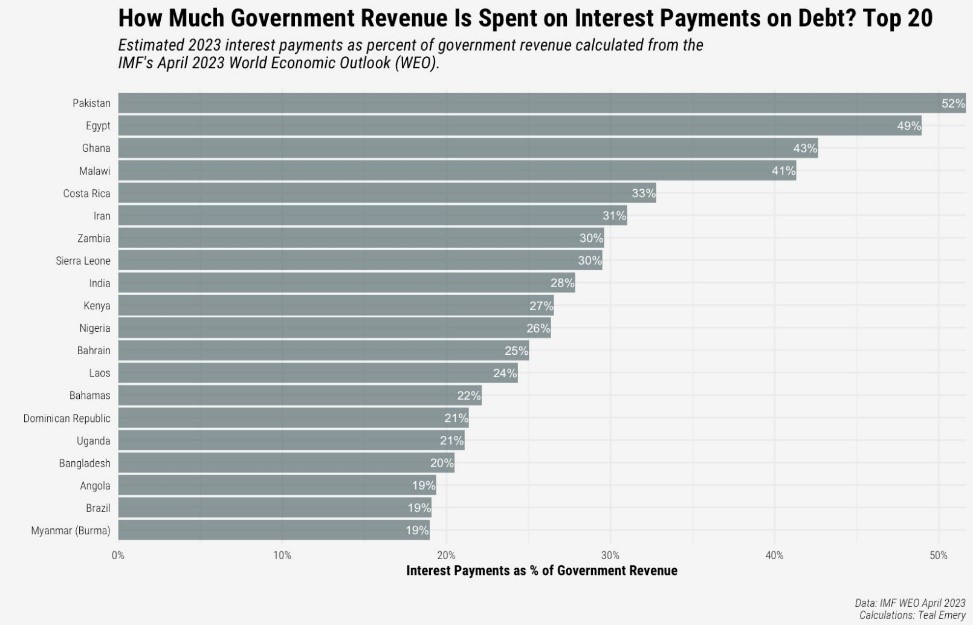

Pakistan is facing a similar situation like the one mentioned above, where the central bank has been raising the policy rate for the past year, and the government is attempting to handle the fiscal deficit. As a result, the cost of servicing debt has risen significantly, and it now accounts for more than 50% of the government's revenue.

This leaves behind very little to spend on development and the country’s lowest economic strata would probably be the most severely impacted. In an interview, Economist Dr. Aqdas Afzal stressed on the importance of expanding the current social assistance framework of the Benazir Income Support Program (BISP). According to Dr. Afzal, the government may need to offer additional aid in the form of food stamps and rent payments to further assist those that are most vulnerable in the current economic scenario.

Therefore, the question arises if the government should continue to service its debt at the cost of the Pakistani population’s standards of living?

"I don't think we are going to have many defaults - the cost of default is very high. What we are going to see is that unsustainable debt service is going to lead to development crises rather than debt crises. There will be default for future generations, cutting back on investments for the future," Masood Ahmed, President of Center for Global Development, stated in a recent conference.

For Pakistan, the answer to this question lies in its ability to restructure debt which in part depends on the willingness of its two major creditors, multilateral development banks (MDBs) and China.

“The Western-led commercial creditors and multilateral financial institutions are the basic creditors for developing countries, so China calls for a concerted effort of all parties to play a constructive role on the economic and social developments of Pakistan,” reported the Bloomberg.

As per a panel discussion organized by the Economic Advisory Group which included Dr. Mohammed Ahmed Zubair, Dr. Ahmed Pirzada and Javed Hassan, the process of restructuring sovereign debt can be separated into three steps: initiation, negotiation, and implementation. Initiation begins with the government approaching the IMF for a Debt Sustainability Analysis (DSA) to determine the gross government debt and primary surpluses required to make the debt sustainable, as well as potential sources of external financing.

Negotiations then take place with major creditors such as the Paris Club, World Bank, China, Saudi Arabia, and commercial creditors, with the guidance of established bilateral frameworks like the G20 Common Framework. During this stage, all creditors must be offered comparable treatment as urged by the G20’s framework, and a committee of creditors is also formed. Lastly, implementation of the restructuring process can take time. As per the Financial Times, the process is taking three times as long as in previous decades in part because of highly complex negotiations between China, the world’s largest bilateral lender, other bilateral and multilateral creditors and private bondholders.

What do the IMF-WB meetings hold for Pakistan?

Pakistan, given its current situation, would be hoping that the IMF-WB meetings yield results in the form of an amicable solution for the debt relief of distressed nations.

“The Global Sovereign Debt Roundtable (GSDR) met today (12th April) and discussed debt sustainability and debt restructuring challenges and ways to address them. We are grateful to all the participants that included Paris Club and non-Paris Club creditors, debtor countries, and representatives of the private sector. The discussion focused on the actions that can be taken now to accelerate debt restructuring processes and make them more efficient, including under the G20 Common Framework,” read a press release from the IMF.

“The meeting discussed the role of Multilateral Development Banks (MDBs) in these processes through the provision of net positive flows of concessional finance. The International Development Association’s (IDA) provision of positive net flows and the ex-ante implicit debt relief through increased concessionality and grants to countries facing higher risks of debt distress was welcomed,” it added.

While it looks like Pakistan is nearing the resumption of the IMF program, this does not mean that the country is out of hot water. If anything, the problem has just begun, and, much like our history, we need to look elsewhere for developments that can pull us out of this mess.

The Debt Problem

If one starts to list the economic challenges faced by the country, the high level of debt should be at the top of the list.

Pakistan's total external debt and liabilities stood at $126.3 billion in December 2022, with the central government accumulating $97.5 billion of it. Multilateral institutions, including the World Bank, the Asian Development Bank, and the IMF, account for a significant portion of the debt, amounting to around $45 billion. The Paris Club countries are owed $8.5 billion, while Euro bonds and Sukuks account for $7.8 billion of the debt. Commercial loans make up around $7 billion of the total debt. Chinese lending, both private and bilateral, contributes approximately 30% to the central government's total debt profile.

These are significant numbers for a country that has a GDP of around $350 billion. Further, it creates a massive external financing need for the country in the near term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

The Consequences

As per a recent report by the IMF, “Many countries will need a tight fiscal stance to support the ongoing disinflation process—especially if high inflation proves more persistent. Tighter fiscal policy would allow central banks to increase interest rates by less than they otherwise would, which would help contain borrowing costs for governments and keep financial vulnerabilities in check.”

“Tighter fiscal policies require better targeted safety nets to protect the most vulnerable households, including addressing food insecurity, while containing overall spending growth, as governments are likely to confront social pressures to compensate for past increases in the cost of living,” the report further added.

Pakistan is facing a similar situation like the one mentioned above, where the central bank has been raising the policy rate for the past year, and the government is attempting to handle the fiscal deficit. As a result, the cost of servicing debt has risen significantly, and it now accounts for more than 50% of the government's revenue.

This leaves behind very little to spend on development and the country’s lowest economic strata would probably be the most severely impacted. In an interview, Economist Dr. Aqdas Afzal stressed on the importance of expanding the current social assistance framework of the Benazir Income Support Program (BISP). According to Dr. Afzal, the government may need to offer additional aid in the form of food stamps and rent payments to further assist those that are most vulnerable in the current economic scenario.

Therefore, the question arises if the government should continue to service its debt at the cost of the Pakistani population’s standards of living?

"I don't think we are going to have many defaults - the cost of default is very high. What we are going to see is that unsustainable debt service is going to lead to development crises rather than debt crises. There will be default for future generations, cutting back on investments for the future," Masood Ahmed, President of Center for Global Development, stated in a recent conference.

For Pakistan, the answer to this question lies in its ability to restructure debt which in part depends on the willingness of its two major creditors, multilateral development banks (MDBs) and China.

“The Western-led commercial creditors and multilateral financial institutions are the basic creditors for developing countries, so China calls for a concerted effort of all parties to play a constructive role on the economic and social developments of Pakistan,” reported the Bloomberg.

As per a panel discussion organized by the Economic Advisory Group which included Dr. Mohammed Ahmed Zubair, Dr. Ahmed Pirzada and Javed Hassan, the process of restructuring sovereign debt can be separated into three steps: initiation, negotiation, and implementation. Initiation begins with the government approaching the IMF for a Debt Sustainability Analysis (DSA) to determine the gross government debt and primary surpluses required to make the debt sustainable, as well as potential sources of external financing.

Negotiations then take place with major creditors such as the Paris Club, World Bank, China, Saudi Arabia, and commercial creditors, with the guidance of established bilateral frameworks like the G20 Common Framework. During this stage, all creditors must be offered comparable treatment as urged by the G20’s framework, and a committee of creditors is also formed. Lastly, implementation of the restructuring process can take time. As per the Financial Times, the process is taking three times as long as in previous decades in part because of highly complex negotiations between China, the world’s largest bilateral lender, other bilateral and multilateral creditors and private bondholders.

What do the IMF-WB meetings hold for Pakistan?

Pakistan, given its current situation, would be hoping that the IMF-WB meetings yield results in the form of an amicable solution for the debt relief of distressed nations.

“The Global Sovereign Debt Roundtable (GSDR) met today (12th April) and discussed debt sustainability and debt restructuring challenges and ways to address them. We are grateful to all the participants that included Paris Club and non-Paris Club creditors, debtor countries, and representatives of the private sector. The discussion focused on the actions that can be taken now to accelerate debt restructuring processes and make them more efficient, including under the G20 Common Framework,” read a press release from the IMF.

“The meeting discussed the role of Multilateral Development Banks (MDBs) in these processes through the provision of net positive flows of concessional finance. The International Development Association’s (IDA) provision of positive net flows and the ex-ante implicit debt relief through increased concessionality and grants to countries facing higher risks of debt distress was welcomed,” it added.