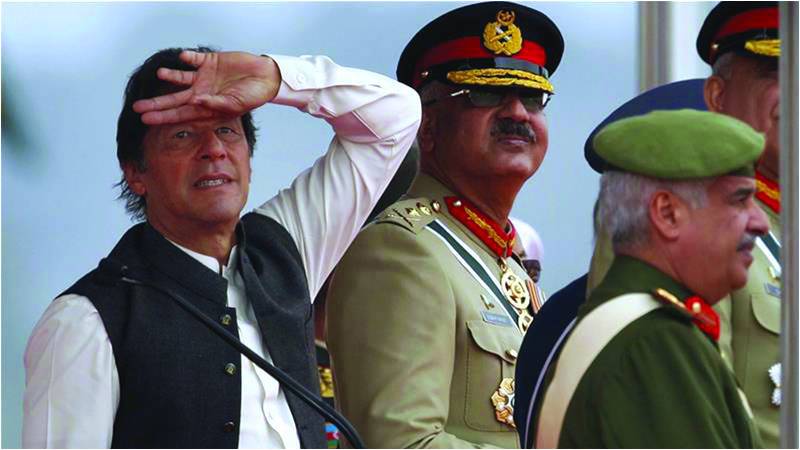

A recent tweet by Prime Minister Imran Khan regarding positive developments on the trade balance side was taken as an indication of his government’s success in tackling the weaknesses afflicting the Pakistani economy. In short, the tweet informed the nation about lower current account (CA) deficit, higher remittances and a slight increase in exports. Looked at from the perspective of meeting external financial obligations, these are indeed positive developments. However, I would argue in this column that behind these numbers are subtle economic forces at work that may well be a sign of challenging times ahead.

Let’s first analyze the factors that led to a reduction in CA deficit. Besides the official policy of significant increase in tariffs on imports, which is nothing new or innovative, there are other factors that did not get a mention in the PM’s tweet. The first is the slower pace of GDP growth, as acknowledged by majority of observers (both domestic and foreign), which slowed down to around 3.8 percent in the previous fiscal. If estimates made by IMF and World Bank hold, then the coming years will witness an even slower pace of growth. Decline in GDP growth is considered a direct proxy of slowdown in economic activities, which in itself is an indication of slowdown in growth of aggregate income. Historically speaking, an upsurge in Pakistan’s imports has always followed a higher GDP growth (as economic activity picks up pace and incomes grow, so does demand for imports). Hence, it is no surprise that a lower level of imports has accompanied a lower GDP growth.

Another factor to consider is the uncertain business environment that has affected investment and business activity negatively. Consider, for example, the fact that Large Scale Manufacturing (LSM) has declined for the first time in a decade. The tussle between the government and business community did not help matters at all. The constant running around to Arab capitals and Beijing to get short term help, and prolonging the time of a deal with IMF, only created more doubts about whether Pakistan’s economy would be able to meet its obligations. The freefall of the rupee further compounded the overall uncertain situation. In such uncertainty, investors are unwilling to invest and those already in the business of production, services, retails, put off their investment decisions as expectations of a better future start to diminish. As investments and new plants and businesses have taken a hit (clearly reflected by slower economic growth and spare capacity in sectors like cement), the demand for imported goods (raw material, high tech equipment like machinery and smart phones) declines. This seems to be happening right now, and is part of this story.

Third, it is important to remember that the first phase of CPEC has come to an end, bringing with it an end to the phase of machinery imports. Fourth, the pronounced increase in inflation has caused the cost of production to jump up significantly, making life difficult for all sets of producers (domestic, export oriented, etc) and consumers (as their real income falls further, thus depressing aggregate spending). Quite a few of these industries are dependent on imported raw material for their survival and manufacturing (pharmaceutical industry, for example, imports 95 percent of raw material for their produce). Combine domestic upsurge in production costs with higher price of imports and lower real incomes, and it is natural that the demand for imports will fall.

By any stretch of imagination, the above stated factors do not aspire a positive outlook or exuberance because they indicate circumstances that pose significant challenges to the economy and its growth.

Next item of discussion is the increase in the quantum of remittances. Let us parse the numbers in order to interpret the factors that led to this. Data indicates that a noticeable surge in remittances materialised around the festive occasions of Eidul Fitr and Eidul Azha. Well, no surprises there since it’s a norm rather than an exception. Do these explain the increase? Not quiet, as there is another important factor at work. One has to appreciate the fact that foreign remittances sustain the livelihoods and lifestyles of thousands of families (if not millions) in Pakistan. For example, Dr Hafiz Pasha’s calculations related to provincial GDPs imply that 20 percent of the total household income in the province of KP owes solely to remittances. Put another way, a large portion of Pakistani households depend critically upon remittances to sustain their livelihoods. Given that life in Pakistan has become much dearer now compared to what it was last year, there should be no surprise that remittances rose in quantum as families struggle to maintain their standard of living. This aspect would seem to be an ideal candidate in explaining this rise since not much has been invested by the diaspora in dollar denominated instruments (like bonds) and not even a percent of the remittances are being used for any productive investment in Pakistan. In this case, there again remains little occasion for joy.

Lastly, we turn to exports which have registered a slight increase. It is a bit of a puzzle since developments at home in the last fiscal do not lend themselves favorably to export increase. It is difficult to comprehend such a development when costs of production have witnessed a steady increase (making Pakistani products much costlier to produce and hence feeding into un-competitiveness of our exports), manufacturing and agricultural sector suffering a contraction and overall environment not conducive to export oriented industries. Does the increase owe to the increase in prices of products that we export, any special concession or did Pakistani products found a new market? It is a bit of a mystery right now. My hunch is that the increase will ultimately be traced to some special concession, just like Beijing provided to our export products last year. How long such concessions would last is anybody’s guess.

Let me conclude by clarifying that it makes me happy to realize that finally some relief did come to Pakistan’s struggling economy. My worry, though, stems from a deeper introspection into the numbers and their probable sources, and also the fact that this is a short term phenomenon. In lieu of all that I’ve penned down, I have a request to make to the honorable PM; respected sir, please be vary of courtiers who have become a permanent fixture in the corridors of power in Pakistan. They have deceived many rulers before you by singing undue praises. Such courtiers and touts surround you too. Instead of taking to Twitter, ask them what these numbers imply, the sources of improvement in Pakistan’s trade balance, and whether this short-term trend has the tendency to transform into a long-term trend without adverse repercussions domestically? You will then be better placed to decide whether it is something to gloat about or worry about.

The writer is an economist

Let’s first analyze the factors that led to a reduction in CA deficit. Besides the official policy of significant increase in tariffs on imports, which is nothing new or innovative, there are other factors that did not get a mention in the PM’s tweet. The first is the slower pace of GDP growth, as acknowledged by majority of observers (both domestic and foreign), which slowed down to around 3.8 percent in the previous fiscal. If estimates made by IMF and World Bank hold, then the coming years will witness an even slower pace of growth. Decline in GDP growth is considered a direct proxy of slowdown in economic activities, which in itself is an indication of slowdown in growth of aggregate income. Historically speaking, an upsurge in Pakistan’s imports has always followed a higher GDP growth (as economic activity picks up pace and incomes grow, so does demand for imports). Hence, it is no surprise that a lower level of imports has accompanied a lower GDP growth.

Another factor to consider is the uncertain business environment that has affected investment and business activity negatively. Consider, for example, the fact that Large Scale Manufacturing (LSM) has declined for the first time in a decade. The tussle between the government and business community did not help matters at all. The constant running around to Arab capitals and Beijing to get short term help, and prolonging the time of a deal with IMF, only created more doubts about whether Pakistan’s economy would be able to meet its obligations. The freefall of the rupee further compounded the overall uncertain situation. In such uncertainty, investors are unwilling to invest and those already in the business of production, services, retails, put off their investment decisions as expectations of a better future start to diminish. As investments and new plants and businesses have taken a hit (clearly reflected by slower economic growth and spare capacity in sectors like cement), the demand for imported goods (raw material, high tech equipment like machinery and smart phones) declines. This seems to be happening right now, and is part of this story.

Given that life in Pakistan has become much dearer now compared to what it was last year, there should be no surprise that remittances rose in quantum as families struggle to maintain their standard of living

Third, it is important to remember that the first phase of CPEC has come to an end, bringing with it an end to the phase of machinery imports. Fourth, the pronounced increase in inflation has caused the cost of production to jump up significantly, making life difficult for all sets of producers (domestic, export oriented, etc) and consumers (as their real income falls further, thus depressing aggregate spending). Quite a few of these industries are dependent on imported raw material for their survival and manufacturing (pharmaceutical industry, for example, imports 95 percent of raw material for their produce). Combine domestic upsurge in production costs with higher price of imports and lower real incomes, and it is natural that the demand for imports will fall.

By any stretch of imagination, the above stated factors do not aspire a positive outlook or exuberance because they indicate circumstances that pose significant challenges to the economy and its growth.

Next item of discussion is the increase in the quantum of remittances. Let us parse the numbers in order to interpret the factors that led to this. Data indicates that a noticeable surge in remittances materialised around the festive occasions of Eidul Fitr and Eidul Azha. Well, no surprises there since it’s a norm rather than an exception. Do these explain the increase? Not quiet, as there is another important factor at work. One has to appreciate the fact that foreign remittances sustain the livelihoods and lifestyles of thousands of families (if not millions) in Pakistan. For example, Dr Hafiz Pasha’s calculations related to provincial GDPs imply that 20 percent of the total household income in the province of KP owes solely to remittances. Put another way, a large portion of Pakistani households depend critically upon remittances to sustain their livelihoods. Given that life in Pakistan has become much dearer now compared to what it was last year, there should be no surprise that remittances rose in quantum as families struggle to maintain their standard of living. This aspect would seem to be an ideal candidate in explaining this rise since not much has been invested by the diaspora in dollar denominated instruments (like bonds) and not even a percent of the remittances are being used for any productive investment in Pakistan. In this case, there again remains little occasion for joy.

Lastly, we turn to exports which have registered a slight increase. It is a bit of a puzzle since developments at home in the last fiscal do not lend themselves favorably to export increase. It is difficult to comprehend such a development when costs of production have witnessed a steady increase (making Pakistani products much costlier to produce and hence feeding into un-competitiveness of our exports), manufacturing and agricultural sector suffering a contraction and overall environment not conducive to export oriented industries. Does the increase owe to the increase in prices of products that we export, any special concession or did Pakistani products found a new market? It is a bit of a mystery right now. My hunch is that the increase will ultimately be traced to some special concession, just like Beijing provided to our export products last year. How long such concessions would last is anybody’s guess.

Let me conclude by clarifying that it makes me happy to realize that finally some relief did come to Pakistan’s struggling economy. My worry, though, stems from a deeper introspection into the numbers and their probable sources, and also the fact that this is a short term phenomenon. In lieu of all that I’ve penned down, I have a request to make to the honorable PM; respected sir, please be vary of courtiers who have become a permanent fixture in the corridors of power in Pakistan. They have deceived many rulers before you by singing undue praises. Such courtiers and touts surround you too. Instead of taking to Twitter, ask them what these numbers imply, the sources of improvement in Pakistan’s trade balance, and whether this short-term trend has the tendency to transform into a long-term trend without adverse repercussions domestically? You will then be better placed to decide whether it is something to gloat about or worry about.

The writer is an economist