The scheduled talks with IMF delegation, headed by Pakistan Mission Chief, Nathan Porter, commenced on Tuesday, 31st January 31, 2023. The government’s delegation, led by Finance Minister, Ishaq Dar, seems hopeful to end the months long stalemate with the global lender of last resort. Those at the helm of affairs have already started implementing IMF requirements in the form of recent rupee devaluation and the subsequent fuel price hikes.

However, with only $3.7 billion left in the SBP’s official reserves, Pakistan has no alternative left except for succumbing to IMF’s demands. The country is seeking a $1 billion loan tranche as part of the $7 billion extended fund facility availed in 2019. Yet, the situation of deadlock has persisted for months as the funds has demanded strict fiscal discipline which authorities at the Pakistani side are reluctant to display.

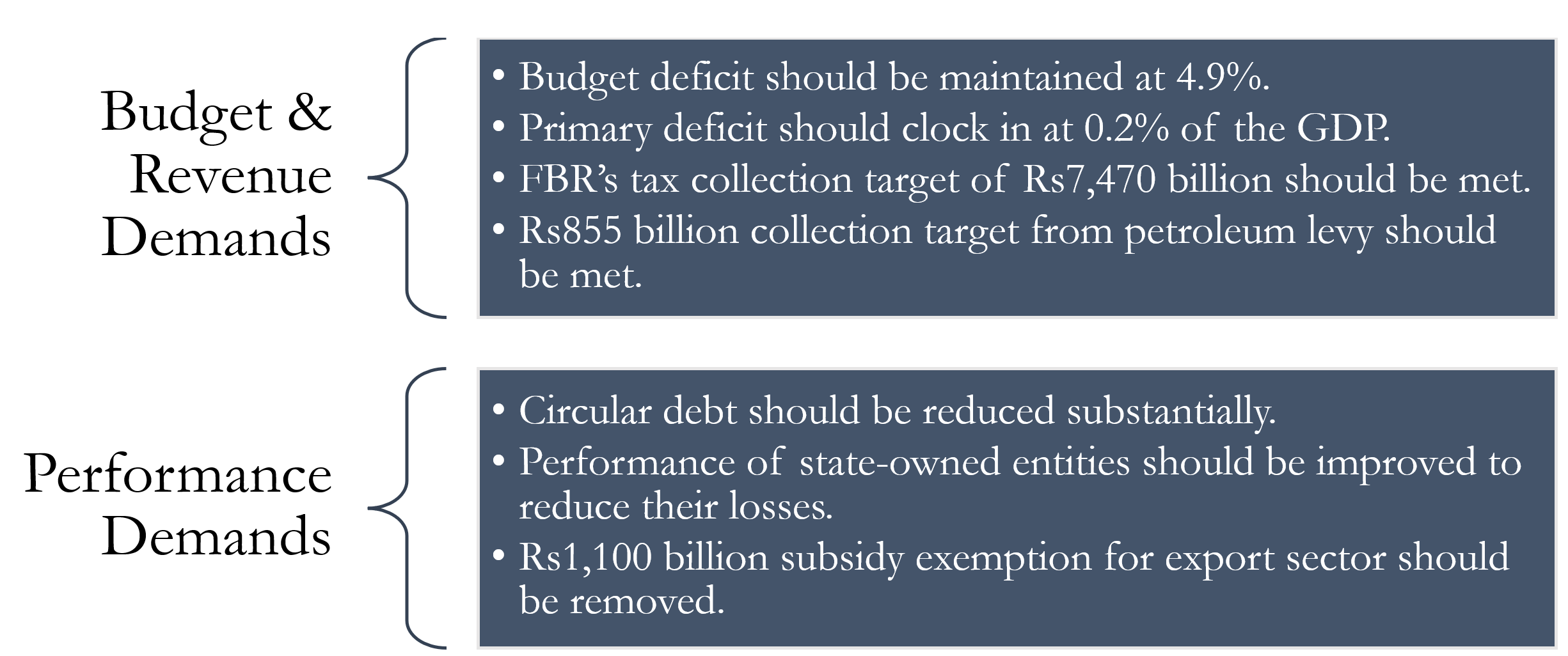

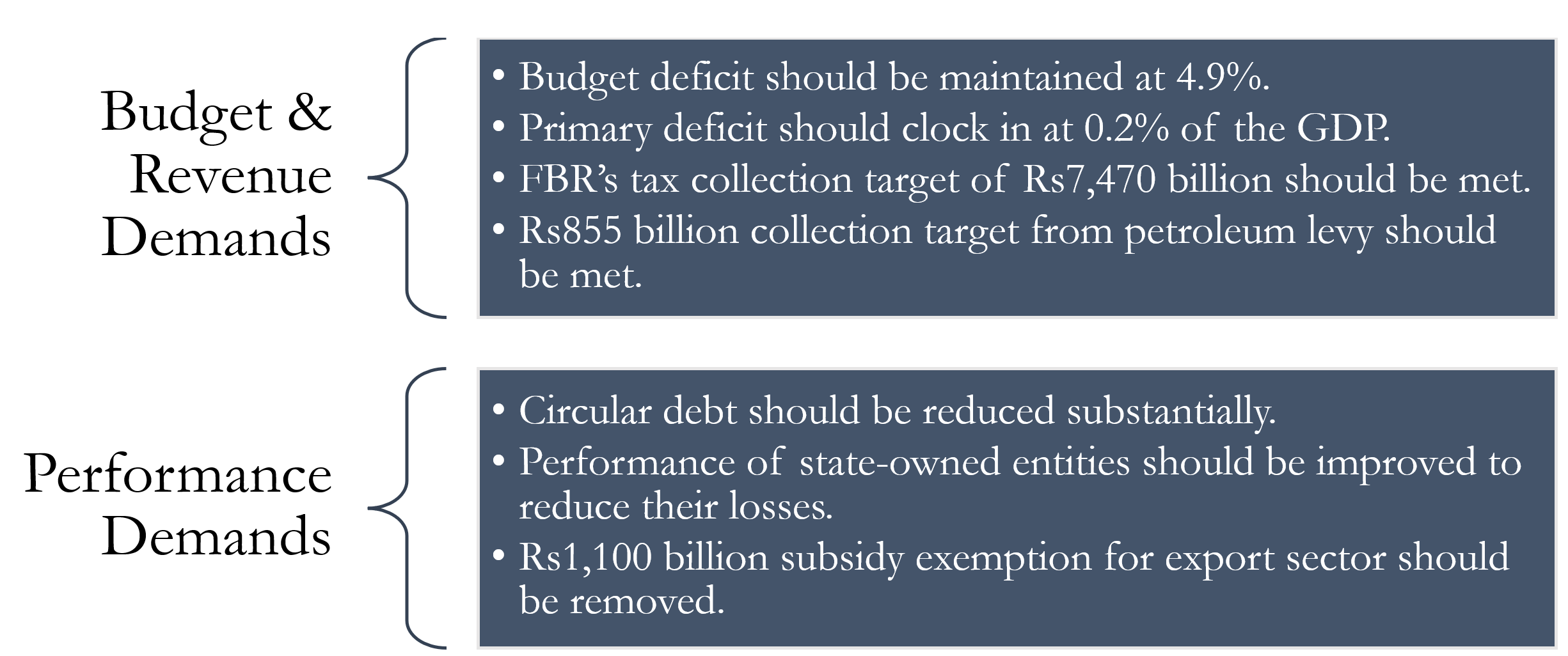

During the first round of talks, Pakistani officials briefed the mission about the government’s strategy to implement the Fund’s conditionalities. The intention to resume the program is clear as on the revenue front, imposition of additional taxes on petroleum products, on imports, and tax on FX gains of banks is likely to be part of a mini-budget. Additionally, rationalization of the energy tariffs are also likely to be implemented in line with the Fund’s demands.

https://twitter.com/analystfahad/status/1619585336916729857

As per a report by Arif Habib Ltd, “We believe, these measures are likely to get the program back on track and pave the way for the release of the next tranche of ~USD 1.2bn in Feb ’23. With the 10th review also due in early 2023 (1Q) - combining the two reviews remains a possibility though this may further delay the IMF disbursement.”

“The government is set to bring a mini-budget where a tax of 1-2% flood levy will be imposed on imports. Our estimates suggest that this will help generate additional revenue of PKR 90-100bn in the second half of the ongoing fiscal year. In addition, additional tax to the tune of 40% will be imposed on Commercial Banks’ FX income, with collection arriving at PKR 48bn,” it further adds.

Further, as reported by local media outlets, the IMF has allowed the government to provide subsidies to low income groups through the Benazir Income Support Program (BISP). This step is necessary to mitigate the impact of fiscal and monetary tightening on the lowest strata of the society.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing a blanket relief,” says economist Fahd Ali.

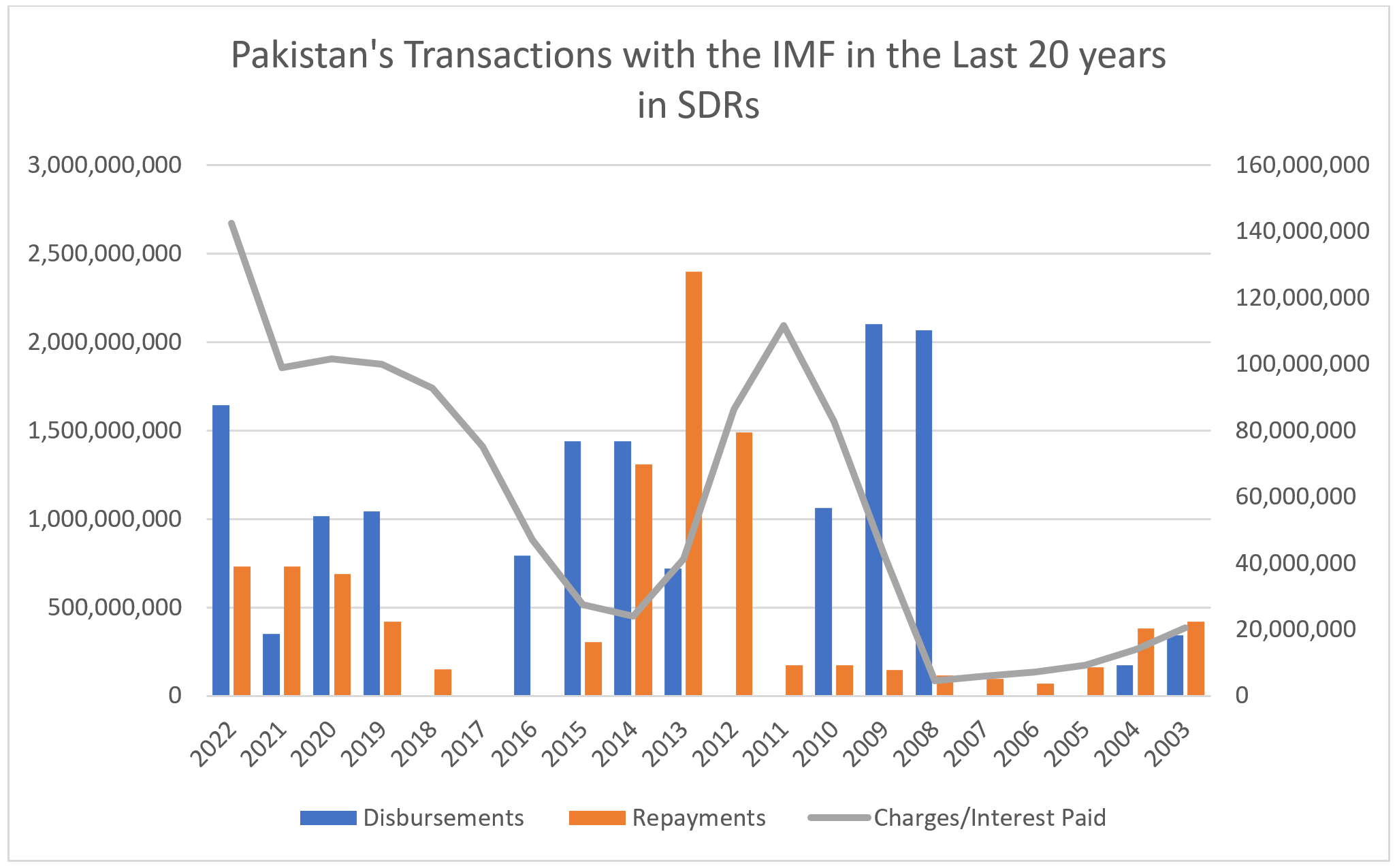

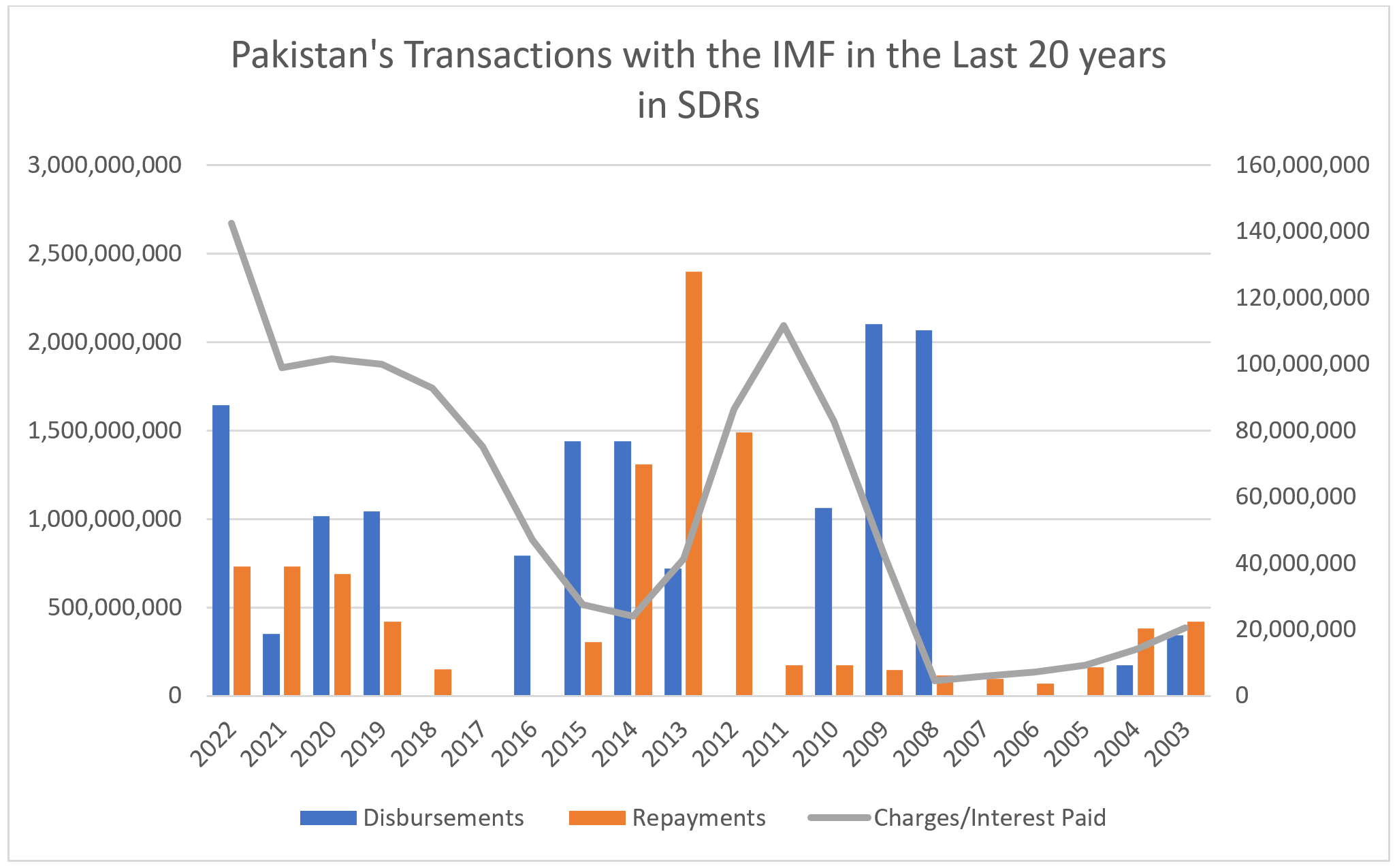

Source: IMF

Source: IMF

While across the border, Bangladesh has also secured IMF funding after implementing the prescribed fiscal reforms. “Bangladesh will get about $3.3 billion under the IMF's extended credit facility and related arrangements, with an immediate disbursement of about $476 million. The IMF executive board also approved about $1.4 billion under its newly created Resilience and Sustainability Facility for climate investments for Bangladesh, the first Asian country to access it,” as reported by Reuters.

The revival of the IMF program is of utmost importance for Pakistan as the country needs a nod of approval from the institution for other bilateral & multilateral funding to follow through.

“Pakistan is squeezed between IMF demands and Chinese interests. Rescheduling debts will provide some relief, but who will bite the bullet first? China or the international financial institutions that are owed $41bn? If Pakistan doesn’t reach an agreement with the IMF within the next few weeks, its reserves could fall to a point where it can no longer buy oil,” wrote Yousuf Nazar, in an article for the Financial Times.

Read more: Mounting Debt And Lack Of Alternatives Calls For A Debt Restructuring Of Pakistan’s Economy. But Would It Be Possible?

Yet, the IMF program and subsequent fundings would only cater to the country’s short-term financing need. Further, with the rapid depreciation of the rupee and the fiscal consolidation, a new wave of commodity led inflation is likely to follow.

“Frontier markets seeking IMF financing are facing greater pressure to loosen their grip on currencies, which will help improve their current-account balances. Egypt, this month suffered its third devaluation in less than a year. Calculations by Bloomberg Economics show the rupee should stabilize at 266 per dollar, according to a note by Ankur Shukla, an analyst in Mumbai,” reported Bloomberg.

Read More: A Period Of Low Growth Awaits Pakistan As It Tries To Fend Off Inflation And External Shocks

However, with only $3.7 billion left in the SBP’s official reserves, Pakistan has no alternative left except for succumbing to IMF’s demands. The country is seeking a $1 billion loan tranche as part of the $7 billion extended fund facility availed in 2019. Yet, the situation of deadlock has persisted for months as the funds has demanded strict fiscal discipline which authorities at the Pakistani side are reluctant to display.

During the first round of talks, Pakistani officials briefed the mission about the government’s strategy to implement the Fund’s conditionalities. The intention to resume the program is clear as on the revenue front, imposition of additional taxes on petroleum products, on imports, and tax on FX gains of banks is likely to be part of a mini-budget. Additionally, rationalization of the energy tariffs are also likely to be implemented in line with the Fund’s demands.

https://twitter.com/analystfahad/status/1619585336916729857

As per a report by Arif Habib Ltd, “We believe, these measures are likely to get the program back on track and pave the way for the release of the next tranche of ~USD 1.2bn in Feb ’23. With the 10th review also due in early 2023 (1Q) - combining the two reviews remains a possibility though this may further delay the IMF disbursement.”

“The government is set to bring a mini-budget where a tax of 1-2% flood levy will be imposed on imports. Our estimates suggest that this will help generate additional revenue of PKR 90-100bn in the second half of the ongoing fiscal year. In addition, additional tax to the tune of 40% will be imposed on Commercial Banks’ FX income, with collection arriving at PKR 48bn,” it further adds.

Further, as reported by local media outlets, the IMF has allowed the government to provide subsidies to low income groups through the Benazir Income Support Program (BISP). This step is necessary to mitigate the impact of fiscal and monetary tightening on the lowest strata of the society.

“Letting the market mechanism prevail is the need of the hour, but the fallout from it would further propel inflation as fuel and food prices will go up. An effective way to deal with it is by providing handouts through frameworks like BISP rather than controlling the exchange rate and providing a blanket relief,” says economist Fahd Ali.

Source: IMF

Source: IMFWhile across the border, Bangladesh has also secured IMF funding after implementing the prescribed fiscal reforms. “Bangladesh will get about $3.3 billion under the IMF's extended credit facility and related arrangements, with an immediate disbursement of about $476 million. The IMF executive board also approved about $1.4 billion under its newly created Resilience and Sustainability Facility for climate investments for Bangladesh, the first Asian country to access it,” as reported by Reuters.

The revival of the IMF program is of utmost importance for Pakistan as the country needs a nod of approval from the institution for other bilateral & multilateral funding to follow through.

“Pakistan is squeezed between IMF demands and Chinese interests. Rescheduling debts will provide some relief, but who will bite the bullet first? China or the international financial institutions that are owed $41bn? If Pakistan doesn’t reach an agreement with the IMF within the next few weeks, its reserves could fall to a point where it can no longer buy oil,” wrote Yousuf Nazar, in an article for the Financial Times.

Read more: Mounting Debt And Lack Of Alternatives Calls For A Debt Restructuring Of Pakistan’s Economy. But Would It Be Possible?

Yet, the IMF program and subsequent fundings would only cater to the country’s short-term financing need. Further, with the rapid depreciation of the rupee and the fiscal consolidation, a new wave of commodity led inflation is likely to follow.

“Frontier markets seeking IMF financing are facing greater pressure to loosen their grip on currencies, which will help improve their current-account balances. Egypt, this month suffered its third devaluation in less than a year. Calculations by Bloomberg Economics show the rupee should stabilize at 266 per dollar, according to a note by Ankur Shukla, an analyst in Mumbai,” reported Bloomberg.

Read More: A Period Of Low Growth Awaits Pakistan As It Tries To Fend Off Inflation And External Shocks