The Ministry of Finance (MoF) is garnering a lot of media attention due to the ongoing negotiations and dealings with the IMF as the country’s economic future hangs by a thread. However, a recent meeting held within the premises of the Ministry has caught many experts’ attention. A delegation from Rothschild & Co., a prominent debt and restructuring adviser, met the Finance minister Ishaq Dar on Tuesday.

“The Rothschild & Co. delegation briefed the Finance Minister on the Company’s profile and its financial services provided to various countries across the world. The delegation supported the policy steps taken by the government for sustaining and boosting fiscal and monetary stability, and expressed confidence in achieving sustainable economic development due to pragmatic policies of the government,” Read the press release by MoF.

https://twitter.com/ThePBC_Official/status/1628242913477136384

This, perhaps, indicates towards that there is ongoing deliberation amongst the country’s economic managers regarding the restructuring and reprofiling of outstanding sovereign debt.

Further, on the international front, the restructuring topic will gain traction as our neighbor and the current presidency holder of the G20, India, is working on a proposal to be presented during the G20 round table scheduled on 25th February. The proposal aims to help debt distressed nations by convincing bilateral lenders to take a large haircut on their loans.

“Two Indian government sources told Reuters of the proposal as finance ministers and central bank chiefs from the Group of 20 prepared to meet in Bengaluru next week. The gathering will be the first major event of India's one-year presidency of the G20, a bloc composed of the world's biggest economies,” Reuters reported.

Therefore, it is worthwhile to explore how the restructuring process unfolds and where Pakistan stands in this context.

The Debt Burden

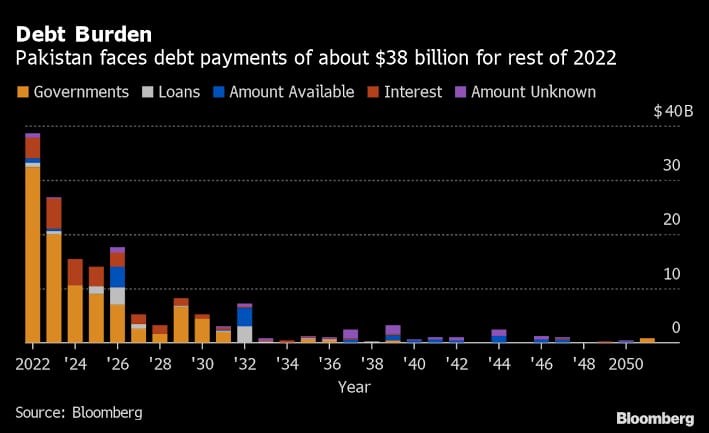

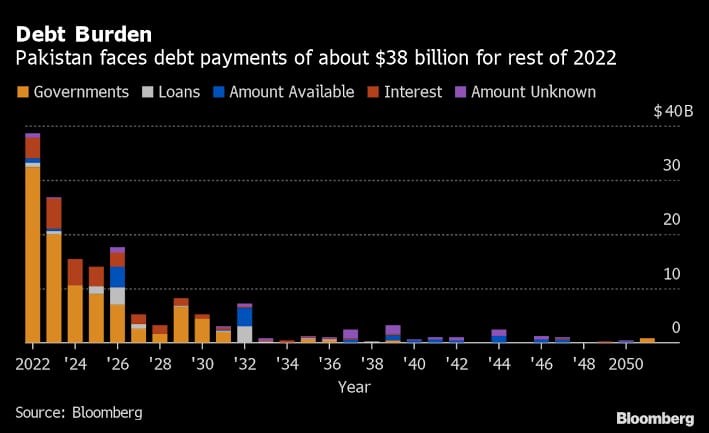

Pakistan’s current external debt amounts to around 28% of the GDP, at approximately $100 billion. Of this debt, around 80% is owed to multilateral & bilateral creditors, while the other 20 percent is owed to commercial creditors such as Eurobond/Sukuk issuances and commercial banks. A major chunk of around 30% of Pakistan’s foreign debt is owed to China, and another 10% is owed to western countries in the Paris Club.

By the end of 2022-23, the expected government debt level is predicted to remain high, and with the possibility of further policy rate increases in the near future, debt servicing costs could jump to Rs 6.8 trillion in 2023-24, representing a significant 30% increase compared to the current fiscal year. This would push debt servicing costs to close to 6.5% of the GDP.

Source: Bloomberg. May 27, 2022

Pakistan’s Case

A sovereign debt restructuring is a complex process but can be summed up as a request from the government of a country for lenders to consider reducing the principal, reducing debt servicing costs, or extending the maturity dates of their debts. This request will typically begin in Pakistan’s case with approval from the country's economic advisory committee and cabinet and must be done discreetly to avoid causing chaos in financial markets.

Lenders generally make a case to be excluded from the restructuring, and the country must carefully decide their position in the future when the time comes to repay according to the revised terms. They must have the ability to borrow when the time comes.

As per a panel discussion organized by the Economic Advisory Group which included Dr. Mohammed Ahmed Zubair, Dr. Ahmed Pirzada and Javed Hassan, the process of restructuring sovereign debt can be separated into three categories. The first is Strictly Preemptive Restructuring, in which the government continues to service interest and principal on its debts and solicits external restructuring assistance from the IMF and other creditors. Weakly Preemptive Restructuring, which seems to be Pakistan’s likely case, is when the government stops payment of principal but continues to service interest debt. Disorderly default is what happened in the case of Sri Lanka.

Further, the three steps in the restructuring process are initiation, negotiation, and implementation. Initiation begins with the government approaching the IMF for a Debt Sustainability Analysis (DSA) to determine the gross government debt and primary surpluses required to make the debt sustainable, as well as potential sources of external financing.

Negotiations then take place with major creditors such as the Paris Club, World Bank, China, Saudi Arabia, and commercial creditors, with the guidance of established bilateral frameworks like the G20 Common Framework. During this stage, all creditors must be offered comparable treatment as urged by the G20’s framework, and a committee of creditors is also formed. Lastly, implementation of the restructuring process can take time, 2 years and counting for example, in Zambia’s case. During this time, multilateral institutions like the IMF may provide additional financing to keep the country afloat. However, multilateral creditors are generally given preferred creditor status and are not a part of the restructuring arrangements.

Once the process of restructuring is completed, the country should be able to enter the bond market through a re-rating and raise additional financing, and work towards stabilizing their debt-to-GDP ratio.

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country,” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

https://twitter.com/FarrukhJAbbasi/status/1628268852789354496?t=yptFb1hUzwmvQuGf5xU4nw&s=09

What works and What doesn’t?

As per the Economic Advisory Group, “Policymakers can choose to approach creditors and initiate a debt restructuring process. This will again come at the expense of meeting additional conditionalities agreed with the creditors, who will bear the cost of restructuring. None of these options are without economic pain, but a well-managed restructuring process can allow the economy to recover sooner than later.”

Further, there might be a trickledown effect of restructuring on domestic debt, yet, as per analyst Javed Hassan, the domestic sector is relatively under-banked and the banks are well capitalized. This helps in absorbing the exogenous shocks in an event of domestic debt restructuring.

Also, for Pakistan, novel type of debts like the bilateral deposits with the SBP and off-balance sheet items like debt swaps can further complicate the process.

On the creditors’ front, there is likely to be push back from China against the western bloc’s approach to restructuring, and the global economic giant might call for the inclusion of multilateral institutions in the restructuring process. A case in point is Zambia.

Therefore, India's effort to build consensus between international lenders - including China - on debt restructuring for Sri Lanka and other nations could be of great benefit to Pakistan, who could use the precedent as a guide to aid in their own restructuring process.

“The Rothschild & Co. delegation briefed the Finance Minister on the Company’s profile and its financial services provided to various countries across the world. The delegation supported the policy steps taken by the government for sustaining and boosting fiscal and monetary stability, and expressed confidence in achieving sustainable economic development due to pragmatic policies of the government,” Read the press release by MoF.

https://twitter.com/ThePBC_Official/status/1628242913477136384

This, perhaps, indicates towards that there is ongoing deliberation amongst the country’s economic managers regarding the restructuring and reprofiling of outstanding sovereign debt.

Further, on the international front, the restructuring topic will gain traction as our neighbor and the current presidency holder of the G20, India, is working on a proposal to be presented during the G20 round table scheduled on 25th February. The proposal aims to help debt distressed nations by convincing bilateral lenders to take a large haircut on their loans.

“Two Indian government sources told Reuters of the proposal as finance ministers and central bank chiefs from the Group of 20 prepared to meet in Bengaluru next week. The gathering will be the first major event of India's one-year presidency of the G20, a bloc composed of the world's biggest economies,” Reuters reported.

Therefore, it is worthwhile to explore how the restructuring process unfolds and where Pakistan stands in this context.

The Debt Burden

Pakistan’s current external debt amounts to around 28% of the GDP, at approximately $100 billion. Of this debt, around 80% is owed to multilateral & bilateral creditors, while the other 20 percent is owed to commercial creditors such as Eurobond/Sukuk issuances and commercial banks. A major chunk of around 30% of Pakistan’s foreign debt is owed to China, and another 10% is owed to western countries in the Paris Club.

By the end of 2022-23, the expected government debt level is predicted to remain high, and with the possibility of further policy rate increases in the near future, debt servicing costs could jump to Rs 6.8 trillion in 2023-24, representing a significant 30% increase compared to the current fiscal year. This would push debt servicing costs to close to 6.5% of the GDP.

Source: Bloomberg. May 27, 2022

Pakistan’s Case

A sovereign debt restructuring is a complex process but can be summed up as a request from the government of a country for lenders to consider reducing the principal, reducing debt servicing costs, or extending the maturity dates of their debts. This request will typically begin in Pakistan’s case with approval from the country's economic advisory committee and cabinet and must be done discreetly to avoid causing chaos in financial markets.

Lenders generally make a case to be excluded from the restructuring, and the country must carefully decide their position in the future when the time comes to repay according to the revised terms. They must have the ability to borrow when the time comes.

As per a panel discussion organized by the Economic Advisory Group which included Dr. Mohammed Ahmed Zubair, Dr. Ahmed Pirzada and Javed Hassan, the process of restructuring sovereign debt can be separated into three categories. The first is Strictly Preemptive Restructuring, in which the government continues to service interest and principal on its debts and solicits external restructuring assistance from the IMF and other creditors. Weakly Preemptive Restructuring, which seems to be Pakistan’s likely case, is when the government stops payment of principal but continues to service interest debt. Disorderly default is what happened in the case of Sri Lanka.

Further, the three steps in the restructuring process are initiation, negotiation, and implementation. Initiation begins with the government approaching the IMF for a Debt Sustainability Analysis (DSA) to determine the gross government debt and primary surpluses required to make the debt sustainable, as well as potential sources of external financing.

Negotiations then take place with major creditors such as the Paris Club, World Bank, China, Saudi Arabia, and commercial creditors, with the guidance of established bilateral frameworks like the G20 Common Framework. During this stage, all creditors must be offered comparable treatment as urged by the G20’s framework, and a committee of creditors is also formed. Lastly, implementation of the restructuring process can take time, 2 years and counting for example, in Zambia’s case. During this time, multilateral institutions like the IMF may provide additional financing to keep the country afloat. However, multilateral creditors are generally given preferred creditor status and are not a part of the restructuring arrangements.

Once the process of restructuring is completed, the country should be able to enter the bond market through a re-rating and raise additional financing, and work towards stabilizing their debt-to-GDP ratio.

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country,” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

https://twitter.com/FarrukhJAbbasi/status/1628268852789354496?t=yptFb1hUzwmvQuGf5xU4nw&s=09

What works and What doesn’t?

As per the Economic Advisory Group, “Policymakers can choose to approach creditors and initiate a debt restructuring process. This will again come at the expense of meeting additional conditionalities agreed with the creditors, who will bear the cost of restructuring. None of these options are without economic pain, but a well-managed restructuring process can allow the economy to recover sooner than later.”

Further, there might be a trickledown effect of restructuring on domestic debt, yet, as per analyst Javed Hassan, the domestic sector is relatively under-banked and the banks are well capitalized. This helps in absorbing the exogenous shocks in an event of domestic debt restructuring.

Also, for Pakistan, novel type of debts like the bilateral deposits with the SBP and off-balance sheet items like debt swaps can further complicate the process.

On the creditors’ front, there is likely to be push back from China against the western bloc’s approach to restructuring, and the global economic giant might call for the inclusion of multilateral institutions in the restructuring process. A case in point is Zambia.

Therefore, India's effort to build consensus between international lenders - including China - on debt restructuring for Sri Lanka and other nations could be of great benefit to Pakistan, who could use the precedent as a guide to aid in their own restructuring process.