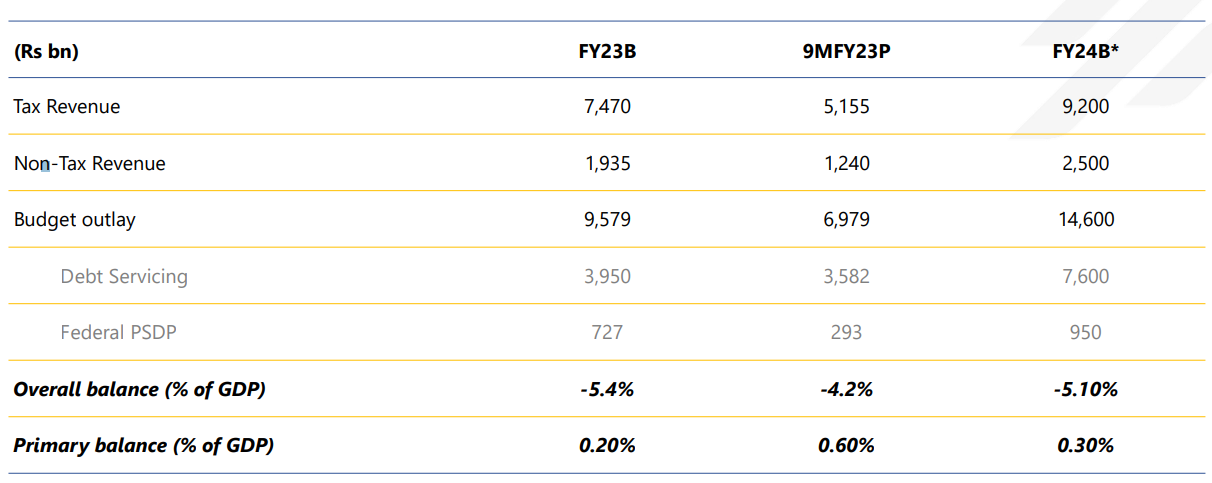

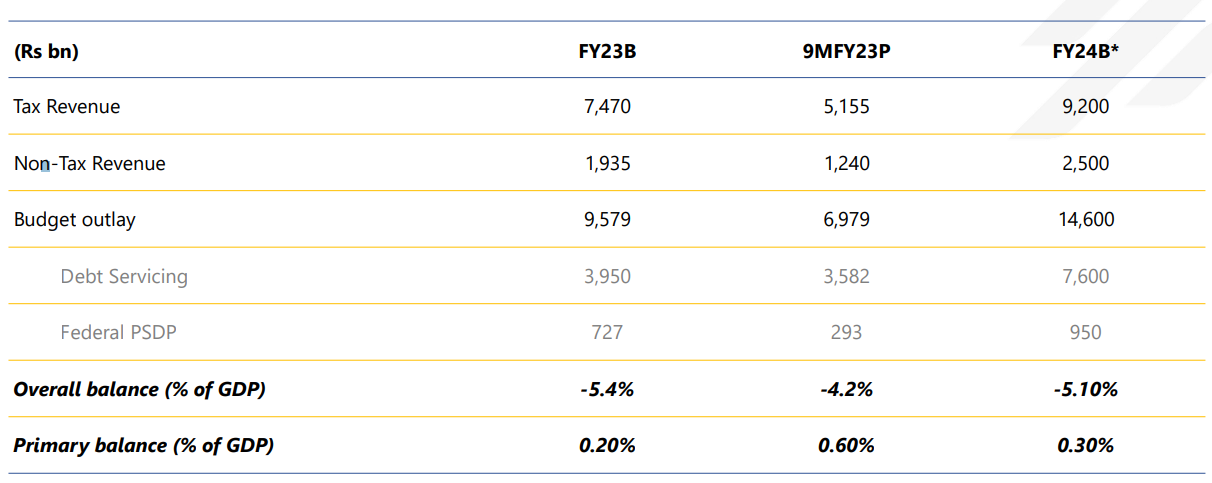

The Pakistani government is gearing up to present the federal budget on 9th June for the fiscal year 2024, with a focus on debt servicing due to current economic concerns. To address the significant expenses, the government has set an ambitious target of Rs 9.2 trillion in tax revenue for FY24, representing a 20% YoY growth from the FY23 budget. However, there has been some volatility leading up to the budget presentation.

The budget is an election-year affair and would mean that the incumbent government is walking a tightrope of appeasing its voter bank and managing the economic crisis. The previous budget was ambitious, but fell short of the desired target. According to the Ministry of Finance's data on fiscal operations in the first nine months of FY23, FBR tax revenues, despite growth, fell short of the target. Direct tax revenues experienced significant growth, yet there was still a shortfall in non-tax revenues. Expenditure, on the other hand, increased significantly due to rising interest rates and debt servicing costs. Therefore, a budget deficit and shortfall in revenues are projected for the end of FY23.

Furthermore, this time around, the IMF deal hangs in the balance, and prior approval of the budget is required to see the deal through. At the time of writing this article, the government has shared the details of the budget with the Fund, and awaits a response.

According to a report by JS Research, the government has some hard choices to make, including choosing between short-term micro or long-term macro stability, satisfying the IMF or pleasing the vote bank, continuing strangulation of the economy, or aligning tax structures and keeping speculation on domestic debt restructuring rife or undertaking tax measures instead.

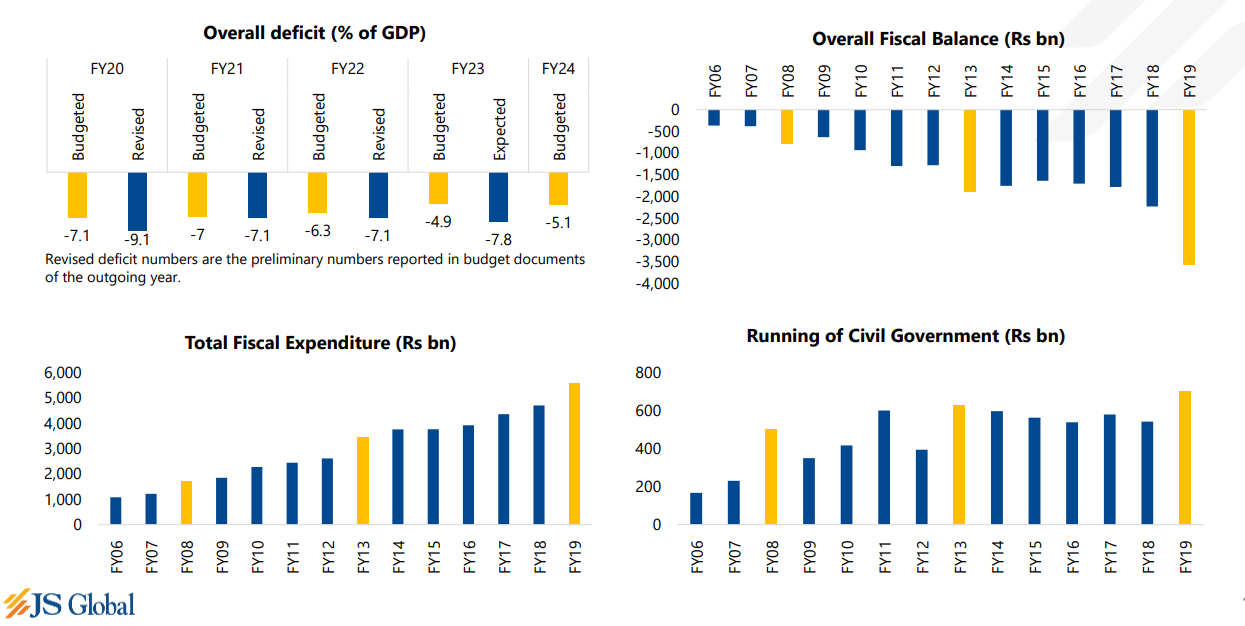

Source: JS Global

The report further adds, "The Rs. 9.2 trillion (tax) target translates into a 21% YoY growth. While some of the existing ad-hoc measures (Super Tax, Higher GST, etc.) will continue, there will be a visible display of innovative methods to increase the tax net. While reported developments on possible tax on reserves of companies have lost some steam, the latest news flow indicates some version of the aforementioned measure and a quasi-wealth tax in the works."

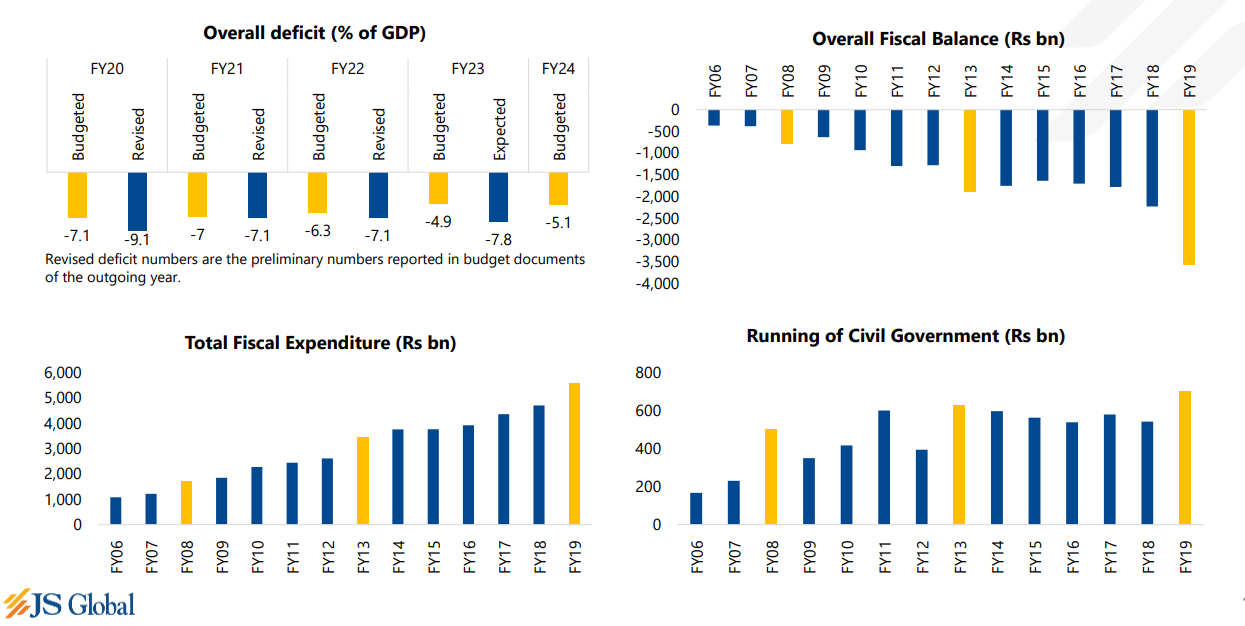

The fact is also highlighted that there is no option but to show discipline as debt servicing will take away over 50% of the expense pool. "Political ambitions will likely find an outlet in BISP and PSDP, but subsidies and other slippages will likely eat away at the allocations eventually. “Actual fiscal deficits have exceeded budgeted deficits in each of the last five years, while expenses have exceeded respective prevailing years during past election years," it read.

As far as the sectors are concerned, according to the JS report, "The paradox for banks will likely lead the way. We believe that a higher tax on government securities is already reflected in valuations – with sub 3x P/E – and the same leading to dispelling concerns over domestic debt restructuring could eventually turn out positive for unlocking valuations. Given the challenging situation, it is unlikely that any sector walks away with any meaningful wins in the budget. We believe the budget will likely carry negative earnings implications for banks and higher import-dependent sectors such as Steel, Chemicals & Autos."

Yet, according to experts, the upcoming budget is expected to be inflationary and could result in a significant fiscal deficit. Record-high inflation levels require an increase in government operating costs, which may not be accompanied by a corresponding increase in tax revenue. With limited room to maneuver, the government may have to expand the tax net, which has been a challenge for previous administrations. As the fiscal deficit expands, the government will rely more on debt to bridge the gap. However, increasing debt may lead to higher interest rates, which will result in a doom loop where interest expenses make up a greater proportion of federal revenue, requiring even more debt to be serviced. This may result in limited funding for development or current expenditure.

The budget is an election-year affair and would mean that the incumbent government is walking a tightrope of appeasing its voter bank and managing the economic crisis. The previous budget was ambitious, but fell short of the desired target. According to the Ministry of Finance's data on fiscal operations in the first nine months of FY23, FBR tax revenues, despite growth, fell short of the target. Direct tax revenues experienced significant growth, yet there was still a shortfall in non-tax revenues. Expenditure, on the other hand, increased significantly due to rising interest rates and debt servicing costs. Therefore, a budget deficit and shortfall in revenues are projected for the end of FY23.

Furthermore, this time around, the IMF deal hangs in the balance, and prior approval of the budget is required to see the deal through. At the time of writing this article, the government has shared the details of the budget with the Fund, and awaits a response.

According to a report by JS Research, the government has some hard choices to make, including choosing between short-term micro or long-term macro stability, satisfying the IMF or pleasing the vote bank, continuing strangulation of the economy, or aligning tax structures and keeping speculation on domestic debt restructuring rife or undertaking tax measures instead.

Source: JS Global

The report further adds, "The Rs. 9.2 trillion (tax) target translates into a 21% YoY growth. While some of the existing ad-hoc measures (Super Tax, Higher GST, etc.) will continue, there will be a visible display of innovative methods to increase the tax net. While reported developments on possible tax on reserves of companies have lost some steam, the latest news flow indicates some version of the aforementioned measure and a quasi-wealth tax in the works."

The fact is also highlighted that there is no option but to show discipline as debt servicing will take away over 50% of the expense pool. "Political ambitions will likely find an outlet in BISP and PSDP, but subsidies and other slippages will likely eat away at the allocations eventually. “Actual fiscal deficits have exceeded budgeted deficits in each of the last five years, while expenses have exceeded respective prevailing years during past election years," it read.

As far as the sectors are concerned, according to the JS report, "The paradox for banks will likely lead the way. We believe that a higher tax on government securities is already reflected in valuations – with sub 3x P/E – and the same leading to dispelling concerns over domestic debt restructuring could eventually turn out positive for unlocking valuations. Given the challenging situation, it is unlikely that any sector walks away with any meaningful wins in the budget. We believe the budget will likely carry negative earnings implications for banks and higher import-dependent sectors such as Steel, Chemicals & Autos."

Yet, according to experts, the upcoming budget is expected to be inflationary and could result in a significant fiscal deficit. Record-high inflation levels require an increase in government operating costs, which may not be accompanied by a corresponding increase in tax revenue. With limited room to maneuver, the government may have to expand the tax net, which has been a challenge for previous administrations. As the fiscal deficit expands, the government will rely more on debt to bridge the gap. However, increasing debt may lead to higher interest rates, which will result in a doom loop where interest expenses make up a greater proportion of federal revenue, requiring even more debt to be serviced. This may result in limited funding for development or current expenditure.