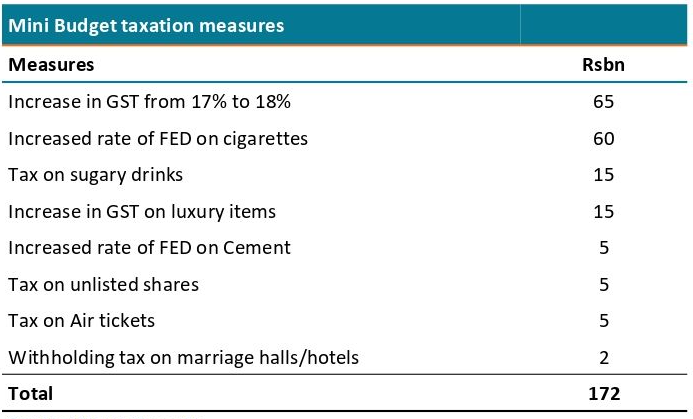

On Wednesday, the finance minister proposed to the Parliament a supplementary finance bill, mini-budget, that would raise the sales tax to 18% from 17%, in order to generate an additional 170 billion rupees during the current fiscal year.

The bill proposed exemptions from GST increase for essential items such as wheat, rice, milk, and meat, to shield the most vulnerable populace from the budget's inflationary effects.

The bill also recommended tax increases on luxury items up to 25%, as well as hikes in taxes on first and business-class air travel, cigarettes, and sugary drinks. Additionally, a 10% adjustable withholding tax on marriage halls and events was also proposed.

Source: Topline Securities

A majority of the measures are targeted towards consumer goods, which would lead to an increase in inflation that, as per some estimates, has already crossed the 30% mark. Further experts are of the view that the incidence of the new tax measures would be passed on to the consumers and will disproportionately affect the lowest economic strata of society.

https://twitter.com/kaiserbengali/status/1626050638739128320?t=bH3zvX11Lbhkd5aBhpmk1w&s=09

The recent rupee devaluation, fuel price hikes and new tax are all likely to severely impact the general population’s standard of living. Therefore, in an attempt to mitigate the effects of the resultant inflationary wave on the vulnerable segment, the allocation for the Benazir Income Support Program has been increased by Rs. 40 billion to a total of Rs. 400 billion for the fiscal year 2023.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing blanket relief,” says economist Fahd Ali.

Why are the majority of revenues collected through indirect taxes?

Pakistan's tax system relies heavily on indirect taxes (sales tax etc.) due to the low filings rate of income taxes (corporate tax etc.). The Federal Board of Revenue (FBR) has implemented a withholding tax system to ensure that both direct and indirect taxes are collected. This system requires Companies and other withholding agents to deduct taxes at the source of the transaction instead of when filing returns.

Though, some taxes under the withholding tax regime fall under the umbrella of Income Tax (Direct Tax), they are essentially indirect taxes as most of it are never adjusted against one’s income due to non-filing or exemption from filing taxes.

In developing countries like Pakistan, a wide base of indirect tax is necessary to make up for the lack of taxation from undocumented sectors, such as agriculture, small businesses, and informal work. Through indirect taxation, the tax regulator is able to enforce taxation, even if most are not filing their returns.

In the budget, announced last year, the former finance minister Miftah Ismail took some steps towards progressive taxation through various levies, most notably on traders and a Super tax. However, due to the pressures from the business community, the government had to back out on taxes imposed on traders while the implementation of the Super tax was subsequently challenged in the courts.

What’s next?

The new tax measures coupled with fuel price hikes and increases in energy tariffs have resulted in the government achieving most of the prerequisites of resuming the stalled IMF program. However, the Fund still needs convincing that Pakistan can meet its short-term external financing requirements and beef up reserves through bilateral support by the end of this fiscal year.

As per experts, the staff-level agreement with IMF is likely to be signed in the coming week while it would further take 2-4 weeks for IMF’s board to green-light the $1.1 billion tranche disbursement.

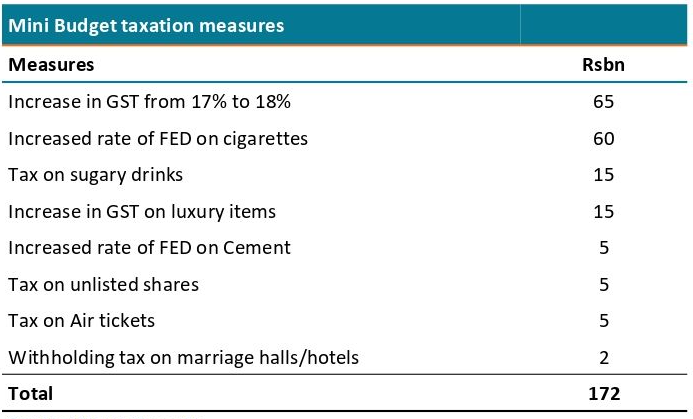

The bill proposed exemptions from GST increase for essential items such as wheat, rice, milk, and meat, to shield the most vulnerable populace from the budget's inflationary effects.

The bill also recommended tax increases on luxury items up to 25%, as well as hikes in taxes on first and business-class air travel, cigarettes, and sugary drinks. Additionally, a 10% adjustable withholding tax on marriage halls and events was also proposed.

Source: Topline Securities

A majority of the measures are targeted towards consumer goods, which would lead to an increase in inflation that, as per some estimates, has already crossed the 30% mark. Further experts are of the view that the incidence of the new tax measures would be passed on to the consumers and will disproportionately affect the lowest economic strata of society.

https://twitter.com/kaiserbengali/status/1626050638739128320?t=bH3zvX11Lbhkd5aBhpmk1w&s=09

The recent rupee devaluation, fuel price hikes and new tax are all likely to severely impact the general population’s standard of living. Therefore, in an attempt to mitigate the effects of the resultant inflationary wave on the vulnerable segment, the allocation for the Benazir Income Support Program has been increased by Rs. 40 billion to a total of Rs. 400 billion for the fiscal year 2023.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing blanket relief,” says economist Fahd Ali.

Why are the majority of revenues collected through indirect taxes?

Pakistan's tax system relies heavily on indirect taxes (sales tax etc.) due to the low filings rate of income taxes (corporate tax etc.). The Federal Board of Revenue (FBR) has implemented a withholding tax system to ensure that both direct and indirect taxes are collected. This system requires Companies and other withholding agents to deduct taxes at the source of the transaction instead of when filing returns.

Though, some taxes under the withholding tax regime fall under the umbrella of Income Tax (Direct Tax), they are essentially indirect taxes as most of it are never adjusted against one’s income due to non-filing or exemption from filing taxes.

In developing countries like Pakistan, a wide base of indirect tax is necessary to make up for the lack of taxation from undocumented sectors, such as agriculture, small businesses, and informal work. Through indirect taxation, the tax regulator is able to enforce taxation, even if most are not filing their returns.

In the budget, announced last year, the former finance minister Miftah Ismail took some steps towards progressive taxation through various levies, most notably on traders and a Super tax. However, due to the pressures from the business community, the government had to back out on taxes imposed on traders while the implementation of the Super tax was subsequently challenged in the courts.

What’s next?

The new tax measures coupled with fuel price hikes and increases in energy tariffs have resulted in the government achieving most of the prerequisites of resuming the stalled IMF program. However, the Fund still needs convincing that Pakistan can meet its short-term external financing requirements and beef up reserves through bilateral support by the end of this fiscal year.

As per experts, the staff-level agreement with IMF is likely to be signed in the coming week while it would further take 2-4 weeks for IMF’s board to green-light the $1.1 billion tranche disbursement.