The ongoing staff-level talks with the IMF are largely directed towards remedying the fiscal deficit, which involves increasing the development levy on petroleum products, enacting a levy on imports, and windfall taxation on banks. Further, resolving circular debt in the power and gas sector, and dealing with the 675 billion rupee subsidy overruns are priority measures.

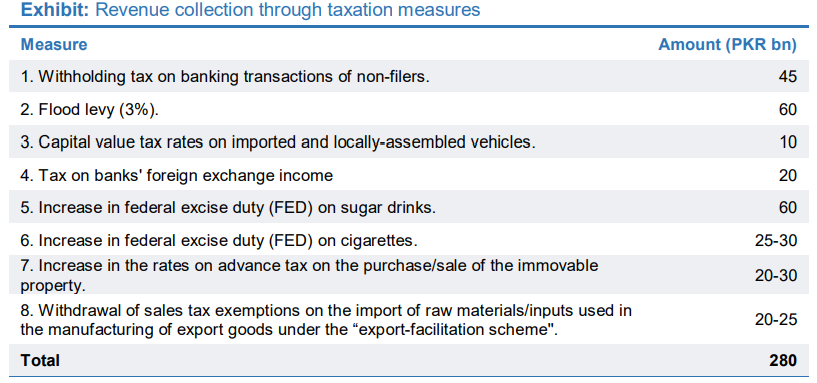

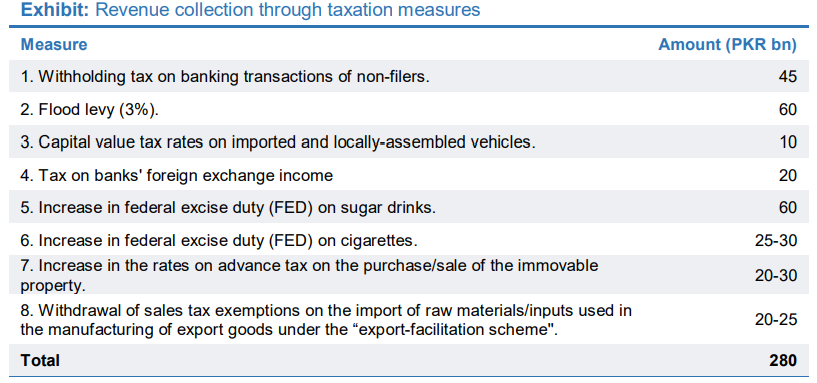

“The government is looking at implementing a host of measures including i) raising excise duties across multiple segments, ii) imposition of flood levy, iii) taxation on banking profits and WHT on banking transactions, iv) CVT on motor vehicles and v) increase in PDL on petroleum products, IMF appears not convinced. It is reportedly asking the government to also remove tax exemptions and increase the standard rate of GST by 1% to 18%,” reads a report by Arif Habib Limited (AHL).

Source: ARHL

The IMF has been focused on the rising stock of circular debt in the power and gas sectors that is accumulating due to unbudgeted power subsidies. The Fund has its reservations over the current Circular Debt Management Plan (CDMP) proposed by the government and is pressing for tariff hikes, which the government is reluctant to impose due to a possible backlash from the public. Additionally, they have proposed the removal of PKR 100 billion in power subsidies to the export sector, as well as a 60-70% increase in gas tariffs, in order to clear the existing circular debt of PKR 543 billion.

Read more: The Government Is Likely To Spin Around Cash To Reduce Gas Circular Debt With A Minimal Fiscal Cost

Further, as reported by the Express Tribune, “Prime Minister Shehbaz Sharif on Monday gave a go-ahead to increase electricity prices aimed at striking a deal with the International Monetary Fund (IMF), which may further push the annual base tariff up by about 33%.”

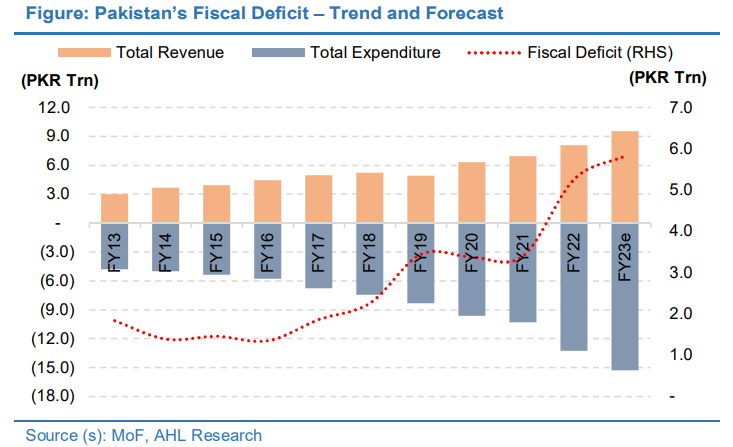

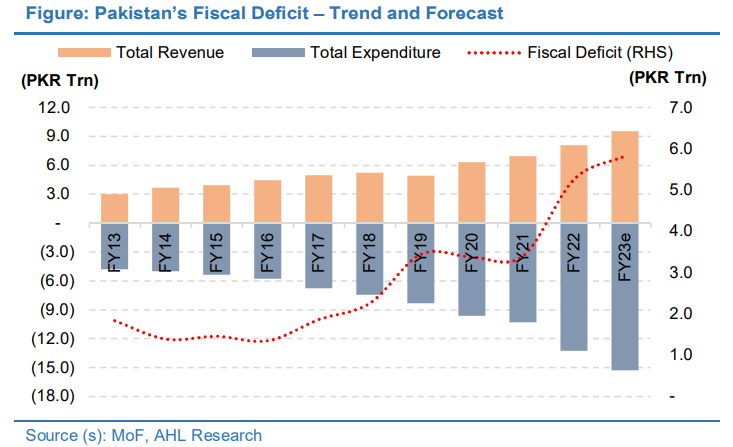

There is also a disagreement between the Fund and the government regarding the fiscal deficit. The latter claims that the primary deficit stands at 0.45%, or around 450 billion rupees ($1.64 billion) while the Fund maintains that the primary deficit is 0.9% of GDP, or around 840 billion Pakistani rupees ($3.06 billion).

Additionally, the Fund has demanded a public declaration of assets by government officials between grade 17-22 to promote transparency. “Priority measures include the establishment of an asset declaration system with a focus on high-level public officials (including federal cabinet members) (end-March 2022 SB, reset to end-September 2022), and publication of a comprehensive review of the anticorruption institutional framework (i.e., National Accountability Bureau) by a task force with the participation of independent experts with international experience and civil society organizations (new end-January 2023 SB),” read the IMF Country Report issued back in September 2022.

In partial compliance with this demand, the FBR has already notified Sharing of Declaration of Assets of Civil Servants Rules, 2023 from 1st February.

The IMF delegation is giving the government a tough time as a trust deficit has emerged over the years due to subsequent Pakistani governments not coming through on their promises after the release of a tranche.

“The government is looking at implementing a host of measures including i) raising excise duties across multiple segments, ii) imposition of flood levy, iii) taxation on banking profits and WHT on banking transactions, iv) CVT on motor vehicles and v) increase in PDL on petroleum products, IMF appears not convinced. It is reportedly asking the government to also remove tax exemptions and increase the standard rate of GST by 1% to 18%,” reads a report by Arif Habib Limited (AHL).

Source: ARHL

The IMF has been focused on the rising stock of circular debt in the power and gas sectors that is accumulating due to unbudgeted power subsidies. The Fund has its reservations over the current Circular Debt Management Plan (CDMP) proposed by the government and is pressing for tariff hikes, which the government is reluctant to impose due to a possible backlash from the public. Additionally, they have proposed the removal of PKR 100 billion in power subsidies to the export sector, as well as a 60-70% increase in gas tariffs, in order to clear the existing circular debt of PKR 543 billion.

Read more: The Government Is Likely To Spin Around Cash To Reduce Gas Circular Debt With A Minimal Fiscal Cost

Further, as reported by the Express Tribune, “Prime Minister Shehbaz Sharif on Monday gave a go-ahead to increase electricity prices aimed at striking a deal with the International Monetary Fund (IMF), which may further push the annual base tariff up by about 33%.”

There is also a disagreement between the Fund and the government regarding the fiscal deficit. The latter claims that the primary deficit stands at 0.45%, or around 450 billion rupees ($1.64 billion) while the Fund maintains that the primary deficit is 0.9% of GDP, or around 840 billion Pakistani rupees ($3.06 billion).

Additionally, the Fund has demanded a public declaration of assets by government officials between grade 17-22 to promote transparency. “Priority measures include the establishment of an asset declaration system with a focus on high-level public officials (including federal cabinet members) (end-March 2022 SB, reset to end-September 2022), and publication of a comprehensive review of the anticorruption institutional framework (i.e., National Accountability Bureau) by a task force with the participation of independent experts with international experience and civil society organizations (new end-January 2023 SB),” read the IMF Country Report issued back in September 2022.

In partial compliance with this demand, the FBR has already notified Sharing of Declaration of Assets of Civil Servants Rules, 2023 from 1st February.

The IMF delegation is giving the government a tough time as a trust deficit has emerged over the years due to subsequent Pakistani governments not coming through on their promises after the release of a tranche.