Pakistan, after gruelling 10-day negotiations, still awaits a staff-level agreement with the IMF. Though it is being reported that significant progress has been made towards finalising the agreement, from now onwards, it essentially is a race against time for a country that has less than $3 billion in its reserves.

Thus, laying the blame on the indecisiveness of the incumbent government wouldn’t be wrong as it was evident that moving forward without an IMF programme was never an option. Similarly, it is imminent, given the country’s debt situation, that there is no option but to restructure its obligations. Experts across the board, from a former governor of the State Bank to senior economists, have highlighted the need for a timely debt restructuring as it can save the country a lot of pain.

https://twitter.com/YousufNazar/status/1623765021619625984

Pakistan’s Debt Position

Pakistan’s current external debt amounts to around 28 percent of the GDP at approximately $100 billion. Of this debt, around 80 percent is owed to multilateral and bilateral creditors, while the other 20 percent is owed to commercial creditors such as Eurobond/Sukuk issuances and commercial banks. While a major chunk of around 30 percent of Pakistan’s foreign debt is owed to China, 10 percent is owed to western countries in the Paris Club.

Need For Restructuring

Debt distress is not just a situation unique to Pakistan, but a lot of countries specially in the global south are suffering from this ailment. However, the dilemma, in most cases is clear – while debts may be sustainable in theory, in practice, the cost of repaying them is unsustainable.

Repayment of debt, while possible, comes at the cost of essential services and investments due to extreme austerity measures. The debt may be repaid, but the damage done to the quality of life of the citizens can be immense.

Therefore, for a country like Pakistan, even if the IMF programme and contingent inflows materialise, the liquidity crunch cannot be averted immediately.

External Restructuring

Pakistan has had its bilateral loans rolled over multiple times. Relief at a greater scale is probably the need of the hour. Something similar to what transpired in the aftermath of the pandemic.

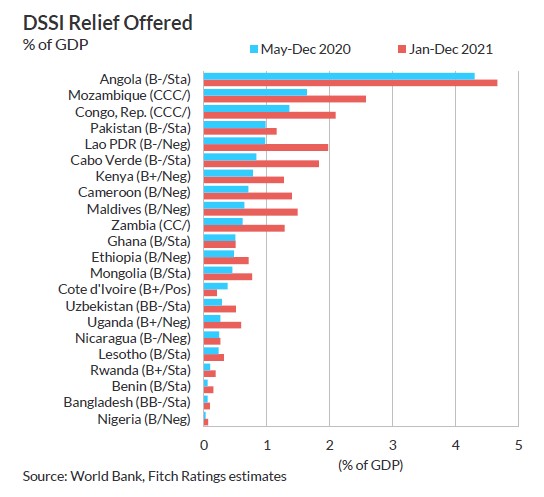

“The G20 launched the Debt Services Suspension Initiative (DSSI) at its April 2020 virtual meeting, calling on official and private-sector creditors to temporarily suspend the interest and principal that eligible LICs owed them. The initiative, originally meant to last through the end of 2020, was extended to the end of 2021. The money due to creditors will be repaid in the following five years, with a one-year grace period,” writes Hung Tran in an article for the Atlantic Council.

Read more: Mounting Debt And Lack Of Alternatives Calls For A Debt Restructuring Of Pakistan’s Economy. But Would It Be Possible?

Choice Between Restructuring and Reprofiling

Reprofiling of debt involves extending the maturities of debt obligations without altering interest payments. In contrast, restructuring of debt entails reducing coupon or principal payments to debt holders, leading to decreased government debt-to-GDP ratio or reduced debt interest expenses.

Experts believe that the preferable avenue for Pakistan to negotiate debt rescheduling is through the IMF and World Bank, which will conduct a debt sustainability analysis to quantify the magnitude of the problem before initiating the formal restructuring process.

On the other hand, in case of reprofiling, the short-term, bilateral and commercial debt from friendly countries can be an avenue for the vital breathing space required to get the country’s fiscal affairs sorted, with minimal disruption.

“Before we deliberate on the need for external debt restructuring, it is important to analyse structure of external debt and debt servicing obligations over the next 3 years. Out of the total debt servicing obligations of USD 73bn approximately USD 39 bn are short-term bilateral borrowings mainly from friendly countries (Saudi Arabia, China and UAE) and their commercial banks. In essence, the total quantum of borrowing is USD 13bn which is projected to be rolled over annually,” read a report by Arif Habib Limited.

It further added, “Prior to FY23, most of these was successfully rolled over on an annual basis however delays with the IMF program led to around USD 2.5bn of commercial loans being repaid. If we exclude this USD 13bn, the annual repayment obligation falls to around USD 11-12bn which appears manageable in our view given we remain in the IMF program.”

Modifying external debt commitments, especially restructuring, is a severe economic event that has implications ranging from harsh austerity measures to losing access to global financial markets after a re-rating.

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country.” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

However, Pakistan is already in no position to access the bond market as its credit rating has downgraded significantly over the past year.

Domestic Restructuring

Additionally, there have been calls of restructuring Pakistan’s domestic public debt which stands at around 50 percent of GDP. This can aid in managing the fiscal deficit and might be a pre-requisite for external debt restructuring.

Among the many methods to reduce the pressures of domestic debt, a few as per an IMF policy paper are: (i) directing state-owned banks and enterprises or government-controlled entities (e.g., social security fund) to hold government securities, (ii) running interest-free arrears with domestic suppliers for extended periods, (iii) setting the interest rate on government securities below market rates and iv) retroactive use of withholding taxes.

https://twitter.com/AliKhizar/status/1623553484984557569

However, modifying domestic debt can have unintended consequences. “The decision of domestic debt restructuring (DDR) or not is always the sovereign’s prerogative and entails the responsibility to limit the damage and help mitigate the effects of a restructuring on the domestic economy. For example, to avoid compromising the viability of the domestic financial system, the government may be required to recapitalize some banks or replenish pension savings. Similarly, ensuring the continued effective functioning of the central bank may require fiscal support. The net benefit calculation will determine whether or not the domestic debt should be part of a restructuring, together with external debt, or on a standalone basis,” Read an article by IMF’s senior economists.

Yet there is a glimmer of hope when one looks at the structure of the country’s external debt which, as explained earlier, is primarily owed to bilateral and multilateral creditors and not the litigious, private investors. Economist Ammar Khan substantiates this claim in his article, “These private investors need to be the first ones to be paid, and it is estimated that the country needs to pay $3.1 billion to these investors during the current year. A sovereign with a GDP of more than $380 billion, which has posted growth rates to the north of five per cent during the last two years isn’t really going to default on an amount less than one per cent of its GDP, or just about equivalent to a month of remittances. This is more of a liquidity crisis rather than a credit issue.”

Thus, laying the blame on the indecisiveness of the incumbent government wouldn’t be wrong as it was evident that moving forward without an IMF programme was never an option. Similarly, it is imminent, given the country’s debt situation, that there is no option but to restructure its obligations. Experts across the board, from a former governor of the State Bank to senior economists, have highlighted the need for a timely debt restructuring as it can save the country a lot of pain.

https://twitter.com/YousufNazar/status/1623765021619625984

Pakistan’s Debt Position

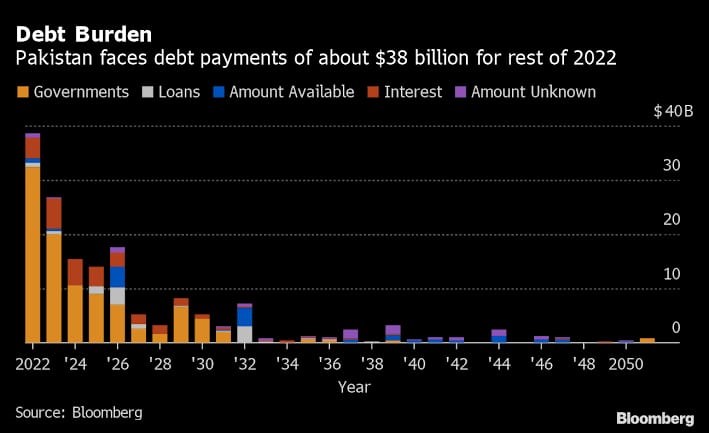

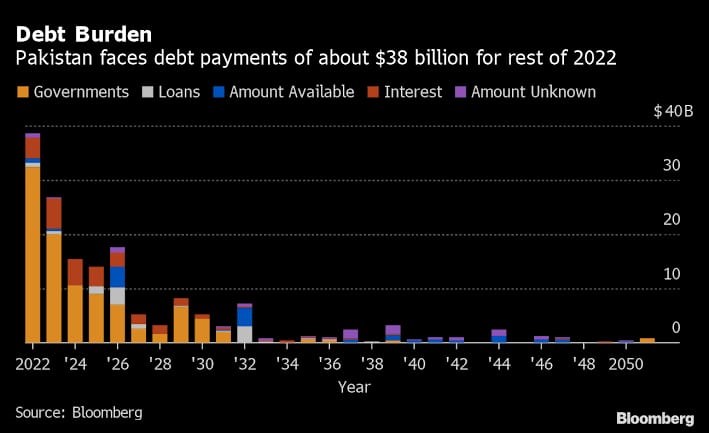

Pakistan’s current external debt amounts to around 28 percent of the GDP at approximately $100 billion. Of this debt, around 80 percent is owed to multilateral and bilateral creditors, while the other 20 percent is owed to commercial creditors such as Eurobond/Sukuk issuances and commercial banks. While a major chunk of around 30 percent of Pakistan’s foreign debt is owed to China, 10 percent is owed to western countries in the Paris Club.

Source: Bloomberg dated May 27, 2022

Need For Restructuring

Debt distress is not just a situation unique to Pakistan, but a lot of countries specially in the global south are suffering from this ailment. However, the dilemma, in most cases is clear – while debts may be sustainable in theory, in practice, the cost of repaying them is unsustainable.

Repayment of debt, while possible, comes at the cost of essential services and investments due to extreme austerity measures. The debt may be repaid, but the damage done to the quality of life of the citizens can be immense.

Therefore, for a country like Pakistan, even if the IMF programme and contingent inflows materialise, the liquidity crunch cannot be averted immediately.

External Restructuring

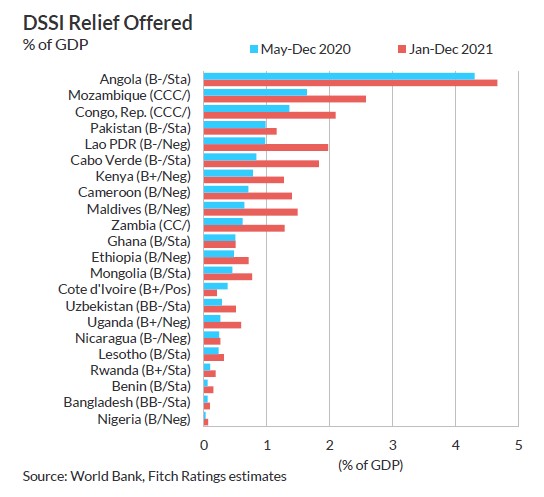

Pakistan has had its bilateral loans rolled over multiple times. Relief at a greater scale is probably the need of the hour. Something similar to what transpired in the aftermath of the pandemic.

“The G20 launched the Debt Services Suspension Initiative (DSSI) at its April 2020 virtual meeting, calling on official and private-sector creditors to temporarily suspend the interest and principal that eligible LICs owed them. The initiative, originally meant to last through the end of 2020, was extended to the end of 2021. The money due to creditors will be repaid in the following five years, with a one-year grace period,” writes Hung Tran in an article for the Atlantic Council.

Graph Source: Reuters

Read more: Mounting Debt And Lack Of Alternatives Calls For A Debt Restructuring Of Pakistan’s Economy. But Would It Be Possible?

Choice Between Restructuring and Reprofiling

Reprofiling of debt involves extending the maturities of debt obligations without altering interest payments. In contrast, restructuring of debt entails reducing coupon or principal payments to debt holders, leading to decreased government debt-to-GDP ratio or reduced debt interest expenses.

Experts believe that the preferable avenue for Pakistan to negotiate debt rescheduling is through the IMF and World Bank, which will conduct a debt sustainability analysis to quantify the magnitude of the problem before initiating the formal restructuring process.

On the other hand, in case of reprofiling, the short-term, bilateral and commercial debt from friendly countries can be an avenue for the vital breathing space required to get the country’s fiscal affairs sorted, with minimal disruption.

“Before we deliberate on the need for external debt restructuring, it is important to analyse structure of external debt and debt servicing obligations over the next 3 years. Out of the total debt servicing obligations of USD 73bn approximately USD 39 bn are short-term bilateral borrowings mainly from friendly countries (Saudi Arabia, China and UAE) and their commercial banks. In essence, the total quantum of borrowing is USD 13bn which is projected to be rolled over annually,” read a report by Arif Habib Limited.

It further added, “Prior to FY23, most of these was successfully rolled over on an annual basis however delays with the IMF program led to around USD 2.5bn of commercial loans being repaid. If we exclude this USD 13bn, the annual repayment obligation falls to around USD 11-12bn which appears manageable in our view given we remain in the IMF program.”

Modifying external debt commitments, especially restructuring, is a severe economic event that has implications ranging from harsh austerity measures to losing access to global financial markets after a re-rating.

“The ratings refer to debt repayment capacity and normally deteriorate way before deliberation on restructuring starts. Once the restructuring is executed, the old bonds are withdrawn from the market and new bonds are introduced to be re-rated. Subsequently, the ratings are ascertained by evaluating multiple factors including the debt relief, fiscal position and the future outlook of the country.” Elena Duggar, Chair of Moody's Macroeconomic Board, stated in an IMF panel discussion held on October 2022.

However, Pakistan is already in no position to access the bond market as its credit rating has downgraded significantly over the past year.

Domestic Restructuring

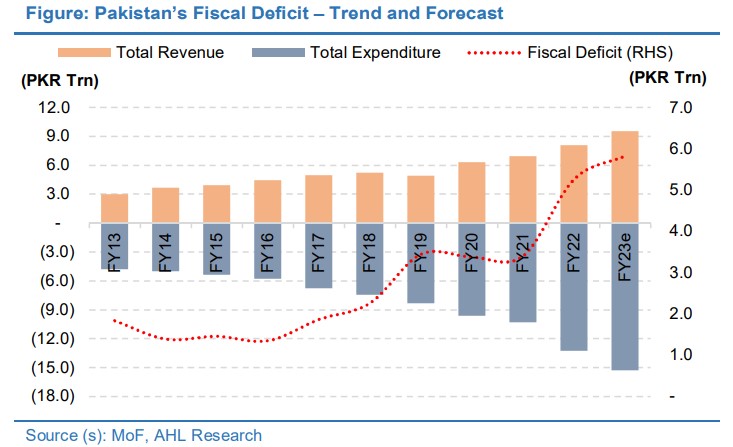

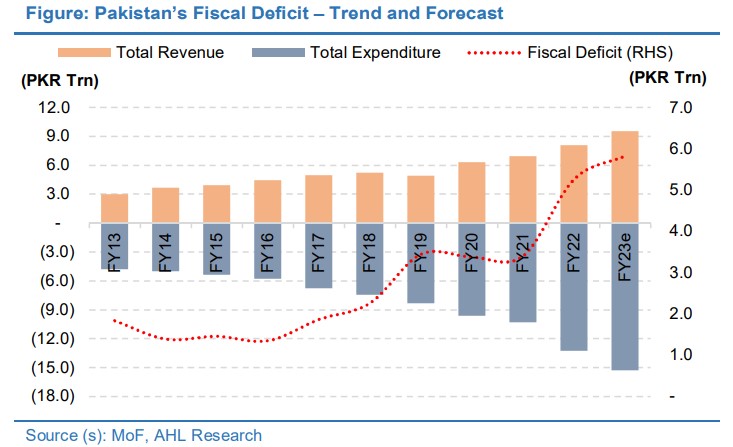

Additionally, there have been calls of restructuring Pakistan’s domestic public debt which stands at around 50 percent of GDP. This can aid in managing the fiscal deficit and might be a pre-requisite for external debt restructuring.

Source: ARHL

Among the many methods to reduce the pressures of domestic debt, a few as per an IMF policy paper are: (i) directing state-owned banks and enterprises or government-controlled entities (e.g., social security fund) to hold government securities, (ii) running interest-free arrears with domestic suppliers for extended periods, (iii) setting the interest rate on government securities below market rates and iv) retroactive use of withholding taxes.

https://twitter.com/AliKhizar/status/1623553484984557569

However, modifying domestic debt can have unintended consequences. “The decision of domestic debt restructuring (DDR) or not is always the sovereign’s prerogative and entails the responsibility to limit the damage and help mitigate the effects of a restructuring on the domestic economy. For example, to avoid compromising the viability of the domestic financial system, the government may be required to recapitalize some banks or replenish pension savings. Similarly, ensuring the continued effective functioning of the central bank may require fiscal support. The net benefit calculation will determine whether or not the domestic debt should be part of a restructuring, together with external debt, or on a standalone basis,” Read an article by IMF’s senior economists.

Yet there is a glimmer of hope when one looks at the structure of the country’s external debt which, as explained earlier, is primarily owed to bilateral and multilateral creditors and not the litigious, private investors. Economist Ammar Khan substantiates this claim in his article, “These private investors need to be the first ones to be paid, and it is estimated that the country needs to pay $3.1 billion to these investors during the current year. A sovereign with a GDP of more than $380 billion, which has posted growth rates to the north of five per cent during the last two years isn’t really going to default on an amount less than one per cent of its GDP, or just about equivalent to a month of remittances. This is more of a liquidity crisis rather than a credit issue.”