Pakistan Telecommunication Limited (PTCL), the country’s oldest telecom service provider, is facing immense difficulties in managing its finances as its subsidiary, Ufone, continues to pile on significant losses. Therefore, it is time that the state-owned telecom giant takes corrective measures for better financial performance and contributes to the national exchequer.

PTCL held a monopoly on telecom services in Pakistan from 1947 to 1989, after which competitors entered the market due to the emergence of mobile telecommunications. In 2000, PTCL launched Ufone as its own mobile service provider. Later, in July 2005, Etisalat acquired a 26% stake with management control in PTCL for $2.6 billion, while around $800 million of that amount is still outstanding, due to the dispute between Etisalat and the government of Pakistan.

PTCL’s recent financial performance

PTCL, on a standalone basis, posted revenue of Rs 22.95 billion, growing at 17.1% in Q1 2023 compared to the same period last year, driven by growth in carrier & wholesale and broadband segments, an operating profit of Rs 1.5 billion, and net profit of Rs 5.5billion, attributed to an increase in non-operating income, network upgradation, and fiberization.

Meanwhile, Ufone experienced 20% revenue growth in Q1 2023 compared to Q1 2022, and achieved a milestone with 24 million subscribers, resulting in a 0.4% increase in market share, but remained a loss-making entity. The third major subsidiary, UBank, saw a 73.0% growth in quarterly revenue.

PTCL group, however, even after clocking in Rs 43.2 billion in the first quarter of 2023, experienced a net loss of Rs 5.7 billion. Primarily because of the losses incurred by its Wireless Cellular wing, Ufone.

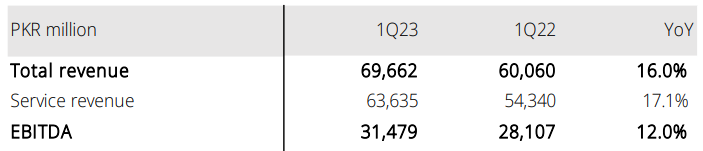

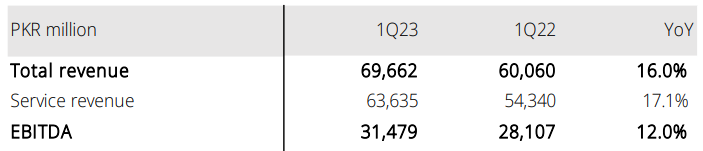

Source: Group Financials

Competitors’ performance

On the contrary, as per Veon’s trading update, “Jazz delivered double-digit growth in both revenue and EBITDA, and gained further market share. Total revenues rose by 16.0% YoY in 1Q23, as Jazz continued to gain market share. This double-digit revenue growth was enabled by disciplined inflationary pricing as Jazz successfully executed its digital operator strategy. It was also strengthened by encouraging momentum in our financial services offering, with robust increases in service revenues for both JazzCash (+65.3% YoY) and Mobilink Microfinance Bank (+71.0% YoY). EBITDA rose by 12.0% YoY on the back of the double-digit top-line growth despite the challenging macroeconomic environment.”

Source: VEON (Jazz’s Parent)

Further, “Based on the latest results announced by its parent Telenor Group for the quarter that ended March 31, 2023, Telenor Pakistan recorded nearly 3 percent growth in total revenues to Rs27 billion and 16 percent growth in operating profit (EBIT) to Rs5.7 billion,” reported the Business Recorder.

Key drivers of losses

As mentioned earlier, Ufone is the laggard causing PTCL's losses due to various challenges, including costs such as license and spectrum fees paid to the Pakistani government in dollars, leading to adverse effects from rapid rupee devaluation. Additionally, high energy consumption in telco tower sites results in significant expenses attributed to fuel and power costs. Fuel and energy costs amounted to approximately Rs. 20 billion, the largest cost of service component after depreciation for PTCL Group in the financial year 2022 due to the operation of Ufone's over 11,000 tower sites.

Ufone's acquisition of spectrum and the subsequent fees, which are pegged against the dollar, also add to the group's costs. PTCL's financial statements (2022) noted that 50% of license fees were paid upon acquisition of the spectrum, with the rest paid in equal installments with interest due each year in US dollars or equivalent Pakistan Rupees.

However, these challenges are not unique to Ufone and PTCL, but rather impact every cellular CMO in the country. Thus, what explains Ufone's exceptional losses is perhaps its flawed strategy.

On the strategic front, what hurt PTCL’s cellular operations was being late to the 4G party. “As of early 2017, Ufone was the only company in the Pakistani telecommunications market that did not offer 4G data services. And it has shown up in the fact that it is now the smallest of the four mobile telecommunications operators in the country. Since Zong began its assault on the market share of its competitors in 2014, Ufone has suffered particularly badly. 2014 was the last time Ufone made a profit. It has consistently lost money since then. In August 2019, however, Ufone launched its 4G services quietly, with the government apparently allowing it to set up such operations without having to buy the 4G spectrum separately, similar to how Warid started its 4G services, ” writes Farooq Tirmizi in an article for Profit.

Two years later, the company purchased a 4G spectrum license for a significant amount of $279 million. To finance this acquisition, Ufone secured its largest syndicated financing facility, which was jointly led by five banks.

Ufone's heavy leveraging for the purpose of the aggressive service rollout would, however, come back to haunt the company. In the past year and a half, interest rates have tripled, resulting in the group's Q1-23 finance costs to reach approximately $22 billion, which accounts for around 50% of its revenue.

Source: PTA

What’s the way out?

To improve its financial situation, PTCL has multiple options at its disposal. One possibility is to divest itself of Ufone and refocus on its core business. In an article for Profit, Farooq Tirmizi presents a persuasive case for this approach by highlighting PTCL's diverse array of thriving businesses, including its pioneering landline-based operations that serve as the foundation for its broadband internet and cable TV services.

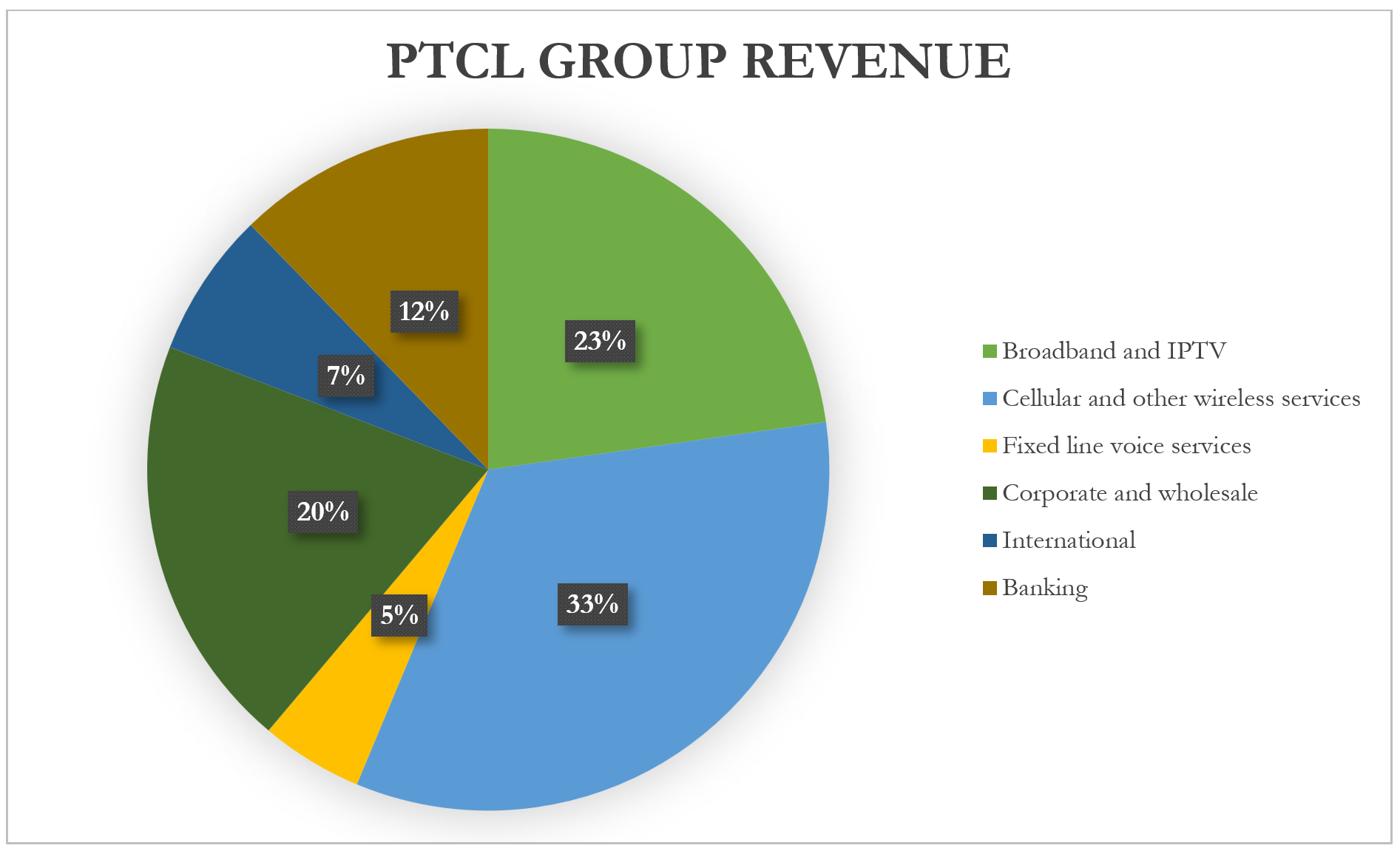

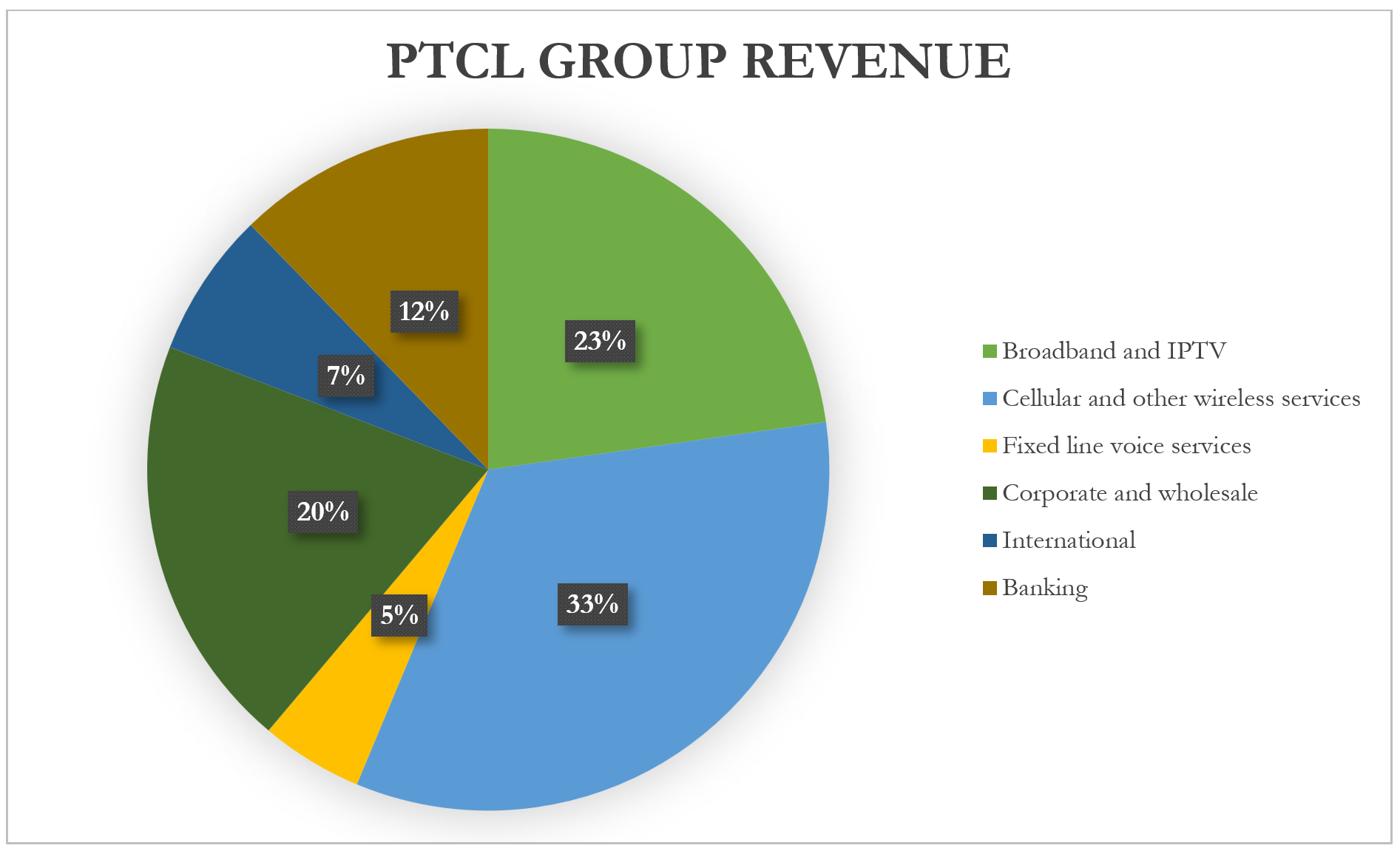

Source: Group Financials

Additionally, PTCL's international business has cemented its position as a critical carrier of Pakistan's telecommunications worldwide, while its banking unit has witnessed significant growth in recent years. Tirmizi explains that PTCL's "carrier of carriers" segment, which offers fiber connectivity to other telecommunications companies such as Jazz, presents the most promising prospect for the company. This optimism is fueled by the opportunity presented by mobile operator data growth, given that PTCL owns the most extensive fiber network in Pakistan.

Although mobile operators may be seen as potential competitors for Ufone, Tirmizi suggests that they represent untapped potential for PTCL. Despite this, any transaction involving a spin-off of Ufone seems unlikely in the near future. However, PTCL may consider the idea of acquiring Telenor, another CMO. “Management of the company (PTCL/Ufone) expects consolidation of the mobile operators to three players and believes that this consolidation will be good for the mobile operator business, shareholder and customers as well,” read a report by AKD Securities.

PTCL held a monopoly on telecom services in Pakistan from 1947 to 1989, after which competitors entered the market due to the emergence of mobile telecommunications. In 2000, PTCL launched Ufone as its own mobile service provider. Later, in July 2005, Etisalat acquired a 26% stake with management control in PTCL for $2.6 billion, while around $800 million of that amount is still outstanding, due to the dispute between Etisalat and the government of Pakistan.

PTCL’s recent financial performance

PTCL, on a standalone basis, posted revenue of Rs 22.95 billion, growing at 17.1% in Q1 2023 compared to the same period last year, driven by growth in carrier & wholesale and broadband segments, an operating profit of Rs 1.5 billion, and net profit of Rs 5.5billion, attributed to an increase in non-operating income, network upgradation, and fiberization.

Meanwhile, Ufone experienced 20% revenue growth in Q1 2023 compared to Q1 2022, and achieved a milestone with 24 million subscribers, resulting in a 0.4% increase in market share, but remained a loss-making entity. The third major subsidiary, UBank, saw a 73.0% growth in quarterly revenue.

PTCL group, however, even after clocking in Rs 43.2 billion in the first quarter of 2023, experienced a net loss of Rs 5.7 billion. Primarily because of the losses incurred by its Wireless Cellular wing, Ufone.

Source: Group Financials

Competitors’ performance

On the contrary, as per Veon’s trading update, “Jazz delivered double-digit growth in both revenue and EBITDA, and gained further market share. Total revenues rose by 16.0% YoY in 1Q23, as Jazz continued to gain market share. This double-digit revenue growth was enabled by disciplined inflationary pricing as Jazz successfully executed its digital operator strategy. It was also strengthened by encouraging momentum in our financial services offering, with robust increases in service revenues for both JazzCash (+65.3% YoY) and Mobilink Microfinance Bank (+71.0% YoY). EBITDA rose by 12.0% YoY on the back of the double-digit top-line growth despite the challenging macroeconomic environment.”

Source: VEON (Jazz’s Parent)

Further, “Based on the latest results announced by its parent Telenor Group for the quarter that ended March 31, 2023, Telenor Pakistan recorded nearly 3 percent growth in total revenues to Rs27 billion and 16 percent growth in operating profit (EBIT) to Rs5.7 billion,” reported the Business Recorder.

Key drivers of losses

As mentioned earlier, Ufone is the laggard causing PTCL's losses due to various challenges, including costs such as license and spectrum fees paid to the Pakistani government in dollars, leading to adverse effects from rapid rupee devaluation. Additionally, high energy consumption in telco tower sites results in significant expenses attributed to fuel and power costs. Fuel and energy costs amounted to approximately Rs. 20 billion, the largest cost of service component after depreciation for PTCL Group in the financial year 2022 due to the operation of Ufone's over 11,000 tower sites.

Ufone's acquisition of spectrum and the subsequent fees, which are pegged against the dollar, also add to the group's costs. PTCL's financial statements (2022) noted that 50% of license fees were paid upon acquisition of the spectrum, with the rest paid in equal installments with interest due each year in US dollars or equivalent Pakistan Rupees.

However, these challenges are not unique to Ufone and PTCL, but rather impact every cellular CMO in the country. Thus, what explains Ufone's exceptional losses is perhaps its flawed strategy.

On the strategic front, what hurt PTCL’s cellular operations was being late to the 4G party. “As of early 2017, Ufone was the only company in the Pakistani telecommunications market that did not offer 4G data services. And it has shown up in the fact that it is now the smallest of the four mobile telecommunications operators in the country. Since Zong began its assault on the market share of its competitors in 2014, Ufone has suffered particularly badly. 2014 was the last time Ufone made a profit. It has consistently lost money since then. In August 2019, however, Ufone launched its 4G services quietly, with the government apparently allowing it to set up such operations without having to buy the 4G spectrum separately, similar to how Warid started its 4G services, ” writes Farooq Tirmizi in an article for Profit.

Two years later, the company purchased a 4G spectrum license for a significant amount of $279 million. To finance this acquisition, Ufone secured its largest syndicated financing facility, which was jointly led by five banks.

Ufone's heavy leveraging for the purpose of the aggressive service rollout would, however, come back to haunt the company. In the past year and a half, interest rates have tripled, resulting in the group's Q1-23 finance costs to reach approximately $22 billion, which accounts for around 50% of its revenue.

Source: PTA

What’s the way out?

To improve its financial situation, PTCL has multiple options at its disposal. One possibility is to divest itself of Ufone and refocus on its core business. In an article for Profit, Farooq Tirmizi presents a persuasive case for this approach by highlighting PTCL's diverse array of thriving businesses, including its pioneering landline-based operations that serve as the foundation for its broadband internet and cable TV services.

Source: Group Financials

Additionally, PTCL's international business has cemented its position as a critical carrier of Pakistan's telecommunications worldwide, while its banking unit has witnessed significant growth in recent years. Tirmizi explains that PTCL's "carrier of carriers" segment, which offers fiber connectivity to other telecommunications companies such as Jazz, presents the most promising prospect for the company. This optimism is fueled by the opportunity presented by mobile operator data growth, given that PTCL owns the most extensive fiber network in Pakistan.

Although mobile operators may be seen as potential competitors for Ufone, Tirmizi suggests that they represent untapped potential for PTCL. Despite this, any transaction involving a spin-off of Ufone seems unlikely in the near future. However, PTCL may consider the idea of acquiring Telenor, another CMO. “Management of the company (PTCL/Ufone) expects consolidation of the mobile operators to three players and believes that this consolidation will be good for the mobile operator business, shareholder and customers as well,” read a report by AKD Securities.