Pakistan's economy has been facing immense challenges of late, leading to a consensus that the country’s economic future is bleak. The possibility of sovereign default has added to the noise, fueled by the liquidity crisis. However, a recent report by KTrade Securities suggests that Pakistan is likely to weather the storm and not default on its sovereign commitments. The report highlights the country's pivotal geostrategic position in the region and predicts sustainable growth driven by external funding. Despite the challenges, the report suggests that the funding gap is small enough to be bridged and that Pakistan's economy will continue to thrive.

“Our reading of global geopolitical trends, along with the government’s initiatives on both foreign policy and financial management, make us confident that Pakistan will not default,” read the report.

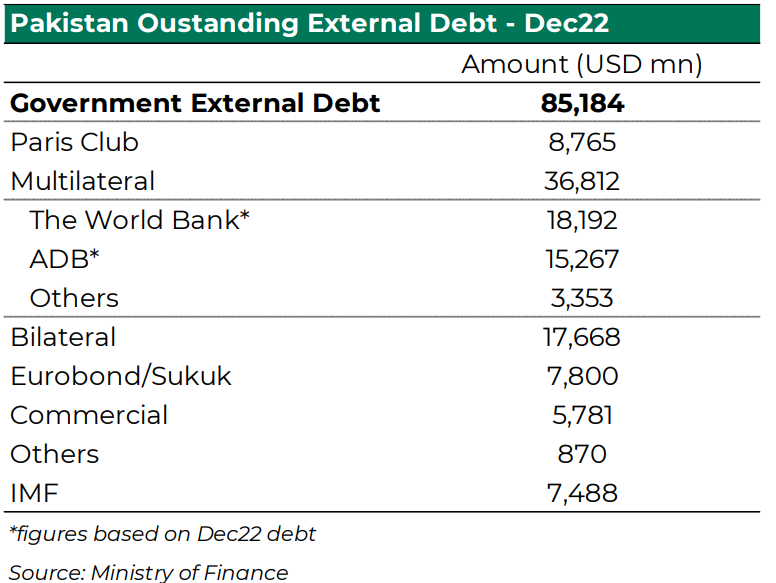

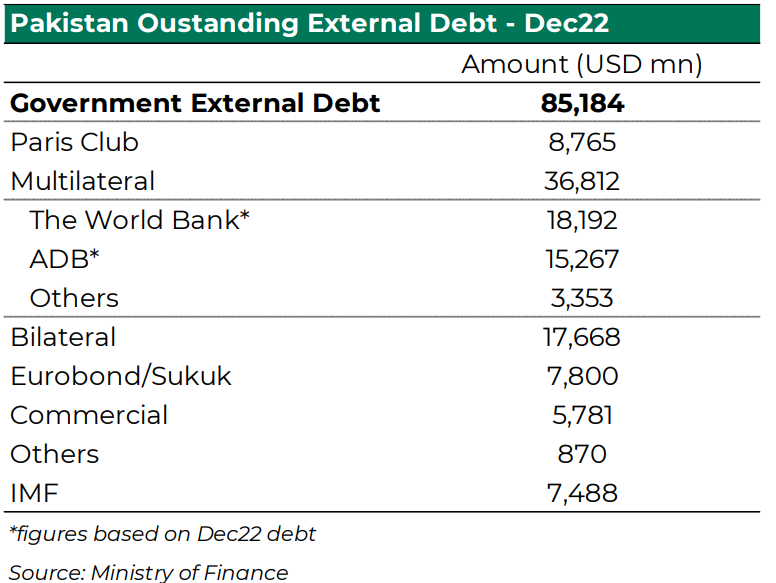

The analysts note that Pakistan's funding gap is estimated to be around $3-5 billion, due for repayment in the next 12 months. Hence, the amount is such that the country can raise these funds from friendly countries such as Saudi Arabia and China. Further, external debt is around a quarter of the GDP, which is quite manageable given the fact that domestic players including businesses and households are not highly leveraged.

The report suggests that domestic politics is to blame for the current economic difficulties. Pakistan's compliance with the IMF's plan conditionality and avoidance of short-term political benefits could have resulted in earlier investment flows from friendly countries.

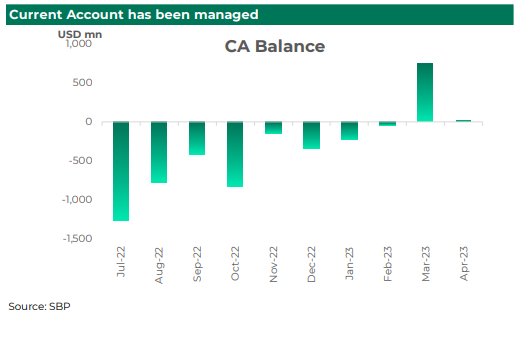

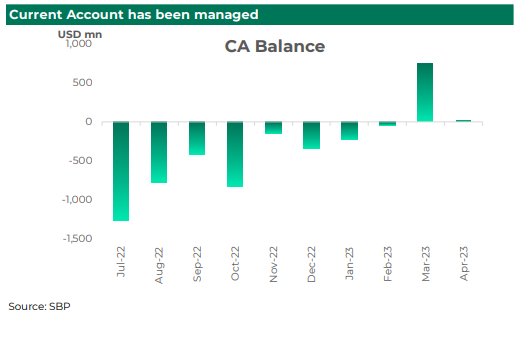

Yet, the government still possesses enough controls and resources to handle the crisis. For instance, the country's FX reserves have increased from $3 billion to $4.3 billion, and the current account deficit has reduced from 4.5% of GDP to 1% of GDP compared to the start of this year.

Further, analysts urge that recent geopolitical developments inspire confidence about Pakistan’s economic future. As per the report, “Pakistan’s status as a swing state is still equally relevant and significant today. It has an extremely important pivotal status both for China as well as for the US.”

Recent developments including news regarding Saudi Arabia and China’s interest in investing in Pakistan's power, agriculture, and technology sectors are a positive sign, while political instability in Pakistan delaying these plans, the KTrade analysts see investment opportunities as tangible and necessary, considering Pakistan's strategic position in global and regional geopolitics.

“Consequently, as a financial analyst, it seems very hard for us to believe that while China and Saudi are willing to rollover their existing debt, and have announced plans for further investment into the country, they will be unwilling to provide additional $3-5 billion. It is not rational.” The report read.

On the multilateral front, the IMF seems to be playing hardball with Pakistan, yet analysts have pointed out that pushing Pakistan towards bilateral lenders may signal to other countries in the global south that they should seek support directly from countries like China. This could potentially weaken the IMF's position as a lender of last resort.

On the multilateral front, the IMF seems to be playing hardball with Pakistan, yet analysts have pointed out that pushing Pakistan towards bilateral lenders may signal to other countries in the global south that they should seek support directly from countries like China. This could potentially weaken the IMF's position as a lender of last resort.

However, those who don’t share the same level of optimism have warned that reserves may drop below the critical level of $2 billion by the end of September, making it virtually impossible to honor external debt payments. The fiscal practices of the provinces also appear to be making matters worse, with borrowing required for interest payments (domestic and external), leading the country towards a debt trap.

“Our reading of global geopolitical trends, along with the government’s initiatives on both foreign policy and financial management, make us confident that Pakistan will not default,” read the report.

The analysts note that Pakistan's funding gap is estimated to be around $3-5 billion, due for repayment in the next 12 months. Hence, the amount is such that the country can raise these funds from friendly countries such as Saudi Arabia and China. Further, external debt is around a quarter of the GDP, which is quite manageable given the fact that domestic players including businesses and households are not highly leveraged.

The report suggests that domestic politics is to blame for the current economic difficulties. Pakistan's compliance with the IMF's plan conditionality and avoidance of short-term political benefits could have resulted in earlier investment flows from friendly countries.

Yet, the government still possesses enough controls and resources to handle the crisis. For instance, the country's FX reserves have increased from $3 billion to $4.3 billion, and the current account deficit has reduced from 4.5% of GDP to 1% of GDP compared to the start of this year.

Further, analysts urge that recent geopolitical developments inspire confidence about Pakistan’s economic future. As per the report, “Pakistan’s status as a swing state is still equally relevant and significant today. It has an extremely important pivotal status both for China as well as for the US.”

Recent developments including news regarding Saudi Arabia and China’s interest in investing in Pakistan's power, agriculture, and technology sectors are a positive sign, while political instability in Pakistan delaying these plans, the KTrade analysts see investment opportunities as tangible and necessary, considering Pakistan's strategic position in global and regional geopolitics.

“Consequently, as a financial analyst, it seems very hard for us to believe that while China and Saudi are willing to rollover their existing debt, and have announced plans for further investment into the country, they will be unwilling to provide additional $3-5 billion. It is not rational.” The report read.

On the multilateral front, the IMF seems to be playing hardball with Pakistan, yet analysts have pointed out that pushing Pakistan towards bilateral lenders may signal to other countries in the global south that they should seek support directly from countries like China. This could potentially weaken the IMF's position as a lender of last resort.

On the multilateral front, the IMF seems to be playing hardball with Pakistan, yet analysts have pointed out that pushing Pakistan towards bilateral lenders may signal to other countries in the global south that they should seek support directly from countries like China. This could potentially weaken the IMF's position as a lender of last resort.However, those who don’t share the same level of optimism have warned that reserves may drop below the critical level of $2 billion by the end of September, making it virtually impossible to honor external debt payments. The fiscal practices of the provinces also appear to be making matters worse, with borrowing required for interest payments (domestic and external), leading the country towards a debt trap.