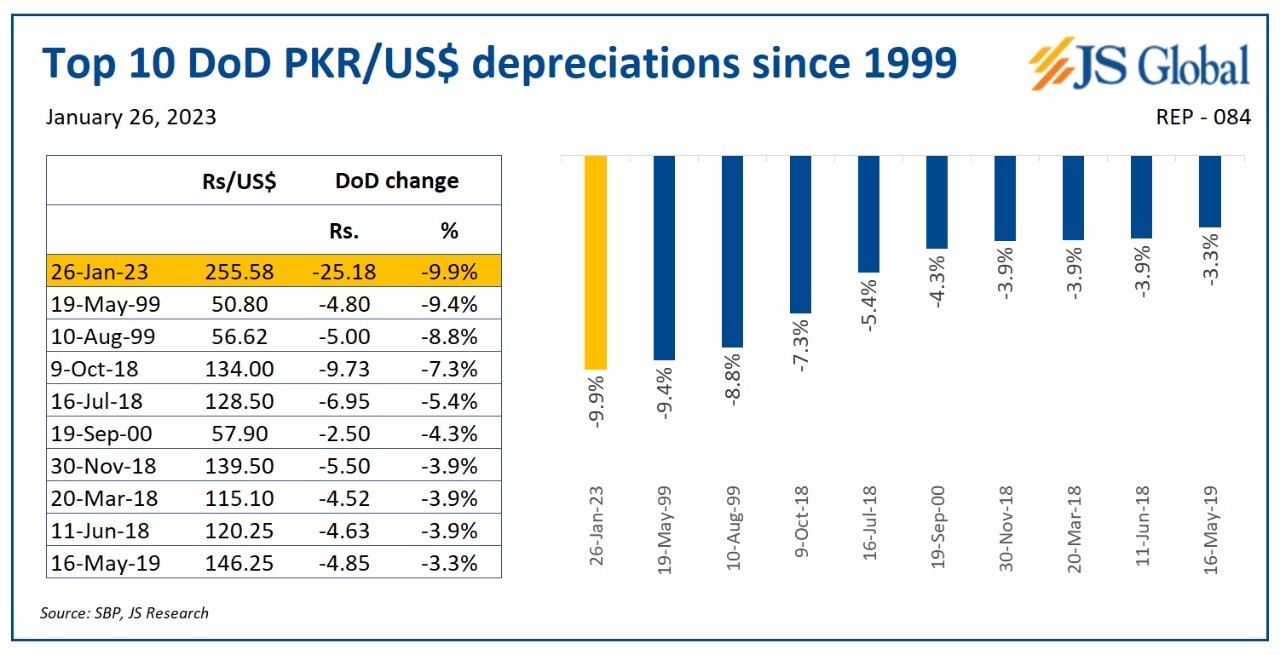

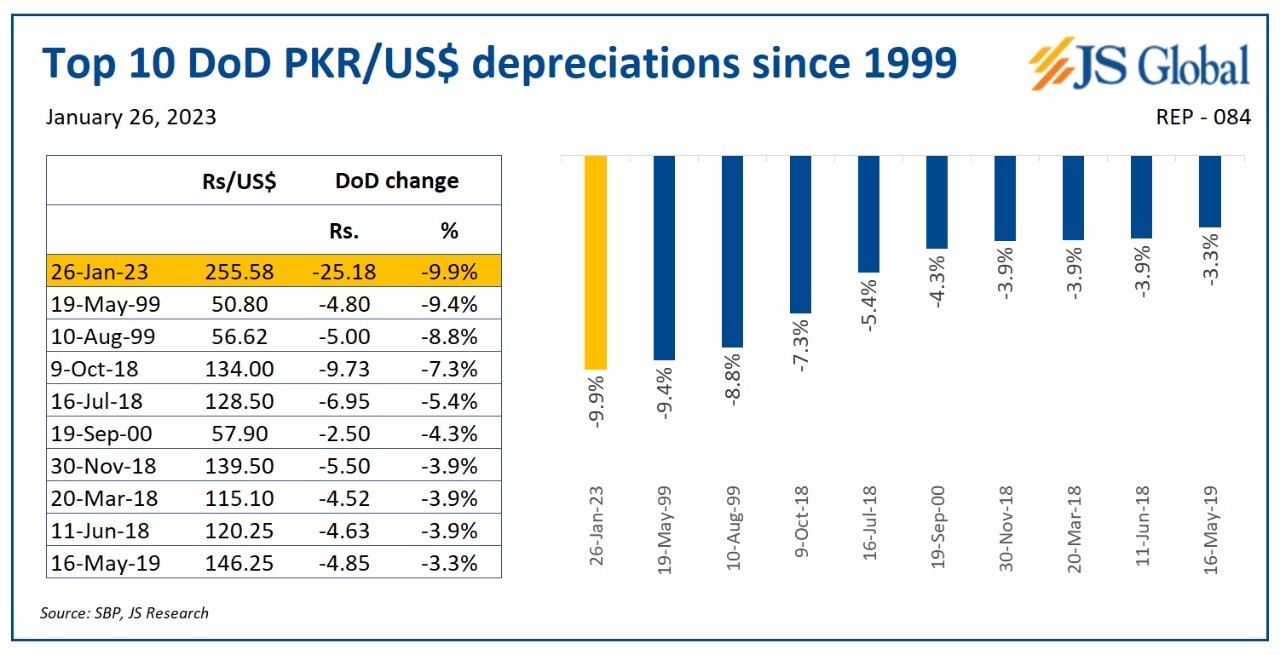

The Pakistani rupee plummeted to a new low of 262 against the dollar on 27th January. Earlier, the interbank rate of the rupee saw a historic fall as the opening rate of the dollar in the interbank market on 26th january fell sharply from PKR 230.89 to PKR 255.43, resulting in a single day rupee depreciation of around 10%. Hence, this translated into the most rapid fall in rupee’s value for over two decades.

Source: JS Global

The news was also cherished by the stock market, which saw an uptick in trading activity. As per a report by Topline Securities, “Pakistan equities skyrocketed today as the benchmark KSE-100 index settled at 40,846 level (up 2.67%). The day kicked off on a positive note and remained positive throughout the day, investors cheered government’s efforts of reviving IMF program where new taxation of nearly Rs300bn is on cards. Further, Pak Rupee (PKR) in the interbank and open market rate has started falling from today which led the market to make an intraday high of 1,209 points.”

As per a policy brief paper issued by Sustainable Development Policy Institute (SDPI), “Developing countries, particularly, misalign the currency toward upper side and prefer overvaluation. An overvaluation of currency may initially sound good as it increases purchasing power. This may generate some political gains in short run as the government may claim improved purchasing power of people an outcome of its successful economic policy. It is important to note that overvalued currency along with other implications makes the exports of the country expensive. Some other country may supply the same products at cheaper rate resulting in loss of exports for the economy with overvalued currency. Further, a strong currency may also increase imports creating current account deficit.”

https://twitter.com/SaleemFarrukh/status/1618595171461103621

What has transpired today is because of the government letting the exchange rate free which was being manipulated since the arrival of the current Finance Minister back in September 2022. Further, Pakistani money changers have also removed the cap on dollar rate which means that the open market rate as well as the interbank rate would now be determined by the market forces.

A market-based exchange rate promotes efficiency in the economy and amongst other things, helps in commodity pricing decisions which provides some cushion against external shocks.

More importantly, a market-based exchange rate is also a condition laid by the IMF for releasing the pending loan tranche. The fund is well within its rights to ask for this adjustment as Pakistani governments have a history of exhausting funds to keep the rupee appreciated rather than making structural reforms.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing a blanket relief,” stated economist Fahd Ali.

By Ahtasam Ahmad

Source: JS Global

The news was also cherished by the stock market, which saw an uptick in trading activity. As per a report by Topline Securities, “Pakistan equities skyrocketed today as the benchmark KSE-100 index settled at 40,846 level (up 2.67%). The day kicked off on a positive note and remained positive throughout the day, investors cheered government’s efforts of reviving IMF program where new taxation of nearly Rs300bn is on cards. Further, Pak Rupee (PKR) in the interbank and open market rate has started falling from today which led the market to make an intraday high of 1,209 points.”

As per a policy brief paper issued by Sustainable Development Policy Institute (SDPI), “Developing countries, particularly, misalign the currency toward upper side and prefer overvaluation. An overvaluation of currency may initially sound good as it increases purchasing power. This may generate some political gains in short run as the government may claim improved purchasing power of people an outcome of its successful economic policy. It is important to note that overvalued currency along with other implications makes the exports of the country expensive. Some other country may supply the same products at cheaper rate resulting in loss of exports for the economy with overvalued currency. Further, a strong currency may also increase imports creating current account deficit.”

https://twitter.com/SaleemFarrukh/status/1618595171461103621

What has transpired today is because of the government letting the exchange rate free which was being manipulated since the arrival of the current Finance Minister back in September 2022. Further, Pakistani money changers have also removed the cap on dollar rate which means that the open market rate as well as the interbank rate would now be determined by the market forces.

A market-based exchange rate promotes efficiency in the economy and amongst other things, helps in commodity pricing decisions which provides some cushion against external shocks.

More importantly, a market-based exchange rate is also a condition laid by the IMF for releasing the pending loan tranche. The fund is well within its rights to ask for this adjustment as Pakistani governments have a history of exhausting funds to keep the rupee appreciated rather than making structural reforms.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing a blanket relief,” stated economist Fahd Ali.

By Ahtasam Ahmad