The sudden drop shocked ordinary Pakistanis who will certainly face higher inflation and even shortages of essential commodities in the coming months. Measures to control currency can seriously backfire when confidence is low and fundamentals are getting weaker. It can lead to sharp and volatile movements and can do serious long-term damage.

There has been a lot of debate on the exchange rate. Manipulating the rate is a bad idea, and having multiple rates is even worse. Mr. Ishaq Dar took over as the finance minister on 28 September 2022 and declared, "our currency right now is not at the place where it should be, it is undervalued." Pakistan rupee was then trading at around 231. Apparently, Dar managed to influence the exchange rate through some banks and it dropped to 217 during the first week of October and Dar smugly declared victory. However, the rupee then gradually fell to 226 by the year’s end even as the official foreign exchange reserves continued to drop. Pakistan’s central bank foreign exchange reserves dropped by $3.1 billion by the end of December from $8.8 billion in October 2022.

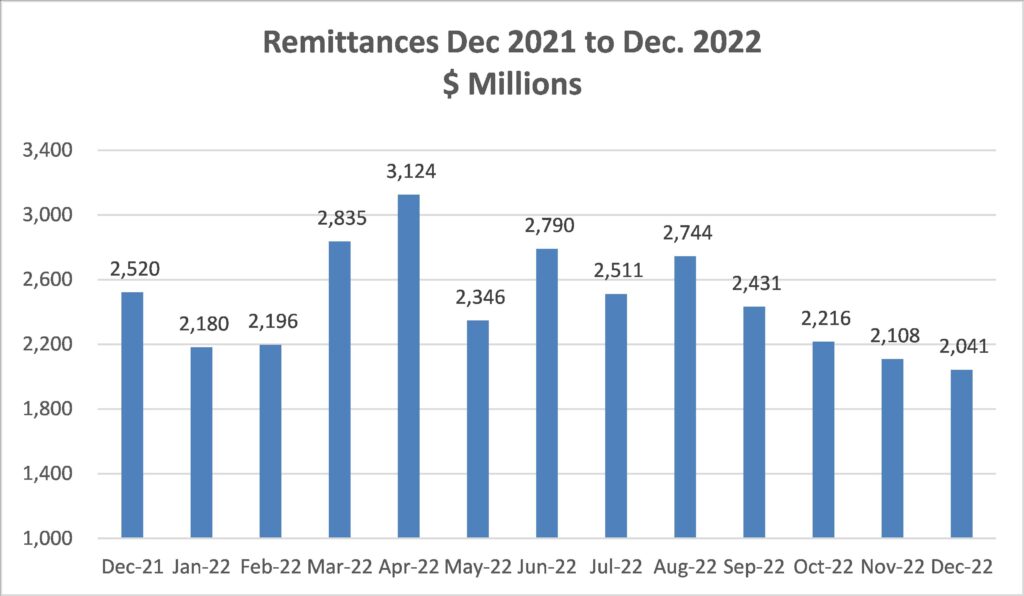

The gap between the official interbank exchange rate for the Pakistan rupee against the US dollar widened to over Rs13 in July 2022, a record. Mr. Dar put a cap on the exchange rate after taking over as finance minister. Consequently, the gap widened to over Rs24 during the first week of January 2023. Mr. Dar and the central bank had refused to allow the market rate to reflect the fundamentals. This policy did more harm than good. People abroad started sending money through unofficial channels. During the month of December 2022, remittances had fallen to their lowest level during the prior twelve months.

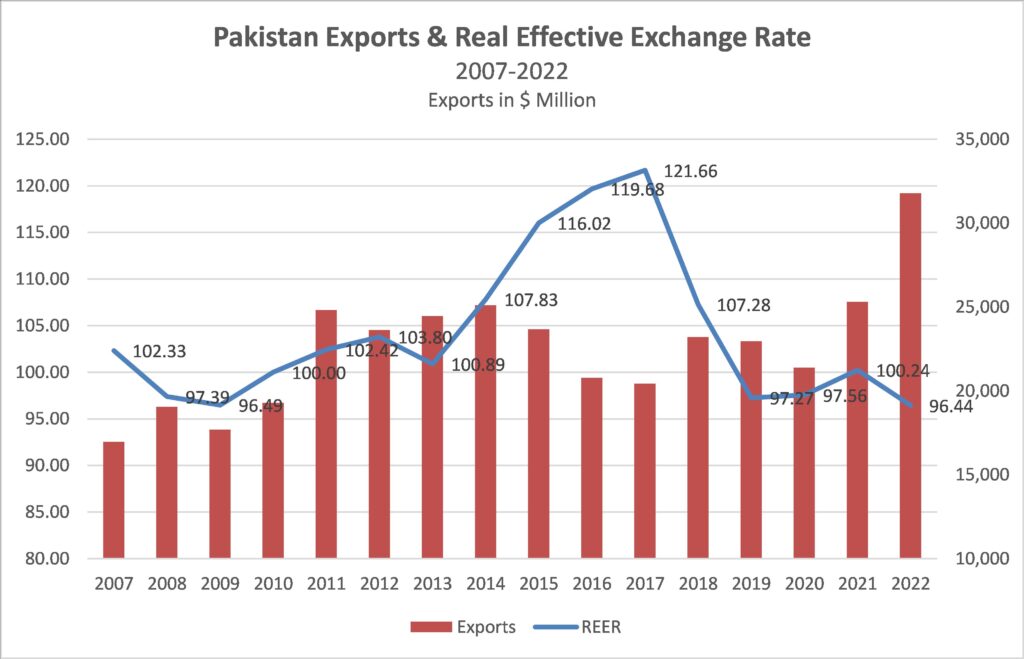

How Pakistan's real effective exchange rate (REER) and exports have behaved? REER is a measure of the value of a currency against a weighted average of several foreign currencies divided by a price deflator or index of costs. The Real Effective Exchange Rate (REER) is one of the most quoted indices in international economics. It measures competitiveness by quantifying the sensitivity of demand for output originating from a particular country as a function of changes in world prices.

It should, however, be noted that most of these standard REER measures make a number of simplifying assumptions that are increasingly becoming questionable in a world characterized by global value chains. The fact is the sectors that are typically prominent exporters are also simultaneously large importers, and hence models which aggregate them with sectors that are non-traded, overstate the domestic value-added content in exports and hence the impact of changes in foreign prices on competitiveness as measured by the REER. Hence, some recommend using Industry-specific Real Effective Exchange Rates.

Notwithstanding the limitations of the REER, an increase in REER implies that exports become more expensive and imports become cheaper; therefore, an increase indicates a loss in trade competitiveness. The following chart shows the movement in Pakistan’s exports against the REER.

Pakistan’s real effective exchange rate remained relatively stable at around 100 during 2007-2013. PMLN government took over in 2013 with Ishaq Dar as finance minister. The REER recorded a sharp rise of 6.8% during 2014 and by 2017 it had appreciated by 20.5% compared to 2013. During 2017, Pakistan’s exports fell to $20.4 billion compared to $20.4 billion in 2013. They fell steadily during 2014-2017 and somewhat recovered subsequently but only after a noticeable fall in the REER.

It is useful to look at what happened to imports during the last 15 years.

Imports were stable around the $44-45bn range during 2013-2016 despite an appreciation of the rupee in real terms. In 2017, imports rose by $8bn to $52.9bn & to $60.8bn in 2018. 70% of the rise in the import bill was accounted for by energy products, capital equipment and related raw material. We imported 11.2m tonnes of coal in 2017, compared with 3.42m tonnes in 2013. In 2022, the $12bn rise in energy imports contributed to $23bn jump in total imports. Medicine imports up $2.7bn, Transport up $1.5bn, & other industrial imports over $2bn.

REER is important but we need to remember a few things. There are always variations around valuations based on Purchasing Power Parity (PPP). Any currency trader who forgets it does so at huge risk. The consumer Price Index (CPI) covers all items including non-traded items such as housing. For emerging markets currencies, the level of a country’s foreign reserves and its trend is the most critical variable for the exchange rate. Foreign exchange reserves start to decline when net foreign exchange flows (difference between foreign currency receipts and payments) turn negative. In Pakistan’s case, it had to repay old loans but no new loans could be arranged to stop the fall in the reserves. Hence, the rupee started to fall. It was extremely naive of Mr. Dar to use REER or some other valuation method to assert Rupee was overvalued. It doesn’t work like that.

Unfortunately, Pakistan has to pay the price, yet again, of Mr. Dar’s gravely flawed understanding of how the exchange rate and markets work.