The recent turbulence in the global financial systems has exposed chinks in the armors of banking institutions that were generally considered financial fortresses. Moreover, with a few global banks facing liquidity crises, it has raised concerns among those privy to the financial markets about the unfolding of another banking crisis.

Read More: Does The Fall Of Silicon Valley Bank Indicate Another Global Financial Crisis?

However, in Pakistan, the banking sector’s financials are likely to be impacted by a new development, something that has been pending for quite a while. Pakistani banks are set to implement the financial reporting standard IFRS-9, which would likely result in an upward revision of the losses on loans and investments.

“JS Global Capital Ltd, Head of Research Amreen Soorani, said banks will start reporting their loss expectations on investments and loans under the new accounting requirements of the International Financial Reporting Standards (IFRS)-9 from the first quarter of 2023,” reported DAWN.

What is IFRS-9?

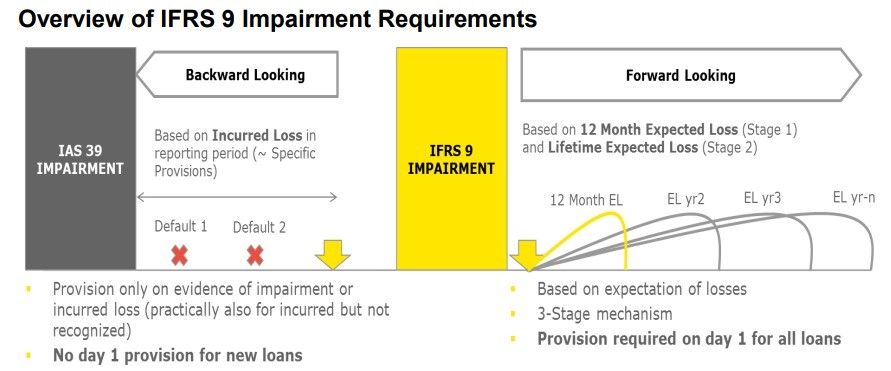

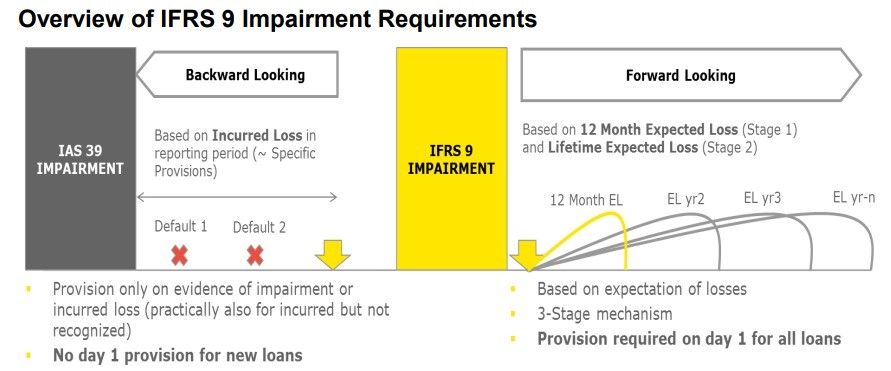

IFRS 9, like its predecessor IAS-39, is an accounting framework that directs how to recognize, measure, and disclose financial assets and liabilities. As these are crucial aspects of a bank's balance sheet, e.g., loans and Investments, the regulation has several effects on the banking sector.

The standard necessitates that banks recognize anticipated credit losses on their loan portfolios rather than waiting for actual losses before recognizing them.

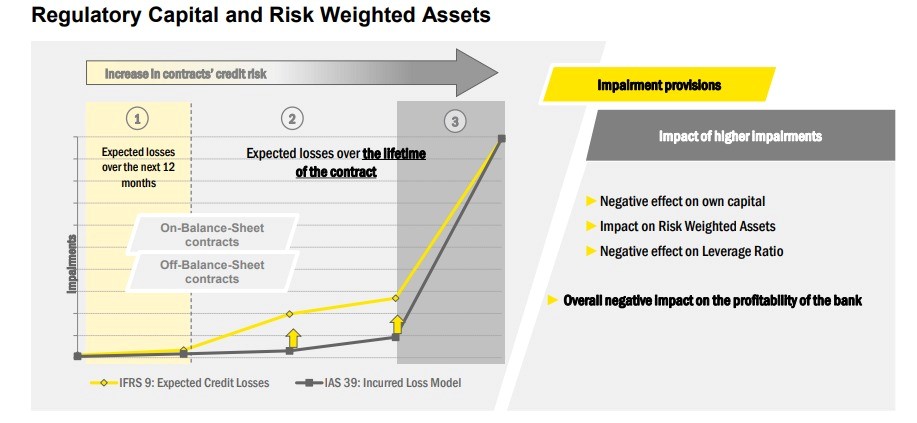

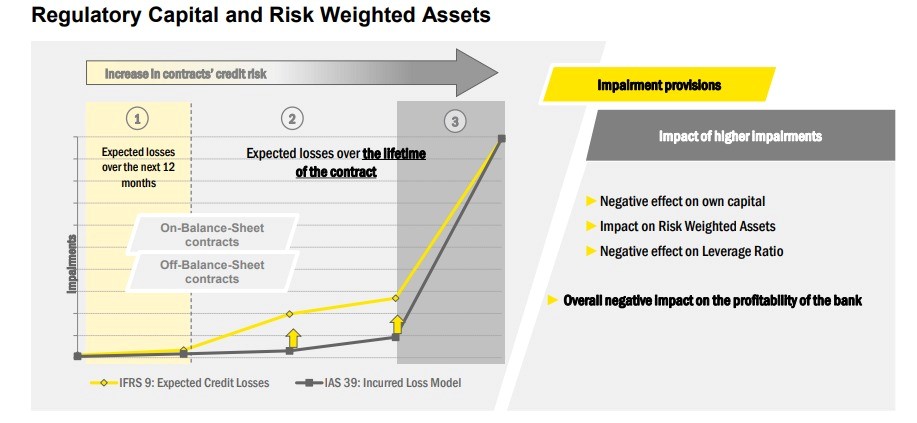

This implies that banks must evaluate the credit risk of their loan portfolios and establish reserves for potential losses. As a result, banks may need to raise their reserves and capital requirements, which could impact their profitability and lending ability.

Additionally, IFRS 9 introduces a new financial asset classification system that affects how banks account for various assets. Banks must now classify financial assets into amortized cost, fair value through other comprehensive income (FVOCI), and fair value through profit or loss (FVTPL). This may affect how banks handle their investment portfolios and protect themselves against risks.

Source: EY

What does this mean for banking clients?

Banks usually factor in the expected level of credit losses when setting the loan interest rate. This means that if a bank anticipates higher losses, the interest rate charged will reflect that risk with a higher rate. As banks adopt the new framework, the average anticipated loss per loan may also rise, leading to lower profitability on these loans or a higher cost of borrowing for consumers.

Further, the State Bank of Pakistan has regulations in place ensuring banks do not take excessive risks when disbursing loans, including requirements for adequacy of banks’ capital and liquidity positions. Therefore, an upward revision in the banking sector’s credit risk might impact their lending ability.

Implications for Banks

“As per the SBP directives, IFRS 9 stands implemented effective January 01, 2023, which will change the computation of credit cost for banks - based on expected losses, resulting in, (i) a one-time provision on existing assets, routed through Equity and (ii) recurring provisions cost on P&L depending on each bank’s asset book quality, and reclassification of a certain investment,” read National Bank of Pakistan’s (NBP) annual report for 2022.

Source: EY

Apart from credit costs, some banks might find themselves dealing with additional loss-making bonds due to reclassification. To understand this concept, it is necessary to know how bond markets work.

“A fundamental principle of bond investing is that market interest rates and bond prices generally move in opposite directions. When market interest rates rise, prices of fixed-rate bonds fall. This phenomenon is known as interest rate risk,” read an investor bulletin by US Securities and Exchange Commission (SEC).

The fact is that the Pakistani banking sector has massive exposure to government bonds, and due to the successive interest rate hikes over the past year, revaluation losses on these bonds have accumulated.

“Banks bought fixed-rate bonds when the policy rate was lower. However, following a rise in the policy rate, the bond’ seems meager. This becomes important when you keep the inflation rate in mind and the negative real interest rate available. These bonds won’t fetch a great price in the secondary market either. As the theory goes, the price of a fixed-rate bond moves inversely to its yield – when the yield goes up, the price of a fixed-rate bond goes down,” explains journalist Ariba Shahid in her article for Profit.

Further, losses on some of these investments are not accounted for in the banking financials. However, impairment provisions in IFRS-9 and specific criteria for the classification of investments can lead to the accumulation of these losses.

"Securities held at amortized costs are not required to be marked to the market. However, if the implementation of IFRS-9 leads to a reclassification of the aforementioned to AFS, then it would lead to accumulation of unrealized losses," stated Havaris Arshad, a senior Chartered Accountant and ex-manager at PwC Pakistan.

The impact, however, would vary on a case-to-case basis. “No major impact is expected on the bank’s capital adequacy, as SBP has allowed banks to opt for a ‘transitional arrangement’ staggering the impact over five years,” NBP’s annual report added.

Yet, implementing IFRS 9 will necessitate banks to modify their accounting systems, risk management processes, and disclosures. Although the standard aims to enhance transparency and comparability in financial reporting, it may significantly affect the banking sector's financial performance and risk profile.

Read More: Does The Fall Of Silicon Valley Bank Indicate Another Global Financial Crisis?

However, in Pakistan, the banking sector’s financials are likely to be impacted by a new development, something that has been pending for quite a while. Pakistani banks are set to implement the financial reporting standard IFRS-9, which would likely result in an upward revision of the losses on loans and investments.

“JS Global Capital Ltd, Head of Research Amreen Soorani, said banks will start reporting their loss expectations on investments and loans under the new accounting requirements of the International Financial Reporting Standards (IFRS)-9 from the first quarter of 2023,” reported DAWN.

What is IFRS-9?

IFRS 9, like its predecessor IAS-39, is an accounting framework that directs how to recognize, measure, and disclose financial assets and liabilities. As these are crucial aspects of a bank's balance sheet, e.g., loans and Investments, the regulation has several effects on the banking sector.

The standard necessitates that banks recognize anticipated credit losses on their loan portfolios rather than waiting for actual losses before recognizing them.

This implies that banks must evaluate the credit risk of their loan portfolios and establish reserves for potential losses. As a result, banks may need to raise their reserves and capital requirements, which could impact their profitability and lending ability.

Additionally, IFRS 9 introduces a new financial asset classification system that affects how banks account for various assets. Banks must now classify financial assets into amortized cost, fair value through other comprehensive income (FVOCI), and fair value through profit or loss (FVTPL). This may affect how banks handle their investment portfolios and protect themselves against risks.

Source: EY

What does this mean for banking clients?

Banks usually factor in the expected level of credit losses when setting the loan interest rate. This means that if a bank anticipates higher losses, the interest rate charged will reflect that risk with a higher rate. As banks adopt the new framework, the average anticipated loss per loan may also rise, leading to lower profitability on these loans or a higher cost of borrowing for consumers.

Further, the State Bank of Pakistan has regulations in place ensuring banks do not take excessive risks when disbursing loans, including requirements for adequacy of banks’ capital and liquidity positions. Therefore, an upward revision in the banking sector’s credit risk might impact their lending ability.

Implications for Banks

“As per the SBP directives, IFRS 9 stands implemented effective January 01, 2023, which will change the computation of credit cost for banks - based on expected losses, resulting in, (i) a one-time provision on existing assets, routed through Equity and (ii) recurring provisions cost on P&L depending on each bank’s asset book quality, and reclassification of a certain investment,” read National Bank of Pakistan’s (NBP) annual report for 2022.

Source: EY

Apart from credit costs, some banks might find themselves dealing with additional loss-making bonds due to reclassification. To understand this concept, it is necessary to know how bond markets work.

“A fundamental principle of bond investing is that market interest rates and bond prices generally move in opposite directions. When market interest rates rise, prices of fixed-rate bonds fall. This phenomenon is known as interest rate risk,” read an investor bulletin by US Securities and Exchange Commission (SEC).

The fact is that the Pakistani banking sector has massive exposure to government bonds, and due to the successive interest rate hikes over the past year, revaluation losses on these bonds have accumulated.

“Banks bought fixed-rate bonds when the policy rate was lower. However, following a rise in the policy rate, the bond’ seems meager. This becomes important when you keep the inflation rate in mind and the negative real interest rate available. These bonds won’t fetch a great price in the secondary market either. As the theory goes, the price of a fixed-rate bond moves inversely to its yield – when the yield goes up, the price of a fixed-rate bond goes down,” explains journalist Ariba Shahid in her article for Profit.

Further, losses on some of these investments are not accounted for in the banking financials. However, impairment provisions in IFRS-9 and specific criteria for the classification of investments can lead to the accumulation of these losses.

"Securities held at amortized costs are not required to be marked to the market. However, if the implementation of IFRS-9 leads to a reclassification of the aforementioned to AFS, then it would lead to accumulation of unrealized losses," stated Havaris Arshad, a senior Chartered Accountant and ex-manager at PwC Pakistan.

The impact, however, would vary on a case-to-case basis. “No major impact is expected on the bank’s capital adequacy, as SBP has allowed banks to opt for a ‘transitional arrangement’ staggering the impact over five years,” NBP’s annual report added.

Yet, implementing IFRS 9 will necessitate banks to modify their accounting systems, risk management processes, and disclosures. Although the standard aims to enhance transparency and comparability in financial reporting, it may significantly affect the banking sector's financial performance and risk profile.