The Existential Crisis

Pakistan, a nuclear-armed country with the world’s fifth-largest population (median age is 23) and one of the fastest urbanisation rates, is facing its worst economic crisis since 1998 when it froze foreign currency bank accounts to avert a default. 34 per cent of the population lives on just $3.2 a day income and has been hit by double-digit inflation which is the third-highest among the major economies of the world.

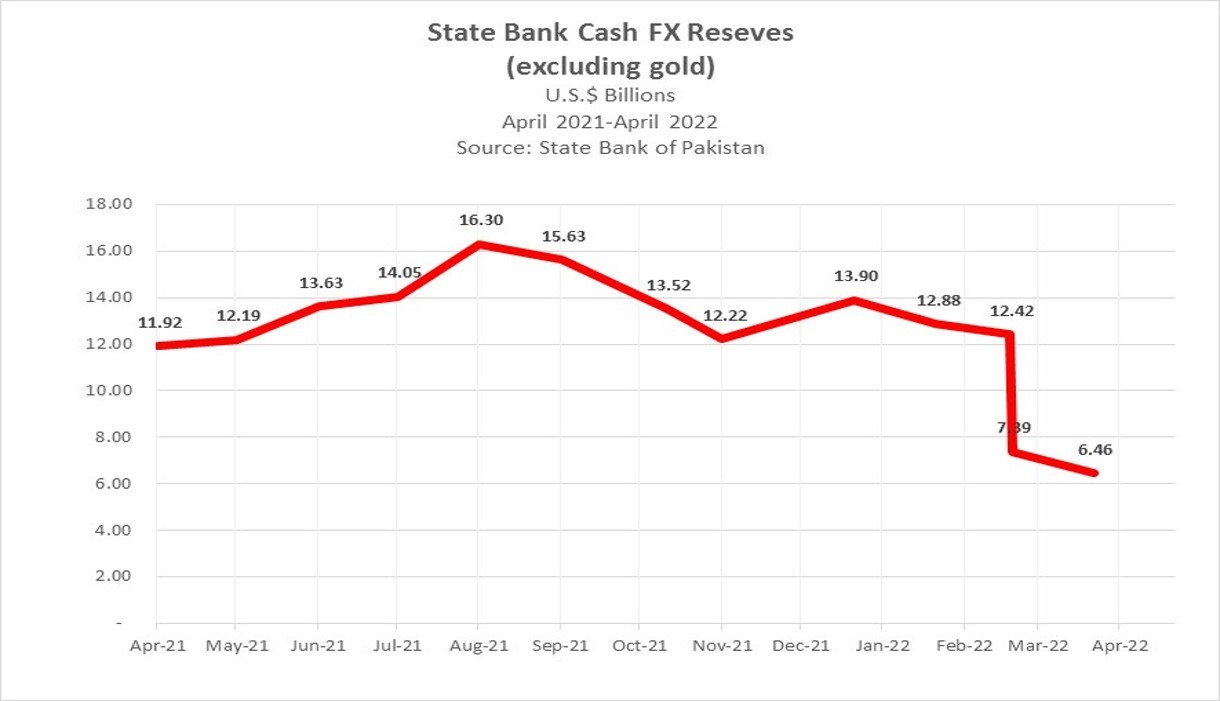

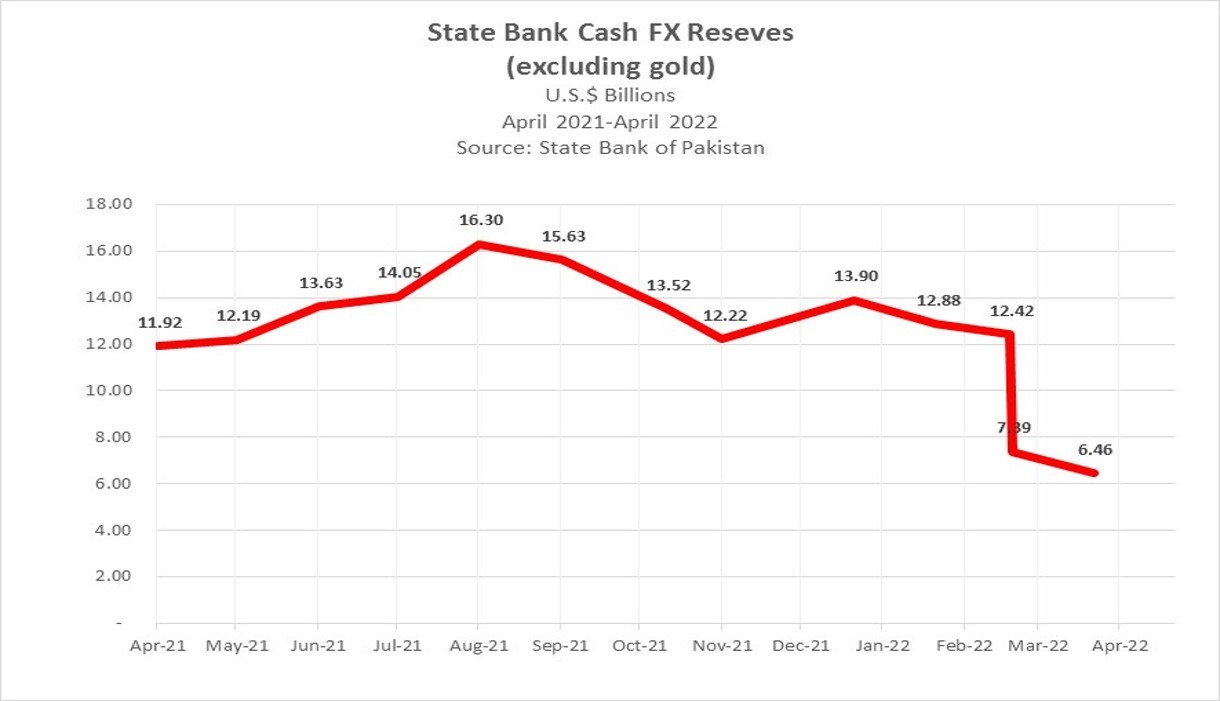

Pakistan’s central bank foreign exchange cash reserves (excluding gold) have dropped to just $6.5 billion or by nearly 50 per cent since the end of February, barely enough to cover just a few weeks of imports. The currency is under pressure and has dropped by 6 per cent this year.

The economic crisis threatens to do irreparable damage given that Imran Khan is pushing Pakistan to the brink and his party has issued threats of even civil war in a clear and shocking disregard for the potentially catastrophic consequences their war on the state - in a naked, blatant, and unconstitutional pursuit of power- may lead to.

Fundamental Reasons

Pakistan Human Development Report published by the United Nations in 2021 found that the economic privileges accorded to Pakistan’s elite groups, including the corporate sector, feudal landlords, and the country’s powerful military, add up to an estimated $17.4bn, or roughly 6 per cent of the country’s economy.

The biggest beneficiary of the privileges – in the form of tax breaks, cheap input prices, higher output prices or preferential access to capital, land and services – was found to be the country’s corporate sector, which accrued an estimated $4.7bn in privileges, the report said.

Imran Khan or others for that matter don't talk about the corporate sector whose representatives are with every government and represent a serious obstacle to reforms. They include Dawoods, Manshas, Tareens, Engros, Fauji Foundation, etc.

The protectionist political economy of Pakistan is dominated by the military establishment and special interests and represents the biggest obstacle to reform. The cumulative effect of the policy distortions has been a hugely disproportionate allocation of national resources to unproductive investments in land and property.

According to the IMF, Pakistan's exports as a share of GDP have declined over the past decade as export volume growth has stagnated amid considerable de-industrialization. Consequently, Pakistan's share in global trade has steadily declined. The export basket lacks technological sophistication and is concentrated on primary goods at the lowest rungs of the value chain. Pakistani exports are moreover susceptible to high volatility due to terms of trade shocks and face growing competition from lower-cost economies.

In short, a rent-seeking economy driven by tax exemptions and concessions is not competitive internationally and is the primary reason for the country’s recurring balance of payments crises. Since Pakistan’s exports have not grown compared to its competitors, it is especially vulnerable to oil price shocks given its huge dependence on imported fuel.

India surpassed $400 billion in exports in FY2022, an all-time high, comfortably higher than the five-year average of $300 billion before coronavirus struck. India’s FX reserves at nearly $600 billion, are the world’s fourth-largest.

Bangladesh’s export earnings in July-April of the current financial year 2021-22 stood at $43.34 billion (Pakistan $26.2 billion) with a 35.14-per cent growth (Pakistan 25.5 per cent) compared with that of $32.07 billion in the same period of FY 2020-21.

Both India and Bangladesh have left Pakistan decades behind despite the pervasive corruption and their chaotic democracies. The main reasons are political stability and a comparatively higher level of human development, especially the female literacy rate and more participation of women in the workforce. While these are longer-term issues, I would like to focus on the immediate challenge: the energy crisis.

The Current Crisis

This oil price chart from mid-2013 to date is critical to understanding volatility in Pakistan’s import bill and balance of trade.

Oil prices collapsed between 2013 and 2016 and dropped by more than 50%, from $108 in 2013 to $43 in 2016. Pakistan’s external account improved and the rupee was stable. Oil prices bottomed out in 2016 and started rising again.

Fast forward to 2021-22. Pakistan’s trade deficit crossed $39 billion in the first 10 months (July 2021-April 2022) of the current fiscal year, as the pace of increase in imports was double the surge in exports, causing a rapid decline in Pakistan’s foreign exchange reserves.

See SBP reserves (excluding -gold) chart for 12 months. The peak level was in August 2021. The reason for the gradual decline since August 2021 was the current account deficit, which was $13.2 billion from July 2021-March 2022 vs $0.3 billion during July 2020-March 2021.

Oil imports almost doubled to $14.8bn for 9 months from July 2021 to March 2022. This $7.3bn increase in oil imports represented 55% of the current account deficit of $13.2bn for the period. The energy crisis lies at the core of the recent deterioration in Pakistan’s reserves and consequently in the value of the rupee against the U.S. dollar.

Past Policy Responses

In the past, Pakistan’s main policy response has been to borrow more without making any major effort to reform the economy and remove huge distortions.

Now, even friendly countries like China and Saudi Arabia are not willing to provide more aid unless Pakistan reaches an agreement with the IMF.

Pakistan owes $4.2 billion in bilateral credits to Saudi Arabia. Pakistan owes China $4.3 billion in short term loans in addition to the expensive loans obtained to finance the power plants built under the China-Pakistan Economic Corridor Programme (CPEC). The Chinese companies have pushed Pakistan to clear overdue payments of around Rs300 billion ($1.5 billion). China is now Pakistan’s largest creditor with a total exposure of more than $25 billion, or nearly one-quarter of its total public debt.

Pakistan’s chronic economic issues are affecting the viability of state structures, and can no longer be addressed by prescriptions offered by conventional thinking (of both local and foreign experts), because it mostly focuses on the symptoms, while the rot has turned into a gangrenous mess.

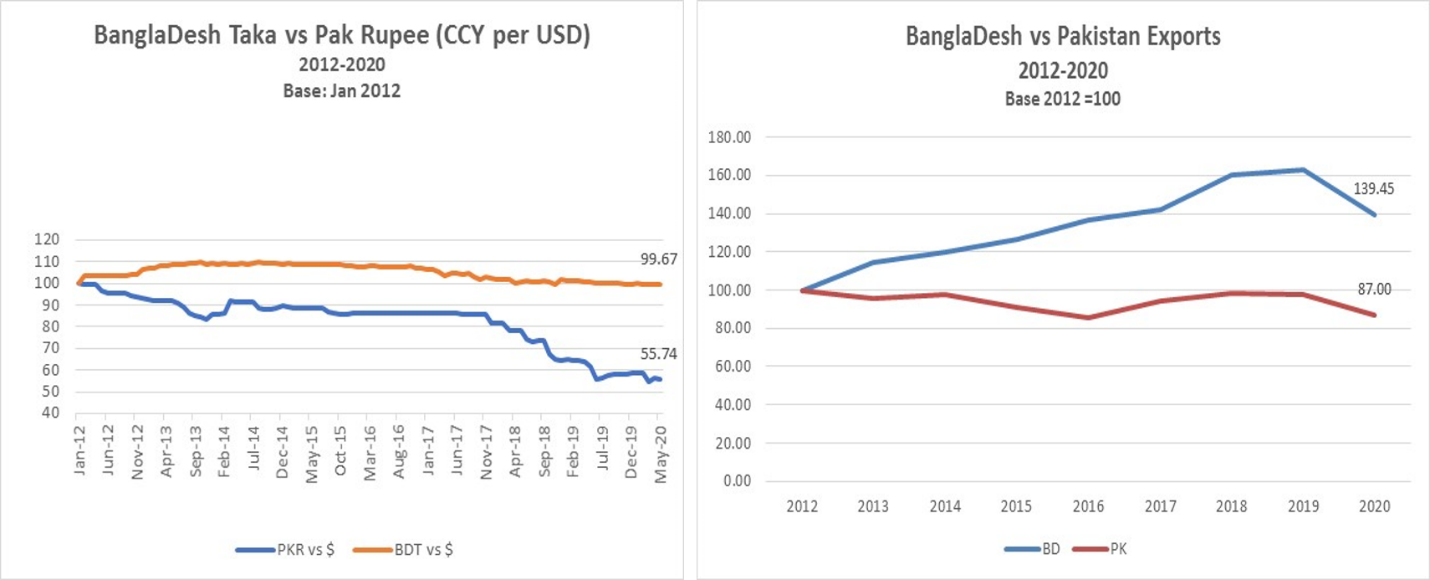

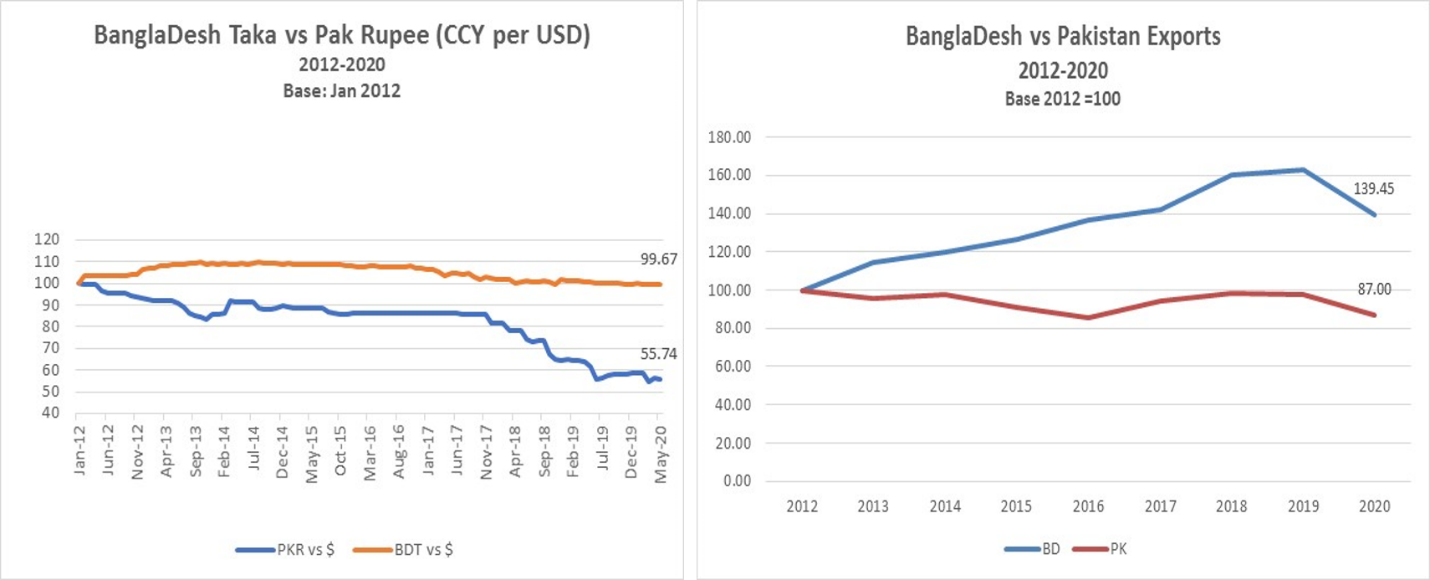

For example, Atif Mian exaggerated the importance of the exchange rate impact on exports. According to a World Bank study: "results show that every 10% bilateral real appreciation leads to a decline in exports to that destination by 0.68%, while every 10 % bilateral real depreciation leads to an increase in exports of 0.51%.”

From 2012 to 2020, the Bangladesh currency dropped barely 1% against the USD, and Pak Rs went down by 45%. BD exports were up 39% in 2020 compared to 2012 and Pakistan's were down by 13%. (Source: World Bank data). Why? Bangladesh has focused on value-added exports and Pakistan’s exports are dominated by low-value-added commodity exports like yarn and cloth.

The argument for using just the exchange rate as a policy response to Pakistan’s recurring external account crises is not supported by studies or empirical evidence.

Another policy response has been to use monetary policy, notably by increasing interest rates. This too is debatable and problematic. Why?

An IMF study on India stated that “tightening of monetary policy had little effect on the aggregate demand or inflation. It also noted that “the response of the exchange rate to monetary policy shocks is in the right direction but the magnitude is very small.” The IMF paper concluded that “tightening of monetary policy and pass-through to lending rates is only partial and exchange rate effects are weak. We could find no significant effects on real output or the inflation rate."

Given this overall background and the gravity of Pakistan’s current economic crisis, we must take measures to (a) stop the bleeding of foreign exchange reserves and fall in the rupee value, and (b) initiate reforms to remove fundamental reasons.

What Must be Done Now

My five-point economic plan focuses on addressing immediate and near-term issues.

Lot more will need to be done but the current government’s position is weak and the policy choices are limited. However, any further delay in corrective steps would aggravate the crisis and could prove to be very costly if the foreign exchange reserves continue to drop and rupee crosses 200 level against the U.S. dollar.

Pakistan, a nuclear-armed country with the world’s fifth-largest population (median age is 23) and one of the fastest urbanisation rates, is facing its worst economic crisis since 1998 when it froze foreign currency bank accounts to avert a default. 34 per cent of the population lives on just $3.2 a day income and has been hit by double-digit inflation which is the third-highest among the major economies of the world.

Pakistan’s central bank foreign exchange cash reserves (excluding gold) have dropped to just $6.5 billion or by nearly 50 per cent since the end of February, barely enough to cover just a few weeks of imports. The currency is under pressure and has dropped by 6 per cent this year.

The economic crisis threatens to do irreparable damage given that Imran Khan is pushing Pakistan to the brink and his party has issued threats of even civil war in a clear and shocking disregard for the potentially catastrophic consequences their war on the state - in a naked, blatant, and unconstitutional pursuit of power- may lead to.

Fundamental Reasons

Pakistan Human Development Report published by the United Nations in 2021 found that the economic privileges accorded to Pakistan’s elite groups, including the corporate sector, feudal landlords, and the country’s powerful military, add up to an estimated $17.4bn, or roughly 6 per cent of the country’s economy.

The biggest beneficiary of the privileges – in the form of tax breaks, cheap input prices, higher output prices or preferential access to capital, land and services – was found to be the country’s corporate sector, which accrued an estimated $4.7bn in privileges, the report said.

Imran Khan or others for that matter don't talk about the corporate sector whose representatives are with every government and represent a serious obstacle to reforms. They include Dawoods, Manshas, Tareens, Engros, Fauji Foundation, etc.

Pakistan Human Development Report published by the United Nations in 2021 found that the economic privileges accorded to Pakistan’s elite groups, including the corporate sector, feudal landlords, and the country’s powerful military, add up to an estimated $17.4bn, or roughly 6 per cent of the country’s economy.

The protectionist political economy of Pakistan is dominated by the military establishment and special interests and represents the biggest obstacle to reform. The cumulative effect of the policy distortions has been a hugely disproportionate allocation of national resources to unproductive investments in land and property.

According to the IMF, Pakistan's exports as a share of GDP have declined over the past decade as export volume growth has stagnated amid considerable de-industrialization. Consequently, Pakistan's share in global trade has steadily declined. The export basket lacks technological sophistication and is concentrated on primary goods at the lowest rungs of the value chain. Pakistani exports are moreover susceptible to high volatility due to terms of trade shocks and face growing competition from lower-cost economies.

In short, a rent-seeking economy driven by tax exemptions and concessions is not competitive internationally and is the primary reason for the country’s recurring balance of payments crises. Since Pakistan’s exports have not grown compared to its competitors, it is especially vulnerable to oil price shocks given its huge dependence on imported fuel.

India surpassed $400 billion in exports in FY2022, an all-time high, comfortably higher than the five-year average of $300 billion before coronavirus struck. India’s FX reserves at nearly $600 billion, are the world’s fourth-largest.

Bangladesh’s export earnings in July-April of the current financial year 2021-22 stood at $43.34 billion (Pakistan $26.2 billion) with a 35.14-per cent growth (Pakistan 25.5 per cent) compared with that of $32.07 billion in the same period of FY 2020-21.

Both India and Bangladesh have left Pakistan decades behind despite the pervasive corruption and their chaotic democracies. The main reasons are political stability and a comparatively higher level of human development, especially the female literacy rate and more participation of women in the workforce. While these are longer-term issues, I would like to focus on the immediate challenge: the energy crisis.

The Current Crisis

This oil price chart from mid-2013 to date is critical to understanding volatility in Pakistan’s import bill and balance of trade.

Oil prices collapsed between 2013 and 2016 and dropped by more than 50%, from $108 in 2013 to $43 in 2016. Pakistan’s external account improved and the rupee was stable. Oil prices bottomed out in 2016 and started rising again.

Fast forward to 2021-22. Pakistan’s trade deficit crossed $39 billion in the first 10 months (July 2021-April 2022) of the current fiscal year, as the pace of increase in imports was double the surge in exports, causing a rapid decline in Pakistan’s foreign exchange reserves.

See SBP reserves (excluding -gold) chart for 12 months. The peak level was in August 2021. The reason for the gradual decline since August 2021 was the current account deficit, which was $13.2 billion from July 2021-March 2022 vs $0.3 billion during July 2020-March 2021.

Oil imports almost doubled to $14.8bn for 9 months from July 2021 to March 2022. This $7.3bn increase in oil imports represented 55% of the current account deficit of $13.2bn for the period. The energy crisis lies at the core of the recent deterioration in Pakistan’s reserves and consequently in the value of the rupee against the U.S. dollar.

Past Policy Responses

In the past, Pakistan’s main policy response has been to borrow more without making any major effort to reform the economy and remove huge distortions.

Now, even friendly countries like China and Saudi Arabia are not willing to provide more aid unless Pakistan reaches an agreement with the IMF.

Pakistan owes $4.2 billion in bilateral credits to Saudi Arabia. Pakistan owes China $4.3 billion in short term loans in addition to the expensive loans obtained to finance the power plants built under the China-Pakistan Economic Corridor Programme (CPEC). The Chinese companies have pushed Pakistan to clear overdue payments of around Rs300 billion ($1.5 billion). China is now Pakistan’s largest creditor with a total exposure of more than $25 billion, or nearly one-quarter of its total public debt.

Pakistan’s chronic economic issues are affecting the viability of state structures, and can no longer be addressed by prescriptions offered by conventional thinking (of both local and foreign experts), because it mostly focuses on the symptoms, while the rot has turned into a gangrenous mess.

For example, Atif Mian exaggerated the importance of the exchange rate impact on exports. According to a World Bank study: "results show that every 10% bilateral real appreciation leads to a decline in exports to that destination by 0.68%, while every 10 % bilateral real depreciation leads to an increase in exports of 0.51%.”

From 2012 to 2020, the Bangladesh currency dropped barely 1% against the USD, and Pak Rs went down by 45%. BD exports were up 39% in 2020 compared to 2012 and Pakistan's were down by 13%. (Source: World Bank data). Why? Bangladesh has focused on value-added exports and Pakistan’s exports are dominated by low-value-added commodity exports like yarn and cloth.

The argument for using just the exchange rate as a policy response to Pakistan’s recurring external account crises is not supported by studies or empirical evidence.

Another policy response has been to use monetary policy, notably by increasing interest rates. This too is debatable and problematic. Why?

An IMF study on India stated that “tightening of monetary policy had little effect on the aggregate demand or inflation. It also noted that “the response of the exchange rate to monetary policy shocks is in the right direction but the magnitude is very small.” The IMF paper concluded that “tightening of monetary policy and pass-through to lending rates is only partial and exchange rate effects are weak. We could find no significant effects on real output or the inflation rate."

Given this overall background and the gravity of Pakistan’s current economic crisis, we must take measures to (a) stop the bleeding of foreign exchange reserves and fall in the rupee value, and (b) initiate reforms to remove fundamental reasons.

What Must be Done Now

My five-point economic plan focuses on addressing immediate and near-term issues.

- Increase gasoline prices by Rs30 to Rs50 per litre. Remove tax exemptions/subsidies (for Rs800 billion) for the corporate sector immediately and get $10bn from the IMF. Both the conditions (in principle if not their magnitude suggested by me) are part of the IMF program and were part of the commitments made by the PTI government to the IMF. We must cut energy consumption and higher prices are essential to achieve this objective. Voluntary energy conservation schemes are not usually very effective.

- Impose a financial emergency under Article 235(1) of the constitution and ask the provinces to collect at least Rs100bn through higher taxes on land, property, and agricultural income. It is a shame that all of Punjab with its 100 million-plus population, collects less urban property taxes than the city of Chennai in India, which is home to about 10 million people. During FY 2020-21, the provincial government of Punjab collected a paltry Rs2.5 billion ($15.6 million) from agricultural income tax. This is completely unacceptable. Large landlords must be made to share an equitable burden.

- Impose a special emergency tax of Rs.500,000 on vehicles of 1600cc or more. This can bring in at least Rs20bn. Double the electricity tariff on residential properties of 800 sq yards or more.

- Cut non-combat defence spending by Rs.100bn out of the total defence budget of more than Rs1.3 trillion. Downsize the federal govt and abolish/downsize all those divisions that handle subjects that have been transferred to the provincial governments. This can bring in an additional Rs30bn.

- Ban all land allotments and make it mandatory to sell the state land by public auction only and launch a privatization programme to create an investment-friendly environment.

Lot more will need to be done but the current government’s position is weak and the policy choices are limited. However, any further delay in corrective steps would aggravate the crisis and could prove to be very costly if the foreign exchange reserves continue to drop and rupee crosses 200 level against the U.S. dollar.