Pakistan’s technical talks with the IMF concluded on Feburary 6, 2023, as a stalemate persists over issues including energy sector subsidies and primary deficit. The second phase of the negotiations will commence today, February 7, as both sides enter policy-level talks to finalise the Memorandum of Economic Policies Framework (MEFP) and revisit pending reforms.

One of the prominent issues among these is the circular debt pertaining to the energy sector which has been a bone of contention between the fund and the government in past.

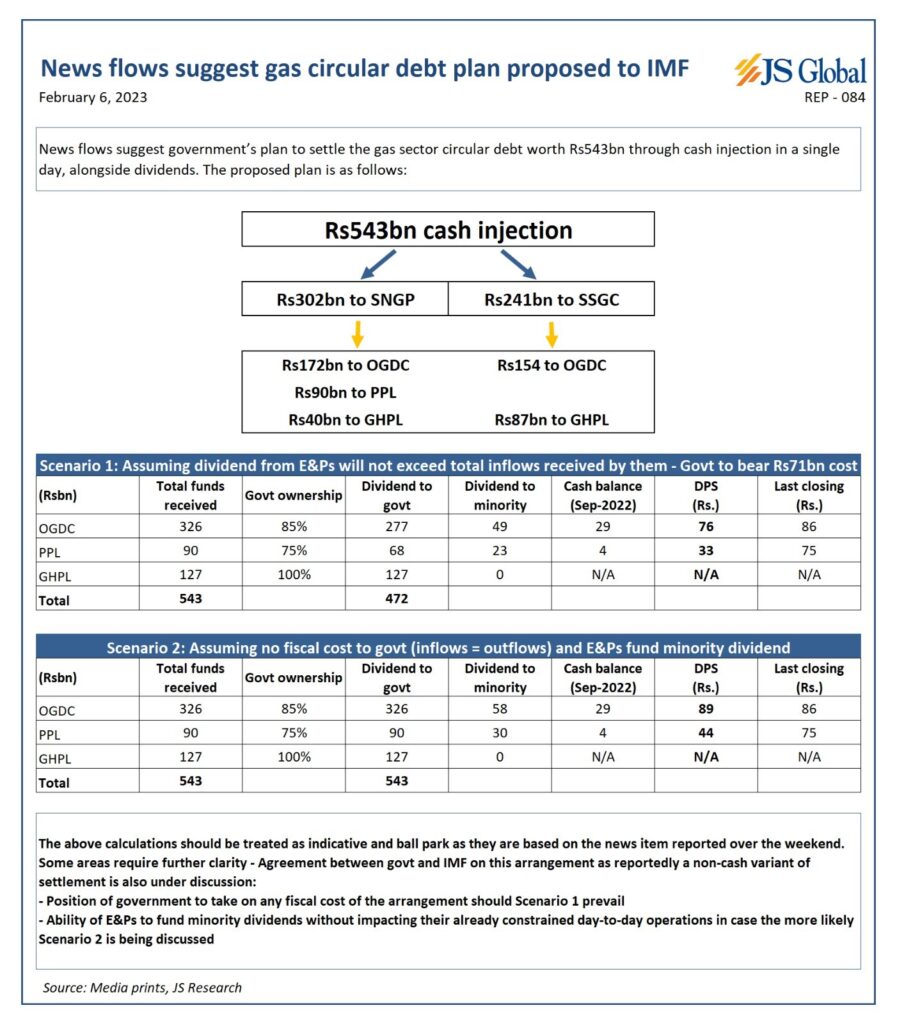

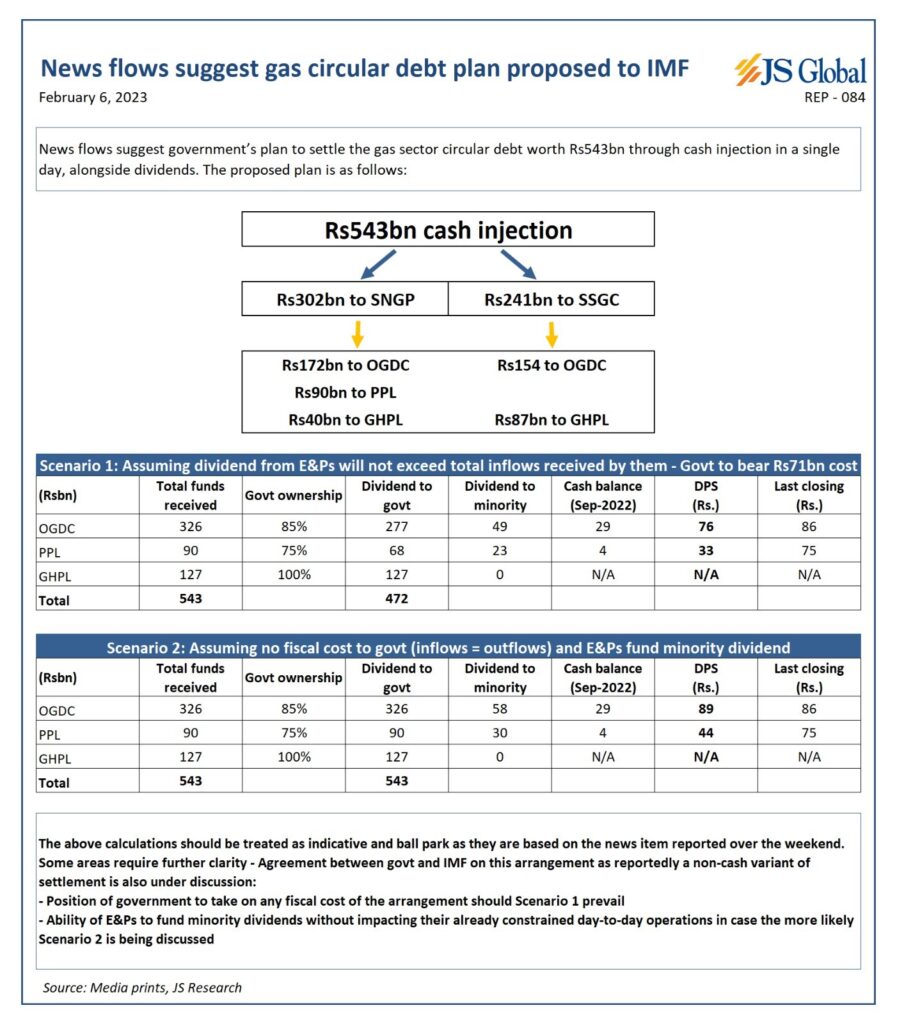

However, the government has devised a plan to retire a part of this debt pertaining to the gas sector by injecting around Rs.543 billion of cash into Sui Northern and Southern Gas Pipelines Limited. The funds will then be utilised to clear the (circular debt) payables to Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL).

Source: JS Global

Circular Debt In The Gas Sector

Circular debt in the gas industry is caused by delay of the government in announcing a new tariff that is consistent with the international gas prices, an inefficient use of the commodity combined with untargeted subsidies. The root of the government’s problem is subsidies that have gone unpaid, affecting Sui Northern Gas Pipelines (SNGPL) and Sui Southern Gas Company’s (SSGC) cash flow because they cannot recover costs of importing LNG from their customers.

In short, the government's decision to supply expensive LNG to customers who are unable to pay for it has resulted in an inability to set the price at a level that would recoup costs. This has caused a circular debt situation.

The resultant effect of non-payment of subsidies to SNGPL and SSGC for offering gas at a reduced rate is evident in increased receivables on balance sheets of two of Pakistan’s largest energy exploration firms, OGDCL and PPL. Further, the fact that both these companies are state-owned enterprises explains why the accumulation of receivables wasn’t contested.

“The increase in gas sector circular debt in particular has significantly outpaced the increase in the power sector circular debt as the consumer gas prices remained stagnant throughout the year. Furthermore, the devaluing rupee resulted in higher cost of gas for the gas distribution companies leading to an ever-increasing mismatch between the cost of gas and its selling price to the consumers. To top it off, the diversion of expensive LNG to domestic households in winter months reduces the cash inflows of the domestic Exploration & Production (E&P) companies as the payments by the gas distribution companies are diverted to RLNG importers,” read the annual report of PPL.

The Plan

As per a report by Arif Habib Limited (AFHL), “The government is considering settling the outstanding gas sector circular debt and discussed the plan with the IMF in this regard. Moreover, the amount of settled circular debt is expected to come back to the government via dividends, either fully funded or at a 13% cost.”

This means that the settlement of circular debt would result in a “circular dividend” which will result in most or all of the cash injected flowing back to the government as it holds an 85 percent stake in OGDCL, 75 percent stake in PPL and 100 percent stake in Government Holdings Private Limited (GHPL).

The AFHL report pointed out two scenarios that could be possible in case of a cash injection.

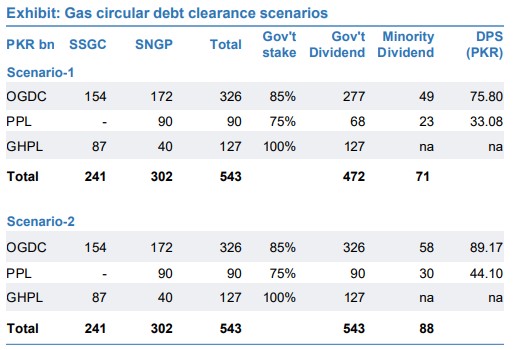

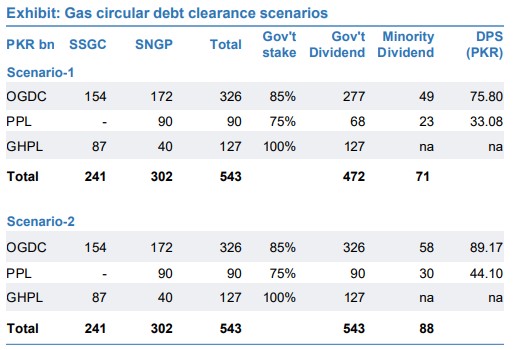

“A cash injection by the incumbent government of PKR 543bn to Sui companies (SNGP and SSGC), which will then be re-routed to OGDC and PPL for dividend declaration of PKR 75.80/share and PKR 33.08/share, respectively. The fiscal cost of this scenario for the govt is estimated at PKR 71.4bn,” read the report.

The fiscal cost in the first case is incurred due to the fact that minority stakes in OGDCL and PPL are held by retail investors which will lead to a part of cash injections not flowing back to the government.

However, the AFHL report also explains another scenario where the fiscal cost to the government would be zero if minority dividends are financed by liquid investments held by respective companies. “This is owed to a potential minority shareholder dividend of PKR 58bn for OGDC and PKR 30bn for PPL, which will take the total payout by OGDC to PKR 89.17/share, and PKR 44.10/share by PPL. Taking a cue from that, we estimate that OGDC’s minority dividend is expected at PKR 57.5bn which will be funded via encashment of PKR 23bn via Pakistan Investment Bonds (PIBs), and the remaining PKR 35bn through cash. While for PPL, the minority dividend is expected to be completely funded through the balance sheet (PKR 30bn).”

Source: AFHL

The government’s plan to retire debt is likely to be complemented by an expected gas price hike that would result in reduction in the pace of circular debt’s accumulation as the difference between cost and selling price of gas would reduce.

However this, alongside other measures demanded by the IMF, will add to the ongoing wave of inflation which is expected to clock in at around 35 percent in the upcoming months.

One of the prominent issues among these is the circular debt pertaining to the energy sector which has been a bone of contention between the fund and the government in past.

However, the government has devised a plan to retire a part of this debt pertaining to the gas sector by injecting around Rs.543 billion of cash into Sui Northern and Southern Gas Pipelines Limited. The funds will then be utilised to clear the (circular debt) payables to Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Limited (PPL).

Source: JS Global

Circular Debt In The Gas Sector

Circular debt in the gas industry is caused by delay of the government in announcing a new tariff that is consistent with the international gas prices, an inefficient use of the commodity combined with untargeted subsidies. The root of the government’s problem is subsidies that have gone unpaid, affecting Sui Northern Gas Pipelines (SNGPL) and Sui Southern Gas Company’s (SSGC) cash flow because they cannot recover costs of importing LNG from their customers.

In short, the government's decision to supply expensive LNG to customers who are unable to pay for it has resulted in an inability to set the price at a level that would recoup costs. This has caused a circular debt situation.

The resultant effect of non-payment of subsidies to SNGPL and SSGC for offering gas at a reduced rate is evident in increased receivables on balance sheets of two of Pakistan’s largest energy exploration firms, OGDCL and PPL. Further, the fact that both these companies are state-owned enterprises explains why the accumulation of receivables wasn’t contested.

“The increase in gas sector circular debt in particular has significantly outpaced the increase in the power sector circular debt as the consumer gas prices remained stagnant throughout the year. Furthermore, the devaluing rupee resulted in higher cost of gas for the gas distribution companies leading to an ever-increasing mismatch between the cost of gas and its selling price to the consumers. To top it off, the diversion of expensive LNG to domestic households in winter months reduces the cash inflows of the domestic Exploration & Production (E&P) companies as the payments by the gas distribution companies are diverted to RLNG importers,” read the annual report of PPL.

The Plan

As per a report by Arif Habib Limited (AFHL), “The government is considering settling the outstanding gas sector circular debt and discussed the plan with the IMF in this regard. Moreover, the amount of settled circular debt is expected to come back to the government via dividends, either fully funded or at a 13% cost.”

This means that the settlement of circular debt would result in a “circular dividend” which will result in most or all of the cash injected flowing back to the government as it holds an 85 percent stake in OGDCL, 75 percent stake in PPL and 100 percent stake in Government Holdings Private Limited (GHPL).

The AFHL report pointed out two scenarios that could be possible in case of a cash injection.

“A cash injection by the incumbent government of PKR 543bn to Sui companies (SNGP and SSGC), which will then be re-routed to OGDC and PPL for dividend declaration of PKR 75.80/share and PKR 33.08/share, respectively. The fiscal cost of this scenario for the govt is estimated at PKR 71.4bn,” read the report.

The fiscal cost in the first case is incurred due to the fact that minority stakes in OGDCL and PPL are held by retail investors which will lead to a part of cash injections not flowing back to the government.

However, the AFHL report also explains another scenario where the fiscal cost to the government would be zero if minority dividends are financed by liquid investments held by respective companies. “This is owed to a potential minority shareholder dividend of PKR 58bn for OGDC and PKR 30bn for PPL, which will take the total payout by OGDC to PKR 89.17/share, and PKR 44.10/share by PPL. Taking a cue from that, we estimate that OGDC’s minority dividend is expected at PKR 57.5bn which will be funded via encashment of PKR 23bn via Pakistan Investment Bonds (PIBs), and the remaining PKR 35bn through cash. While for PPL, the minority dividend is expected to be completely funded through the balance sheet (PKR 30bn).”

Source: AFHL

The government’s plan to retire debt is likely to be complemented by an expected gas price hike that would result in reduction in the pace of circular debt’s accumulation as the difference between cost and selling price of gas would reduce.

However this, alongside other measures demanded by the IMF, will add to the ongoing wave of inflation which is expected to clock in at around 35 percent in the upcoming months.