The relationship was in bad shape anyway, only the violence was previously enacted by the state on citizens. And though this continued this week, there was a visceral reaction by the public to the violent arrest of an undeniably popular national leader. In the same period, the rupee slid further against the dollar.

People who want economic healing to begin with a new social contract are forgetting the reverse: that the economic conditions of political stability are simply not present, and in the end, the economic instability has been caused by competing claims on economic resources by warring parties

I want to impress two things upon the reader in this article. To that end, I will begin with something I wrote previously. In a previous article, I took a leaf out of Keynes’s writing and reflected on the facts of our material conditions – social, political, economic – or what Keynes called outside facts. This is what I wrote:

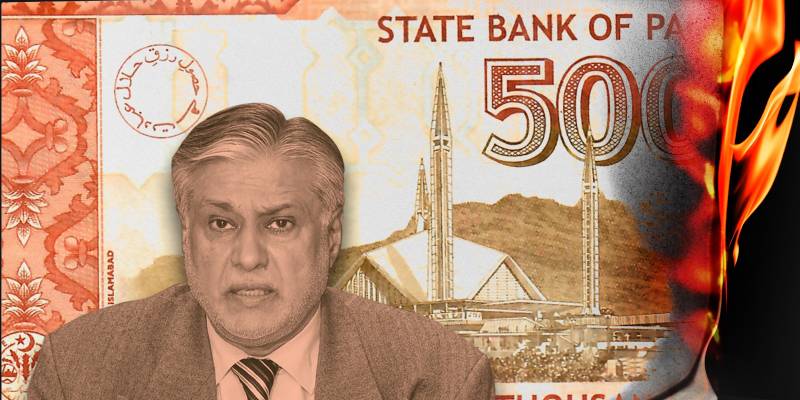

What’s more, our fragile social order with its eroding and crumbling institutions must contend with economic pressures. No social contract is going to survive hyperinflation undermining the rupee. As the value of the national currency erodes with increasing pace, at some point trust in the government’s guarantee of the value of currency, a guarantee stated on the front face of our SBP-issued banknotes, will start eroding with stunning pace. Thus, money as a social relationship between society and state will come under strain. It is possible for the relationship to break down altogether. People are afraid of the country defaulting on its debts, and rightly so. But an irreparable rupture in the state-society relationship caused by the destruction of the rupee as a store of value (or even a means of exchange!) will be far more consequential and have implications entirely unimagined and unanticipated. So we are brought back both by force of argument and outside facts to square one: the urgency of committing to the democratic political process, to parliament, and to the constitution.

Now, if you look at any rupee note issued by the State Bank of Pakistan, you will note that there is a promissory statement on it and a statement of guarantee. The SBP promises, with every note, to pay (something) to the bearer of the note, and that promise is guaranteed or underwritten by the authority of the government of Pakistan which owns the SBP and of which the SBP is an agent. Since we do not function on a gold standard, the promise is not to pay gold in exchange for the note, but as I understand it (and I’m happy to be corrected in case I’m wrong) the promise is to pay the bearer value equivalent to the denomination of the note in question. Hence the rupee is a claim on the government and hence an asset to you and I (though a devaluating asset with every passing day). The value of the rupee, in a sense, is as good as the rupee holder’s confidence in the government of Pakistan. I don’t have to remind the reader that the value of the rupee as an asset, or a store of wealth/value, has already been in decline. The danger, however, is that the acceleration of the price level will undermine the rupee’s function as a means of exchange. That is, the danger that the rupee might lose its utility as a means of payment. This danger is the first thing I wanted to bring to the reader’s attention.

The government has done its utmost to keep the citizens of this country from exercising their political rights and agency, especially through elections.

The second thing is the extreme difficulty of finding our way out of a state of economic depression. Economists (a broader term in which I include economic commentators and analysts) often talk about the impact of political instability on the economy. They miss the flipside of this because they forget how close economics and politics are. And they forget that economic conflict is political because it is about power. People who want economic healing to begin with a new social contract are forgetting the reverse: that the economic conditions of political stability are simply not present, and in the end, the economic instability has been caused by competing claims on economic resources by warring parties – including the military, which recently “requested the Punjab government for one million acres of state land in the Cholistan area for corporate agricultural farming”– claims which have not been able to reach resolution in a way satisfactory to most if not all parties. And the economic preconditions of political peace will become increasingly elusive as hyperinflation erodes the medium of exchange function of the Pakistani rupee and undermines the state-society relationship to the point of irreparable rupture.

Economics and politics move hand in hand. Political repression will create the conditions for economic impoverishment, and economic impoverishment will bring about a political stranglehold. This is essentially Clara Mattei’s point when she writes in the Italian context that “... Austerity required Fascism — a strong, top-down government that could impose its nationalist will coercively and with political impunity — for its prompt success. Fascism, conversely, required austerity to solidify its rule.”

With monetary austerity having been chosen at the policy level and as the rupee disintegrates (and the state-society relationship along with it), the country has felt the political stranglehold becoming stronger by the day. Protestors have been arrested, injured, and killed. Internet services remain disrupted and Twitter continues to be blocked. The government has done its utmost to keep the citizens of this country from exercising their political rights and agency, especially through elections. Ishaq Dar recently thundered in parliament, “what elections?!”

If the citizens of Pakistan have their say, and in the end they will, Dar might just find out.