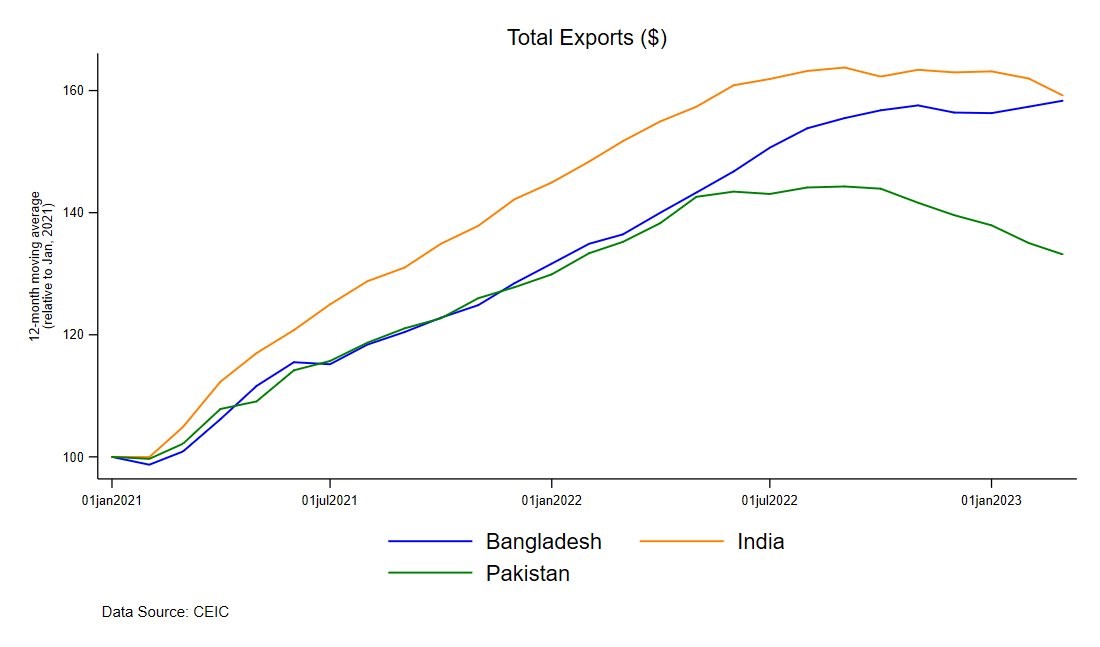

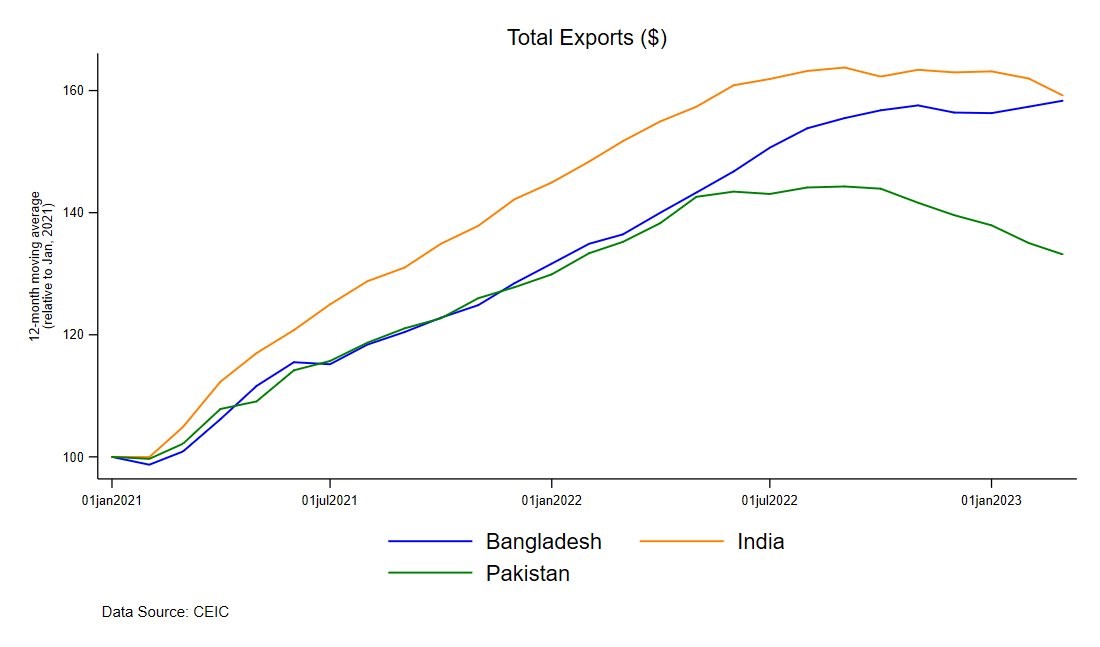

Pakistan's economy is currently experiencing a downward spiral. Macro indicators of the economy’s health are deteriorating at an unprecedented rate, with declining exports being a significant contributing factor. Ironically, supply-side issues aggravated in part by import restrictions have played a role in this decline. Although the current account deficit for the 2023 fiscal year is anticipated to be limited to $5 billion, GDP growth is expected to remain stagnant. Additionally, consumer price inflation has exceeded 35% – the highest it has been in the past 50 years.

Graph tweeted by Atif Mian

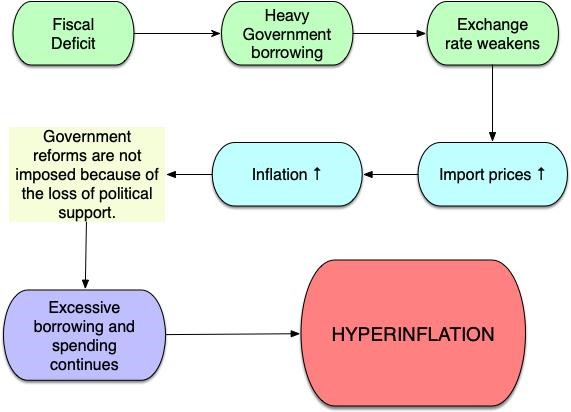

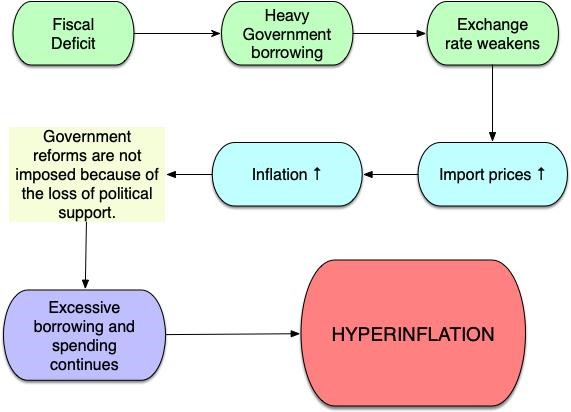

The current crisis in Pakistan's economy can be attributed in part to the irresponsible fiscal behavior of successive governments. Each administration has prioritized short-term political gains over long-term economic sustainability, leading to the current state of affairs. The problems began to emerge during the last year of the PTI government's tenure, with inflation rising and the fiscal deficit increasing. The government sought assistance from the IMF through a bailout package, but as Imran Khan's ouster became inevitable, the PTI administration torpedoed the deal by announcing an unfunded energy subsidy, leaving incoming officeholders to face the consequences.

However, the situation was similar when the PTI took office in 2018. They inherited a massive current account deficit of approximately $20 billion and a currency crisis from the previous PML-N government. Despite the current finance minister’s promises, the incumbent government has seemed clueless about managing the economy, and the situation has only worsened due to their pseudo-economics. The finance minister has failed to restore economic stability or implement measures to mitigate the crisis.

Source: Muneeb Sikander

The crisis in Pakistan has been further exacerbated by the ongoing Russia-Ukraine conflict and the devastating floods that occurred last year. As a result, the country is now in a precarious situation, constantly having to dance on its toes to appease the IMF. Although there is renewed hope of resuming the IMF program, with Saudi Arabia committing to a $2 billion external financing support and China providing a $2 billion loan facility, along with a rollover of its $2 billion SAFE deposit with the SBP, this financing will only be enough to keep Pakistan afloat for a few months at best.

“Even if all the expected financing including the IMF’s tranche, materializes, it will only help Pakistan get over the line through summer,” explained Economist Uzair Younus in his podcast.

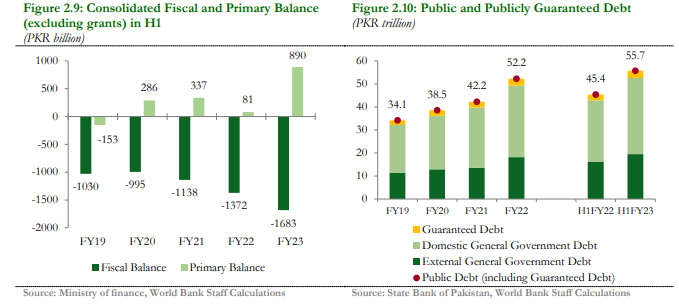

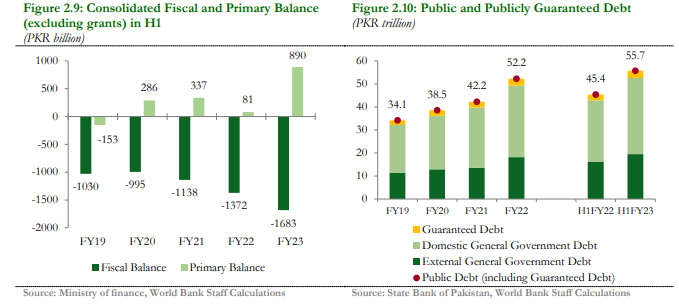

This is primarily due to the massive external financing needs of the country in the near term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

Even though the country has managed to squeeze its current account deficit significantly, debt amortization remains the main pressure on its reserves and forms a major part of the financing requirement.

Source: World Bank

Therefore, it looks like those at the helm will seek a debt restructuring arrangement from creditors, but it is going to be a big ask. Recently, former central bank chief Dr. Reza Baqir also stated that restructuring Pakistan’s external debt would be a very difficult task. The country owes the majority of its debt to Multilateral Development Banks (MDBs) like the World Bank which is essentially the reason why a restructuring and especially a debt haircut looks unlikely. The reason behind this difficulty lies in the mechanics of how these institutions operate.

MDB loans are granted preferred creditor status (PCT), which means that in the event of payment difficulties, lenders may prioritize the repayment of MDB debt over other creditors. This is because MDBs are lenders of last resort, continuing to lend even in the most challenging financial times.

Therefore, MDBs are not reliant on continual capital injections from their shareholder nations. Instead, their success is based on sustaining access to capital at advantageous terms, which is contingent on the market's trust in their financial strength. This trust is indicated by ratings provided by Credit Rating Agencies such as Fitch, Moody's, and Standard & Poor's (S&P).

However, agreeing to a haircut presents a significant risk for these institutions as it can jeopardize their ratings and threaten their existing business model. This is also why China, Pakistan's largest bilateral lender, believes that MDBs should be a part of the restructuring arrangement and assume their share of the financial burden. The participation of MDBs in the restructuring process is crucial to ensure the sustainability of Pakistan's debt and to avoid further economic turmoil.

Read more: Negotiations Remain At Impasse Between Global Powers Over Restructuring, As Nations Like Pakistan Struggle With Debt

The situation has not yet reached a critical point, and there is still a glimmer of hope. During a podcast, former SBP Chief Murtaza Syed outlined five reasons why the current crisis remains manageable. Firstly, Pakistan is part of a program by the IMF, which serves as a lender of last resort. Secondly, there has been a rapid adjustment in monetary and fiscal policy, which has been a departure from past practices. Thirdly, these adjustments are producing results, such as the shrinking CAD. Fourthly, Pakistan can finance short-term external financing needs with the help of friendly countries. Lastly, Pakistan's external debt to GDP ratio is manageable, with only 20% of external debt owed to commercial borrowers.

However, the problem is not just with the fundamentals of the economy. Those responsible for restoring harmony are busy pulling each other down and seem least concerned about the country’s future. “There exists a dire need to formalize capital, and reorient that capital towards export-oriented industries. The demographic and economic dividend that can be unlocked through tactical interventions can enhance economic value generation across the region, and beyond. The problems can be fixed, but the will to fix them is non-existent,” writes economist Ammar Khan, in an article for Profit.

Graph tweeted by Atif Mian

The current crisis in Pakistan's economy can be attributed in part to the irresponsible fiscal behavior of successive governments. Each administration has prioritized short-term political gains over long-term economic sustainability, leading to the current state of affairs. The problems began to emerge during the last year of the PTI government's tenure, with inflation rising and the fiscal deficit increasing. The government sought assistance from the IMF through a bailout package, but as Imran Khan's ouster became inevitable, the PTI administration torpedoed the deal by announcing an unfunded energy subsidy, leaving incoming officeholders to face the consequences.

However, the situation was similar when the PTI took office in 2018. They inherited a massive current account deficit of approximately $20 billion and a currency crisis from the previous PML-N government. Despite the current finance minister’s promises, the incumbent government has seemed clueless about managing the economy, and the situation has only worsened due to their pseudo-economics. The finance minister has failed to restore economic stability or implement measures to mitigate the crisis.

Source: Muneeb Sikander

The crisis in Pakistan has been further exacerbated by the ongoing Russia-Ukraine conflict and the devastating floods that occurred last year. As a result, the country is now in a precarious situation, constantly having to dance on its toes to appease the IMF. Although there is renewed hope of resuming the IMF program, with Saudi Arabia committing to a $2 billion external financing support and China providing a $2 billion loan facility, along with a rollover of its $2 billion SAFE deposit with the SBP, this financing will only be enough to keep Pakistan afloat for a few months at best.

“Even if all the expected financing including the IMF’s tranche, materializes, it will only help Pakistan get over the line through summer,” explained Economist Uzair Younus in his podcast.

This is primarily due to the massive external financing needs of the country in the near term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

Even though the country has managed to squeeze its current account deficit significantly, debt amortization remains the main pressure on its reserves and forms a major part of the financing requirement.

Source: World Bank

Therefore, it looks like those at the helm will seek a debt restructuring arrangement from creditors, but it is going to be a big ask. Recently, former central bank chief Dr. Reza Baqir also stated that restructuring Pakistan’s external debt would be a very difficult task. The country owes the majority of its debt to Multilateral Development Banks (MDBs) like the World Bank which is essentially the reason why a restructuring and especially a debt haircut looks unlikely. The reason behind this difficulty lies in the mechanics of how these institutions operate.

MDB loans are granted preferred creditor status (PCT), which means that in the event of payment difficulties, lenders may prioritize the repayment of MDB debt over other creditors. This is because MDBs are lenders of last resort, continuing to lend even in the most challenging financial times.

Therefore, MDBs are not reliant on continual capital injections from their shareholder nations. Instead, their success is based on sustaining access to capital at advantageous terms, which is contingent on the market's trust in their financial strength. This trust is indicated by ratings provided by Credit Rating Agencies such as Fitch, Moody's, and Standard & Poor's (S&P).

However, agreeing to a haircut presents a significant risk for these institutions as it can jeopardize their ratings and threaten their existing business model. This is also why China, Pakistan's largest bilateral lender, believes that MDBs should be a part of the restructuring arrangement and assume their share of the financial burden. The participation of MDBs in the restructuring process is crucial to ensure the sustainability of Pakistan's debt and to avoid further economic turmoil.

Read more: Negotiations Remain At Impasse Between Global Powers Over Restructuring, As Nations Like Pakistan Struggle With Debt

The situation has not yet reached a critical point, and there is still a glimmer of hope. During a podcast, former SBP Chief Murtaza Syed outlined five reasons why the current crisis remains manageable. Firstly, Pakistan is part of a program by the IMF, which serves as a lender of last resort. Secondly, there has been a rapid adjustment in monetary and fiscal policy, which has been a departure from past practices. Thirdly, these adjustments are producing results, such as the shrinking CAD. Fourthly, Pakistan can finance short-term external financing needs with the help of friendly countries. Lastly, Pakistan's external debt to GDP ratio is manageable, with only 20% of external debt owed to commercial borrowers.

However, the problem is not just with the fundamentals of the economy. Those responsible for restoring harmony are busy pulling each other down and seem least concerned about the country’s future. “There exists a dire need to formalize capital, and reorient that capital towards export-oriented industries. The demographic and economic dividend that can be unlocked through tactical interventions can enhance economic value generation across the region, and beyond. The problems can be fixed, but the will to fix them is non-existent,” writes economist Ammar Khan, in an article for Profit.