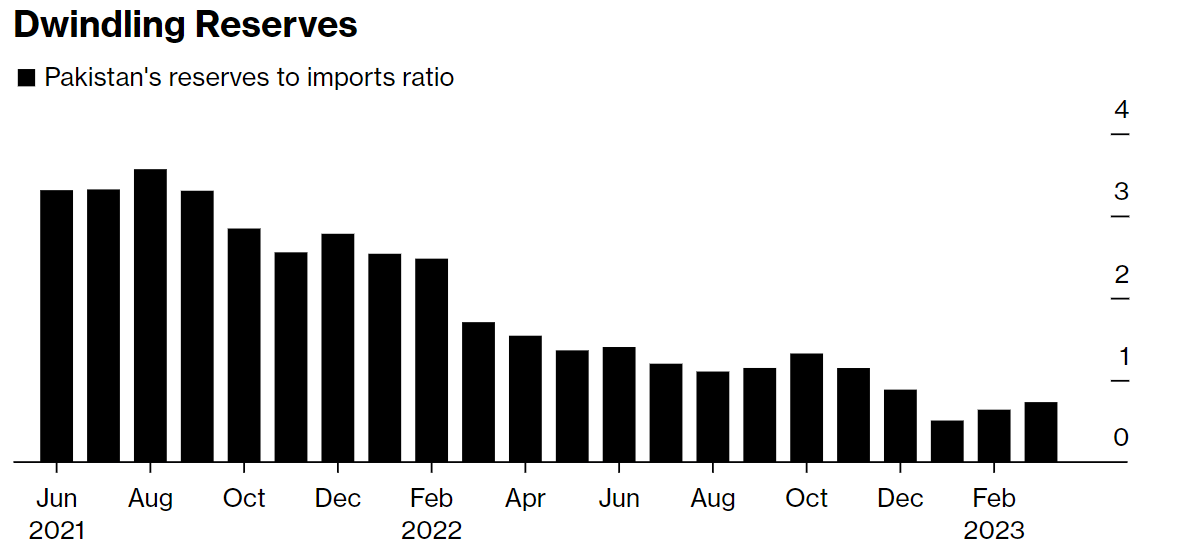

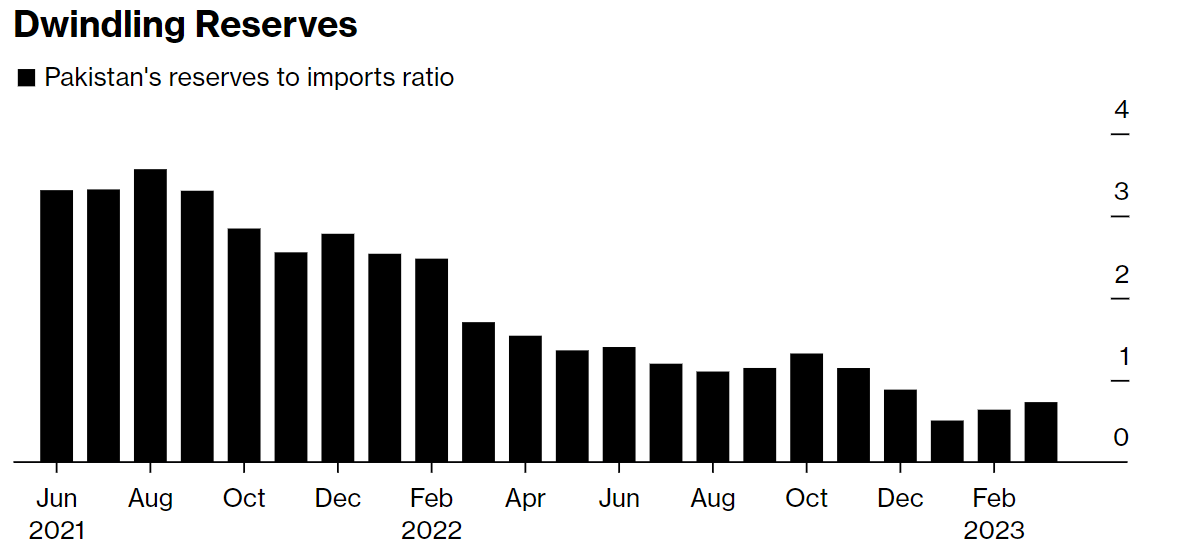

Pakistan's economic outlook has become even more uncertain due to ongoing internal political conflicts and related security concerns. The recent increase in militancy has further exacerbated the situation, while political instability has added to the already complex economic scenario. As a result, investor confidence has hit an all-time low, triggering gradual capital flight. Additionally, critically low foreign exchange reserves and the failure to resume the IMF program have raised concerns about default and further devaluation of the already weakened Pakistani Rupee.

Investor confidence and the Rupee

“Pakistan investors are bracing for a sudden jolt as former premier Imran Khan’s showdown with the powerful military, and the government, reaches a tipping point. Warnings of a massive drop in the rupee are flaring up, with some analysts forecasting another 20% decline is possible. Heightened tensions after Khan’s arrest last week may push the International Monetary Fund’s $6.7 billion bailout further out of reach, with bond managers staring at the specter of a sovereign default,” reported Bloomberg.

Source: Bloomberg

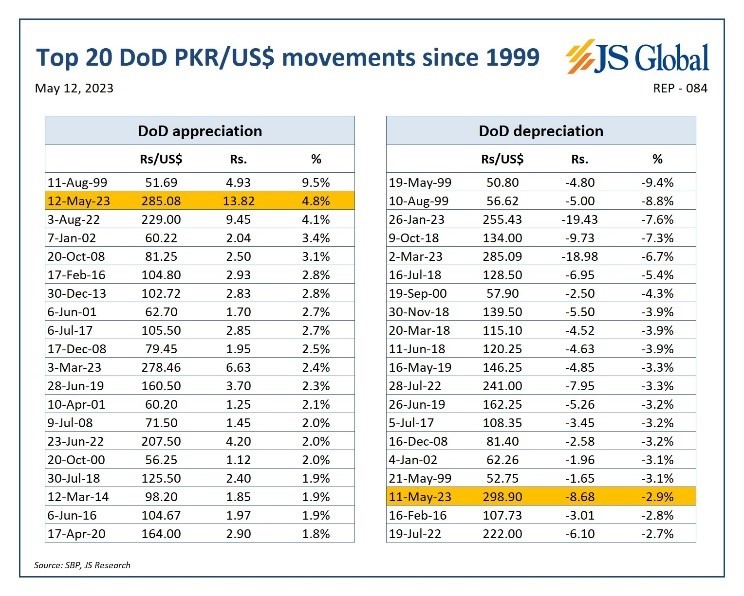

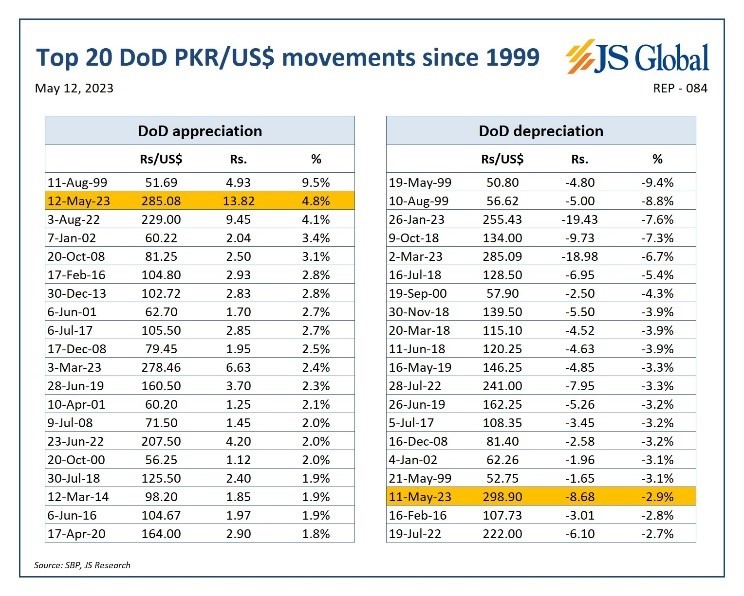

The impact of political uncertainty on a country's currency was evident on May 11, after protests erupted and the Pakistani Rupee hit an all-time low of 299 against the US dollar. However, the currency has since recovered and is currently hovering around 285. Yet, the PKR is one of the worst-performing currencies globally, already having lost 20% of its value since the start of the year.

IMF program

The delay in IMF matters is diminishing hope for the current program's revival, which was planned to end in June 2023. The reasons for the delay, as per a recent article by Business Recorder, are numerous, including the economy's deteriorating fiscal side, particularly with regards to tax revenues.

Import compression policies have effectively reduced imported goods by half compared to last year, resulting in lower tax revenues, particularly indirect taxes. Additionally, there's been a significant increase in direct taxes on sectors that already pay disproportionately high taxes, leading the formal sector to shift toward the informal sector. This shift has caused a decline in FBR tax collection and non-tax revenues.

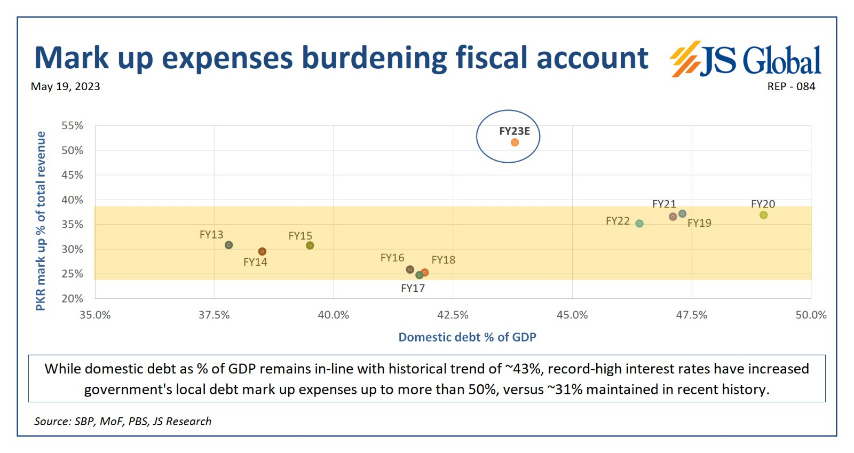

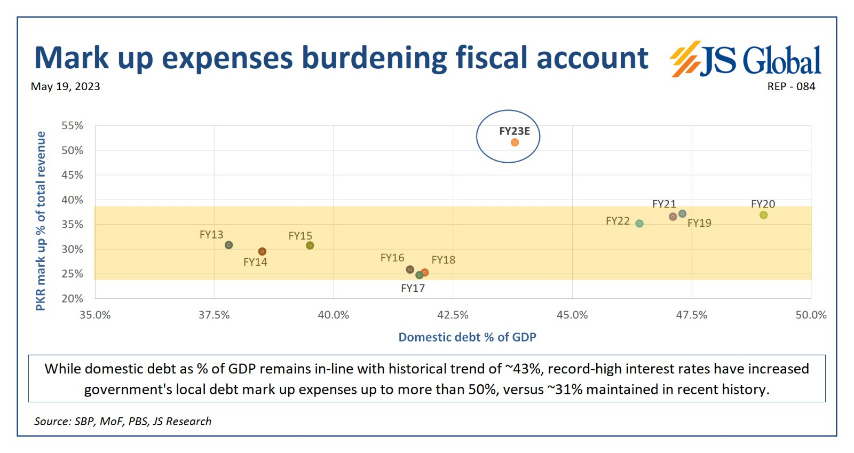

Further, the government has paid Rs 3.1 trillion in domestic debt servicing, which accounts for 87% of the total debt servicing. This presents an immense and unsustainable burden on the fiscal account.

Therefore, the growing fiscal deficit and its financing pose significant challenges to Pakistan's economy. Hence, if the IMF’s 10th review is combined with the ongoing 9th review, the gross funding requirement may have to be increased from $6 billion to $8 billion, making it even more challenging to revive the current program.

Staring at default

Given the underlying factors and the mounting pressure of debt servicing the country is faced with a very realistic threat of a sovereign default.

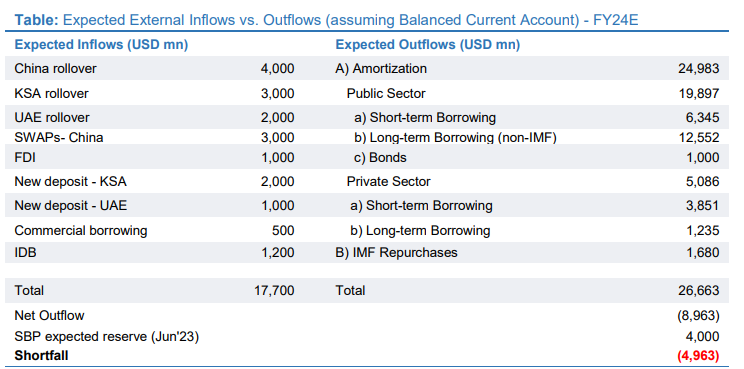

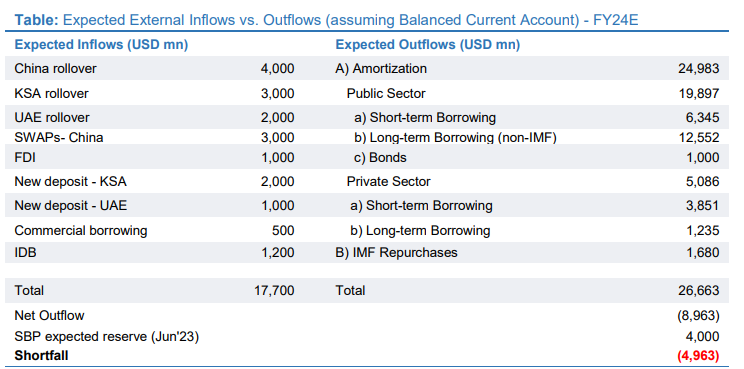

As per the report “What if Pakistan defaults?” by Arif Habib Limited (ARHL), “Pakistan is confronted with significant debt repayments until June 2024. Even in our most optimistic scenario, where we assume that Pakistan will be able to receive support from bilateral friends (Saudi Arabia, UAE, and China) in the form of both rollovers and fresh funding and also run a balanced current account, the country still faces a shortfall of ~USD 5bn to meet the external debt servicing requirement of ~USD 27bn in FY24.”

Source: ARHL

“This clearly highlights the magnitude of challenges and risks ahead. Given support from friendly countries is often tied to the IMF’s tacit approval, a lack of breakthrough with the fund would make sovereign default a very high probability,” the report added.

The ARHL report also highlighted that the duration and extent of economic pain after a sovereign default can be reduced by orderly debt restructuring and relief. Pakistan's debt servicing requirements over the next 2-3 years ($73 billion over FY24-27) imply that it will need to undergo an extensive debt restructuring exercise. This will involve negotiations with China, other bilateral creditors, and Paris Club, under the umbrella of the IMF.

Given the state of affairs, China stands as the most important bilateral partner for Pakistan due to strong strategic and economic ties. China is also the largest creditor, contributing to 30% of Pakistan's total external debt. In a post-default scenario, China's role will be critical in supporting Pakistan's debt restructuring efforts. Without China's support, restructuring will be impossible, and their level of support and concessions will be crucial for an orderly debt restructuring. China's support will likely be a key precondition for any new post-default IMF program, similar to what was seen in Sri Lanka's case. Given the relationship and stakes involved, China is expected to provide similar assurances in a possible post-default scenario.

Investor confidence and the Rupee

“Pakistan investors are bracing for a sudden jolt as former premier Imran Khan’s showdown with the powerful military, and the government, reaches a tipping point. Warnings of a massive drop in the rupee are flaring up, with some analysts forecasting another 20% decline is possible. Heightened tensions after Khan’s arrest last week may push the International Monetary Fund’s $6.7 billion bailout further out of reach, with bond managers staring at the specter of a sovereign default,” reported Bloomberg.

Source: Bloomberg

The impact of political uncertainty on a country's currency was evident on May 11, after protests erupted and the Pakistani Rupee hit an all-time low of 299 against the US dollar. However, the currency has since recovered and is currently hovering around 285. Yet, the PKR is one of the worst-performing currencies globally, already having lost 20% of its value since the start of the year.

IMF program

The delay in IMF matters is diminishing hope for the current program's revival, which was planned to end in June 2023. The reasons for the delay, as per a recent article by Business Recorder, are numerous, including the economy's deteriorating fiscal side, particularly with regards to tax revenues.

Import compression policies have effectively reduced imported goods by half compared to last year, resulting in lower tax revenues, particularly indirect taxes. Additionally, there's been a significant increase in direct taxes on sectors that already pay disproportionately high taxes, leading the formal sector to shift toward the informal sector. This shift has caused a decline in FBR tax collection and non-tax revenues.

Further, the government has paid Rs 3.1 trillion in domestic debt servicing, which accounts for 87% of the total debt servicing. This presents an immense and unsustainable burden on the fiscal account.

Therefore, the growing fiscal deficit and its financing pose significant challenges to Pakistan's economy. Hence, if the IMF’s 10th review is combined with the ongoing 9th review, the gross funding requirement may have to be increased from $6 billion to $8 billion, making it even more challenging to revive the current program.

Staring at default

Given the underlying factors and the mounting pressure of debt servicing the country is faced with a very realistic threat of a sovereign default.

As per the report “What if Pakistan defaults?” by Arif Habib Limited (ARHL), “Pakistan is confronted with significant debt repayments until June 2024. Even in our most optimistic scenario, where we assume that Pakistan will be able to receive support from bilateral friends (Saudi Arabia, UAE, and China) in the form of both rollovers and fresh funding and also run a balanced current account, the country still faces a shortfall of ~USD 5bn to meet the external debt servicing requirement of ~USD 27bn in FY24.”

Source: ARHL

“This clearly highlights the magnitude of challenges and risks ahead. Given support from friendly countries is often tied to the IMF’s tacit approval, a lack of breakthrough with the fund would make sovereign default a very high probability,” the report added.

The ARHL report also highlighted that the duration and extent of economic pain after a sovereign default can be reduced by orderly debt restructuring and relief. Pakistan's debt servicing requirements over the next 2-3 years ($73 billion over FY24-27) imply that it will need to undergo an extensive debt restructuring exercise. This will involve negotiations with China, other bilateral creditors, and Paris Club, under the umbrella of the IMF.

Given the state of affairs, China stands as the most important bilateral partner for Pakistan due to strong strategic and economic ties. China is also the largest creditor, contributing to 30% of Pakistan's total external debt. In a post-default scenario, China's role will be critical in supporting Pakistan's debt restructuring efforts. Without China's support, restructuring will be impossible, and their level of support and concessions will be crucial for an orderly debt restructuring. China's support will likely be a key precondition for any new post-default IMF program, similar to what was seen in Sri Lanka's case. Given the relationship and stakes involved, China is expected to provide similar assurances in a possible post-default scenario.