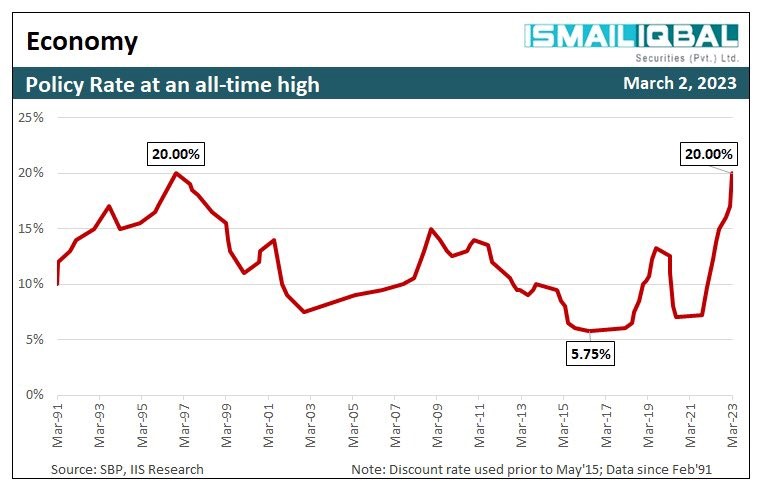

Complying with the IMF’s demands, the State Bank of Pakistan (SBP) raised the interest rate by 3% on 2nd March 2023. The new rate of 20% is the highest it has been in the last 27 years.

“State Bank of Pakistan (SBP) in its Monetary Policy Committee (MPC) meeting decided to increase the policy rate by 300bps to 20% and discount rate at 21%. This is the highest ever policy rate since it started in 2015. Similarly, the discount rate reaches the highest since the start in the early 1990s,” read a report by Topline Securities.

The measure is in line with the IMF’s aim to reduce the gap between the rate of inflation and the prevailing interest rates to curb the demand in the economy and control spiraling inflation.

Source: IIS

As per an article published by the IMF, “While there are many different interest rates in financial markets, the policy interest rate set by a country’s central bank provides the key benchmark for borrowing costs in the country’s economy. Central banks vary the policy rate in response to changes in the economic cycle and to steer the country’s economy by influencing many different (mainly short-term) interest rates. Higher policy rates provide incentives for saving, while lower rates motivate consumption and reduce the cost of business investment.”

Experts, however, have doubts about the efficacy of the contractionary measures in tackling inflationary pressures as Pakistan is facing a wave of, primarily, cost-push inflation driven by relatively inelastic imports of fuel and food items.

https://twitter.com/steve_hanke/status/1632104624864862210

As per an article published by the IMF, “Monetary policy can’t resolve remaining pandemic-related bottlenecks in global supply chains and disruptions in commodities markets due to the war in Ukraine. It can however slow overall demand to address demand-related inflationary pressures, so a tightening of financial conditions is the goal.”

Yet, it is argued that there is no room left to squeeze the consumer discretionary demand as the successive rate hikes have conquered that front. Additionally, higher rates might not necessarily translate into greater savings as a large chunk of the undocumented and informal cash economy doesn’t respond to monetary measures in a systematic manner.

Hence, the root cause of the problem, as economist Ammar Habib argues in his articles, is the prevalence of too much cash in the system.

For over three years, the SPB has kept negative real interest rates, printing trillions of rupees and injecting them into the market, resulting in a surge in demand. At present, the country has over Rs.8 trillion in circulation, equating to almost 20% of the GDP. Increasing interest rates is an ineffective tool to bring grey cash from the informal economy into the formal economy. The growing money supply that remains outside the system continues to add to inflation.

https://twitter.com/MOPasha84/status/1626936333745934337

If the government runs significant fiscal deficits and finances spending through printing money, it can lead to severe inflationary consequences. This occurs when funds enter the broader money supply and are deposited into commercial bank accounts.

Explaining the process of printing money, economist Muneeb Sikander states in his article, “The process of money printing by governments functions as follows. Governments temporarily borrow the money required to finance the fiscal deficit from the bond market (in local currency). Later, when the interest and principal repayments are due, the government prints this money and pays it off. This increase in the money supply results in the decreasing value of money held by other people, but it pays off the government debt.”

Therefore, what transpires is a unique form of taxation, where the government, instead of generating revenue through conventional tax systems, significantly reduces the purchasing power of the public by shrinking their real disposable income.

Muneeb, in another article, explains, “Government expenditures need to be financed and, since taxes are usually insufficient, a significant amount of financing comes from abroad in the form of debt. However, developing countries today face ever-increasing borrowing constraints in international capital markets due to the adverse effects of the recent depreciation of local currencies on public-sector balance sheets with dollar debts. An alternative for many developing countries is borrowing money in their local currencies as well as loosening up their monetary policies, also known as quantitative easing (QE).”

https://twitter.com/YousufNazar/status/1631219769977208833

Hence, it is critical that the government’s aim should be to minimize the amount of currency circulating in the economy. This can be achieved by decreasing the government's financing needs. One way to do this is by managing the policy rate appropriately to keep debt-servicing expenses low. However, since the demand for currency in circulation is not influenced by policy rate adjustments, an alternative approach is to increase tax and non-tax revenues, and avoid acquiring new debt.

“Moreover, additional liquidity in the system can be generated through lowering cash in circulation. A reduction of Rs 2 trillion from Rs 8 trillion cash in circulation would generate ample liquidity to lower the interest rates. The government and SBP need to think of a workable option to rein in the cash economy,” writes Ali Khizar in his article for the Business Recorder.

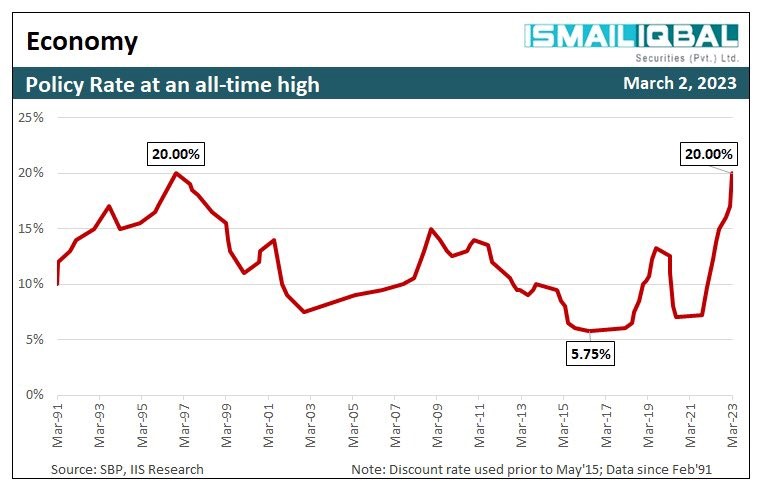

“State Bank of Pakistan (SBP) in its Monetary Policy Committee (MPC) meeting decided to increase the policy rate by 300bps to 20% and discount rate at 21%. This is the highest ever policy rate since it started in 2015. Similarly, the discount rate reaches the highest since the start in the early 1990s,” read a report by Topline Securities.

The measure is in line with the IMF’s aim to reduce the gap between the rate of inflation and the prevailing interest rates to curb the demand in the economy and control spiraling inflation.

Source: IIS

As per an article published by the IMF, “While there are many different interest rates in financial markets, the policy interest rate set by a country’s central bank provides the key benchmark for borrowing costs in the country’s economy. Central banks vary the policy rate in response to changes in the economic cycle and to steer the country’s economy by influencing many different (mainly short-term) interest rates. Higher policy rates provide incentives for saving, while lower rates motivate consumption and reduce the cost of business investment.”

Experts, however, have doubts about the efficacy of the contractionary measures in tackling inflationary pressures as Pakistan is facing a wave of, primarily, cost-push inflation driven by relatively inelastic imports of fuel and food items.

https://twitter.com/steve_hanke/status/1632104624864862210

As per an article published by the IMF, “Monetary policy can’t resolve remaining pandemic-related bottlenecks in global supply chains and disruptions in commodities markets due to the war in Ukraine. It can however slow overall demand to address demand-related inflationary pressures, so a tightening of financial conditions is the goal.”

Yet, it is argued that there is no room left to squeeze the consumer discretionary demand as the successive rate hikes have conquered that front. Additionally, higher rates might not necessarily translate into greater savings as a large chunk of the undocumented and informal cash economy doesn’t respond to monetary measures in a systematic manner.

Hence, the root cause of the problem, as economist Ammar Habib argues in his articles, is the prevalence of too much cash in the system.

For over three years, the SPB has kept negative real interest rates, printing trillions of rupees and injecting them into the market, resulting in a surge in demand. At present, the country has over Rs.8 trillion in circulation, equating to almost 20% of the GDP. Increasing interest rates is an ineffective tool to bring grey cash from the informal economy into the formal economy. The growing money supply that remains outside the system continues to add to inflation.

https://twitter.com/MOPasha84/status/1626936333745934337

If the government runs significant fiscal deficits and finances spending through printing money, it can lead to severe inflationary consequences. This occurs when funds enter the broader money supply and are deposited into commercial bank accounts.

Explaining the process of printing money, economist Muneeb Sikander states in his article, “The process of money printing by governments functions as follows. Governments temporarily borrow the money required to finance the fiscal deficit from the bond market (in local currency). Later, when the interest and principal repayments are due, the government prints this money and pays it off. This increase in the money supply results in the decreasing value of money held by other people, but it pays off the government debt.”

Therefore, what transpires is a unique form of taxation, where the government, instead of generating revenue through conventional tax systems, significantly reduces the purchasing power of the public by shrinking their real disposable income.

Muneeb, in another article, explains, “Government expenditures need to be financed and, since taxes are usually insufficient, a significant amount of financing comes from abroad in the form of debt. However, developing countries today face ever-increasing borrowing constraints in international capital markets due to the adverse effects of the recent depreciation of local currencies on public-sector balance sheets with dollar debts. An alternative for many developing countries is borrowing money in their local currencies as well as loosening up their monetary policies, also known as quantitative easing (QE).”

https://twitter.com/YousufNazar/status/1631219769977208833

Hence, it is critical that the government’s aim should be to minimize the amount of currency circulating in the economy. This can be achieved by decreasing the government's financing needs. One way to do this is by managing the policy rate appropriately to keep debt-servicing expenses low. However, since the demand for currency in circulation is not influenced by policy rate adjustments, an alternative approach is to increase tax and non-tax revenues, and avoid acquiring new debt.

“Moreover, additional liquidity in the system can be generated through lowering cash in circulation. A reduction of Rs 2 trillion from Rs 8 trillion cash in circulation would generate ample liquidity to lower the interest rates. The government and SBP need to think of a workable option to rein in the cash economy,” writes Ali Khizar in his article for the Business Recorder.