Uncertainty prevails over the resumption of Pakistan’s IMF program as the Fund has pushed for strict prior actions before the release of a $1 billion loan tranche.

Amongst the many contentious issues, primarily four demands by the global lender stand out and require prior action. These include an interest rate hike, a permanent debt surcharge on electricity tariffs, exchange rate depreciation to close the gap between the official rate and the market rate and securing written funding commitments from bilateral partners.

Interest Rate Hike

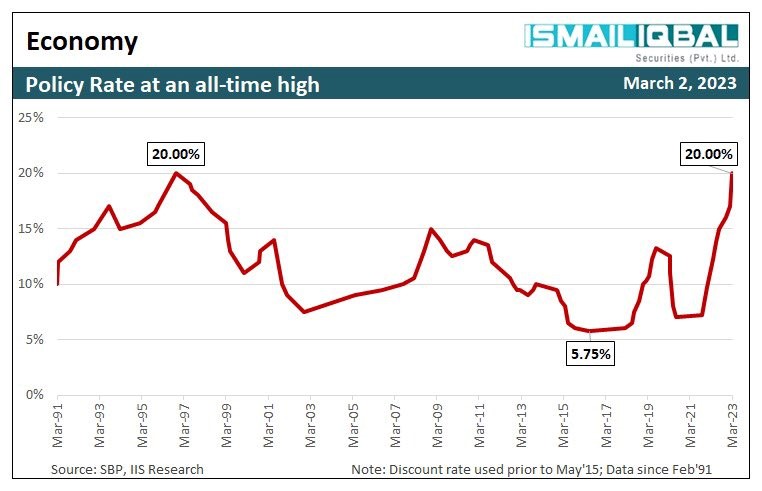

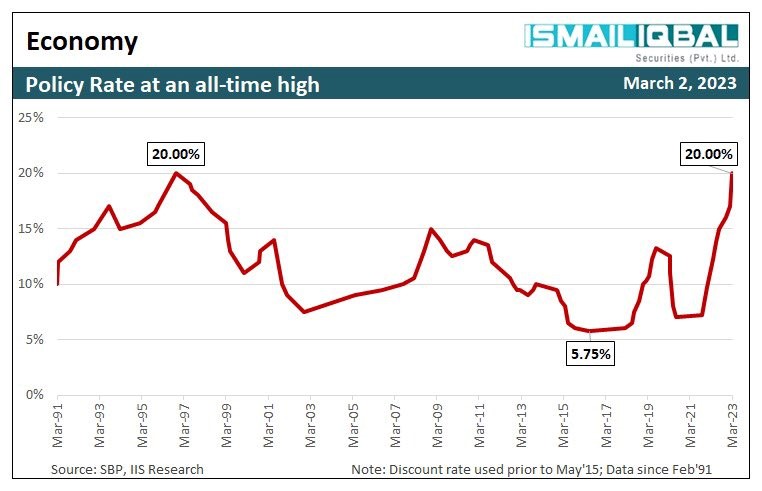

Complying with the IMF’s demands, The State Bank of Pakistan (SBP) has already raised the interest rate by 3 percent on 2nd March 2023. The new rate of 20% is the highest in the last 27 years.

“State Bank of Pakistan (SBP) in its Monetary Policy Committee (MPC) meeting decided to increase the policy rate by 300bps to 20% and discount rate at 21%. This is the highest ever policy rate since it started in 2015. Similarly, the discount rate reaches the highest since the start in the early 1990s,” read a report by Topline Securities.

Source: IIS

Debt Surcharge

Further, accepting IMF’s second demand, the government enacted a permanent electricity surcharge of Rs 3.23 per unit, in order to recover Rs 335 billion from consumers. This move is expected to place an additional burden in the upcoming fiscal year, a consequence of the need to immediately address the Rs 800 billion circular debt plaguing the power sector.

https://twitter.com/YousufNazar/status/1629195209639690242

Rupee Devaluation

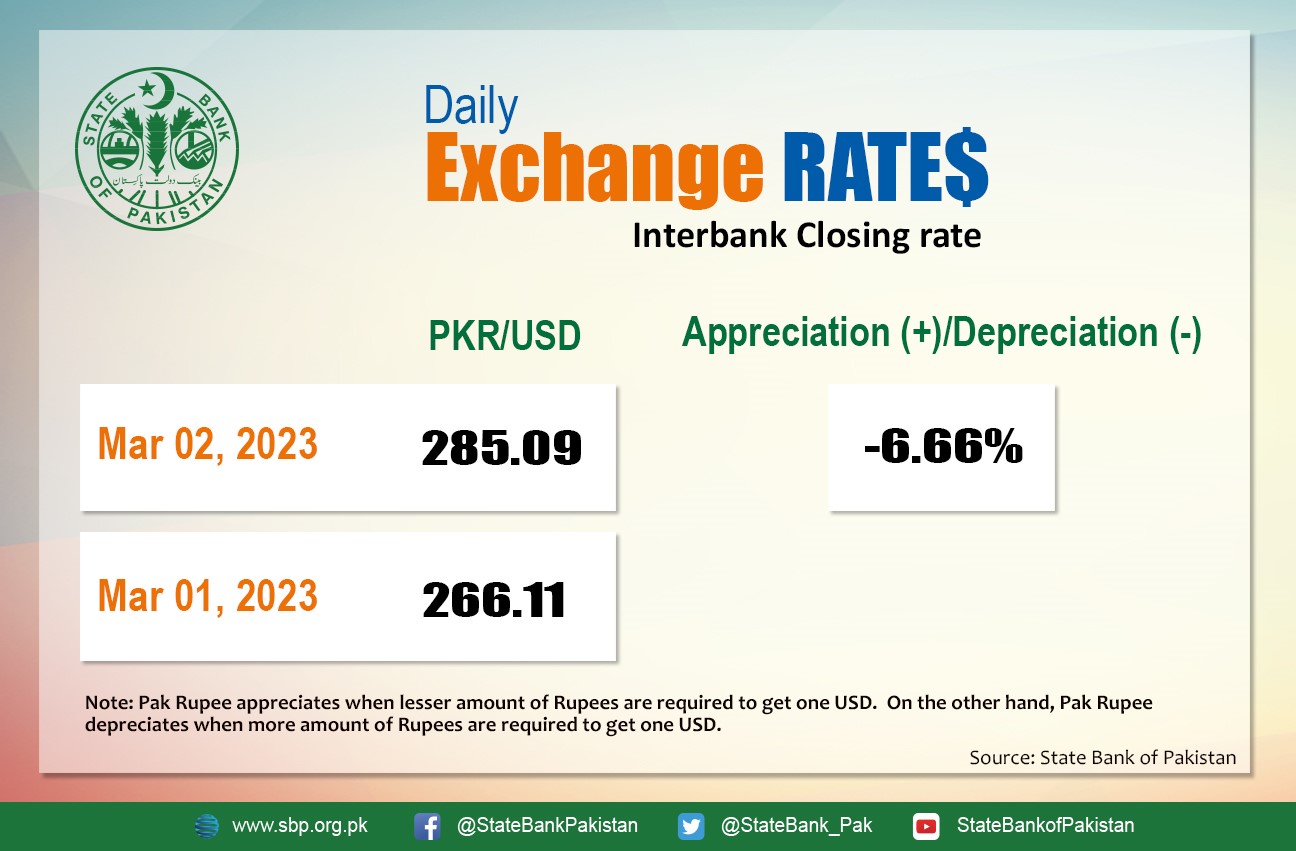

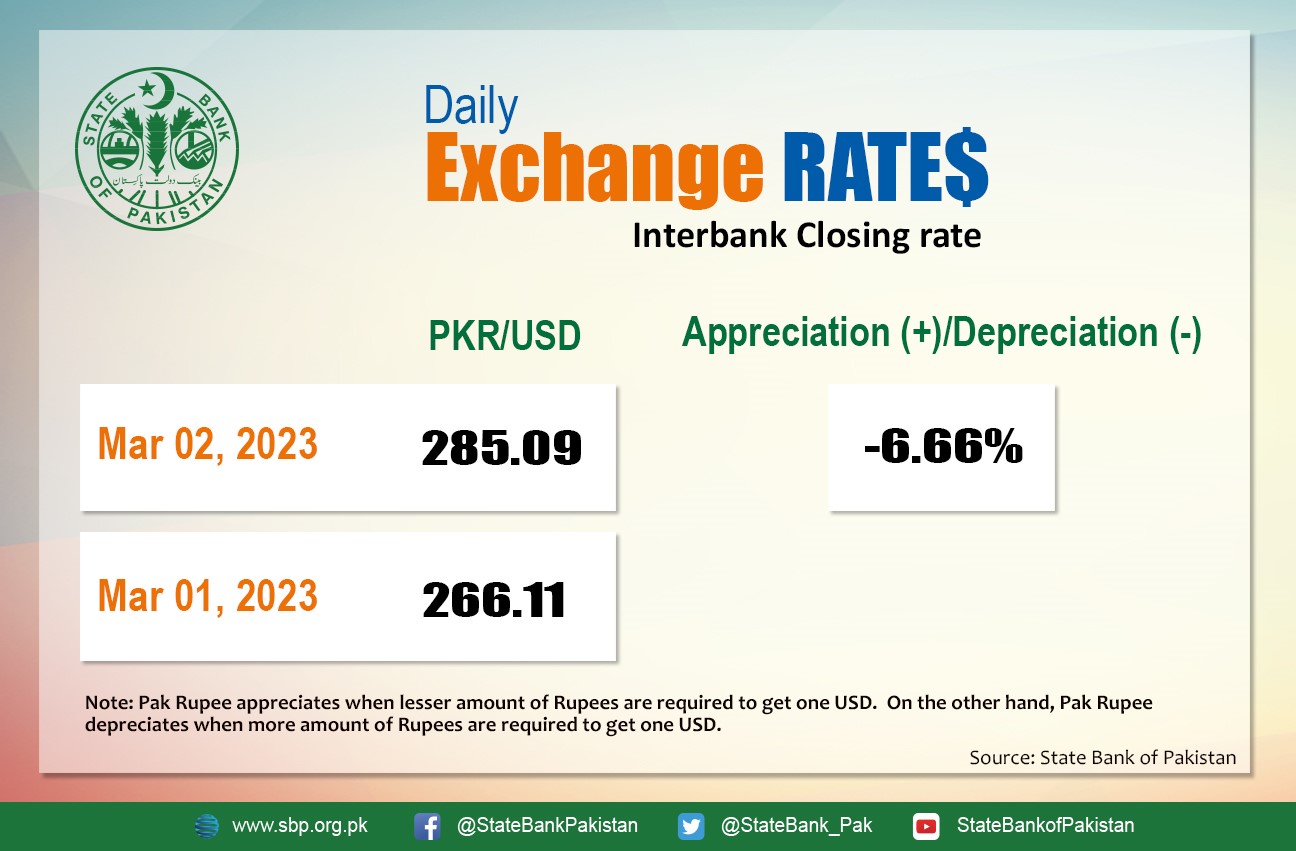

Wednesday continued to be an eventful day in terms of the country’s economic situation as the third and probably the most important adjustment came from the currency markets where the rupee devalued by 6.66% against the dollar and closed at 285. As per sources, actual dollar trades were taking place north of Rs 300 in the black market.

Source: SBP

The depreciation can be attributed to the Fund’s demand of reducing the gap between the official rate and the grey market rate of the dollar. The precarious economic condition over the past few months coupled with the consistent demand for dollars from Afghanistan has kept the parallel currency market busy even after the massive rupee depreciation that took place in January.

https://twitter.com/UzairYounus/status/1631250501810495490

Funding Requirements

The last frontier that needs to be conquered in order to restore the IMF program is securing external financing commitments from friendly countries.

IMF estimated that the total financing deficit for the current fiscal year is estimated to be around $7 billion, contrary to the Pakistani government's forecast of $5 billion. In spite of this, officials are pinning their hopes on SBP’s foreign exchange reserves exceeding $10 billion by the end of June.

As per an article in Dawn, “sources have disclosed that the Pakistani authorities have obtained $1.3 billion in three instalments from Chinese banks, as well as an additional $700 million. This will be partitioned into two equal parts $500 million and $300 million, with a few days in between each transaction. Moreover, Saudi Arabia and the United Arab Emirates have made available approximately $3 billion.”

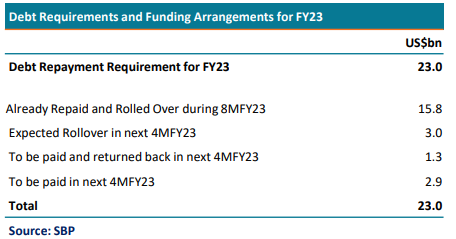

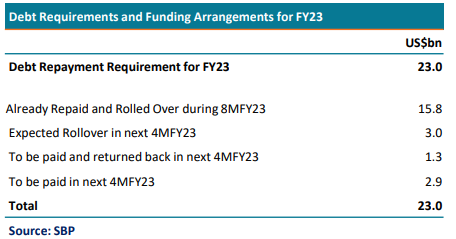

“SBP Governor in the analyst briefing also highlighted that at the start of FY23, financing requirement was around US$33 billion, which included US$10 billion of CAD and US$23 billion principal debt repayments. Out of the US$23 billion debt repayment, US$15.8 billion has already been settled through rollover and repayment. Out of the remaining US$7.2 billion, SBP is hopeful that a rollover of around US$4.3 billion will be done and the actual repayment would be around US$2.9 billion for which financing would need to be arranged. We believe that given the global economic situation and delay in the IMF program, rolling over debt would be challenging unless Pakistan swiftly completes reforms and get IMF on board,” read the Topline report.

However, the finance minister, Ishaq Dar has claimed that the government is nearing a staff-level agreement and a deal is likely to be closed by the next week.

Amongst the many contentious issues, primarily four demands by the global lender stand out and require prior action. These include an interest rate hike, a permanent debt surcharge on electricity tariffs, exchange rate depreciation to close the gap between the official rate and the market rate and securing written funding commitments from bilateral partners.

Interest Rate Hike

Complying with the IMF’s demands, The State Bank of Pakistan (SBP) has already raised the interest rate by 3 percent on 2nd March 2023. The new rate of 20% is the highest in the last 27 years.

“State Bank of Pakistan (SBP) in its Monetary Policy Committee (MPC) meeting decided to increase the policy rate by 300bps to 20% and discount rate at 21%. This is the highest ever policy rate since it started in 2015. Similarly, the discount rate reaches the highest since the start in the early 1990s,” read a report by Topline Securities.

Source: IIS

Debt Surcharge

Further, accepting IMF’s second demand, the government enacted a permanent electricity surcharge of Rs 3.23 per unit, in order to recover Rs 335 billion from consumers. This move is expected to place an additional burden in the upcoming fiscal year, a consequence of the need to immediately address the Rs 800 billion circular debt plaguing the power sector.

https://twitter.com/YousufNazar/status/1629195209639690242

Rupee Devaluation

Wednesday continued to be an eventful day in terms of the country’s economic situation as the third and probably the most important adjustment came from the currency markets where the rupee devalued by 6.66% against the dollar and closed at 285. As per sources, actual dollar trades were taking place north of Rs 300 in the black market.

Source: SBP

The depreciation can be attributed to the Fund’s demand of reducing the gap between the official rate and the grey market rate of the dollar. The precarious economic condition over the past few months coupled with the consistent demand for dollars from Afghanistan has kept the parallel currency market busy even after the massive rupee depreciation that took place in January.

https://twitter.com/UzairYounus/status/1631250501810495490

Funding Requirements

The last frontier that needs to be conquered in order to restore the IMF program is securing external financing commitments from friendly countries.

IMF estimated that the total financing deficit for the current fiscal year is estimated to be around $7 billion, contrary to the Pakistani government's forecast of $5 billion. In spite of this, officials are pinning their hopes on SBP’s foreign exchange reserves exceeding $10 billion by the end of June.

As per an article in Dawn, “sources have disclosed that the Pakistani authorities have obtained $1.3 billion in three instalments from Chinese banks, as well as an additional $700 million. This will be partitioned into two equal parts $500 million and $300 million, with a few days in between each transaction. Moreover, Saudi Arabia and the United Arab Emirates have made available approximately $3 billion.”

“SBP Governor in the analyst briefing also highlighted that at the start of FY23, financing requirement was around US$33 billion, which included US$10 billion of CAD and US$23 billion principal debt repayments. Out of the US$23 billion debt repayment, US$15.8 billion has already been settled through rollover and repayment. Out of the remaining US$7.2 billion, SBP is hopeful that a rollover of around US$4.3 billion will be done and the actual repayment would be around US$2.9 billion for which financing would need to be arranged. We believe that given the global economic situation and delay in the IMF program, rolling over debt would be challenging unless Pakistan swiftly completes reforms and get IMF on board,” read the Topline report.

However, the finance minister, Ishaq Dar has claimed that the government is nearing a staff-level agreement and a deal is likely to be closed by the next week.