Remittances are important entry of the balance sheet of macro-accounting of a developing economy. It is believed that remittances can play a balancing role in trade deficit as well as exports receipts.

Recently, remittances have contributed significantly to the gross national product (GNP) in many developing countries, including India, Mexico, Philippines and Egypt. India has remained the largest recipient of remittances inflows since 2008 (Migration Data Portal 2022).

Globally, the ever-changing demographic and political scenarios encourage migration for better financial resources and good lifestyle, and the attachment to birthplace as well as the extended family has resulted in inflow of remittances to the source country.

Policy changes have stimulated workers’ migration and inflow of remittances into Pakistan. The 1973 constitution of Pakistan ensures basic rights to general public, including easy access to passport and other travelling facilities. This encourages migration of skilled and unskilled workforce. With the inception of Pakistan Higher Education Commission (HEC) on 11 September 2002, a substantial investment was allocated for advanced education in distinct fields of sciences and engineering. This investment helped in the development of highly-educated individuals, triggered the supply of qualified workforce, and increased the inflow of remittances.

A continuous population growth scars the available resources and competing workforce decides to migrate. It can be re-hypothesized that policies and population growth cause migration of workforce and increase remittances.

The big picture

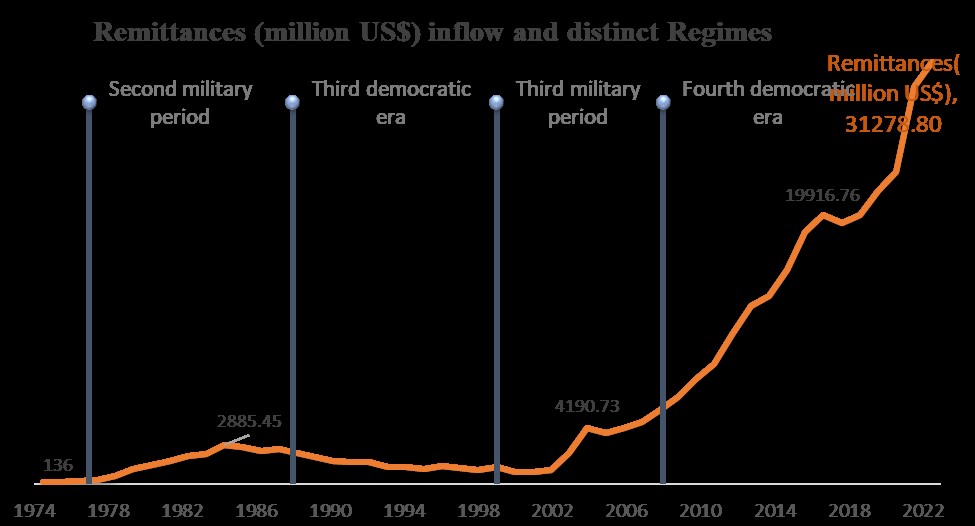

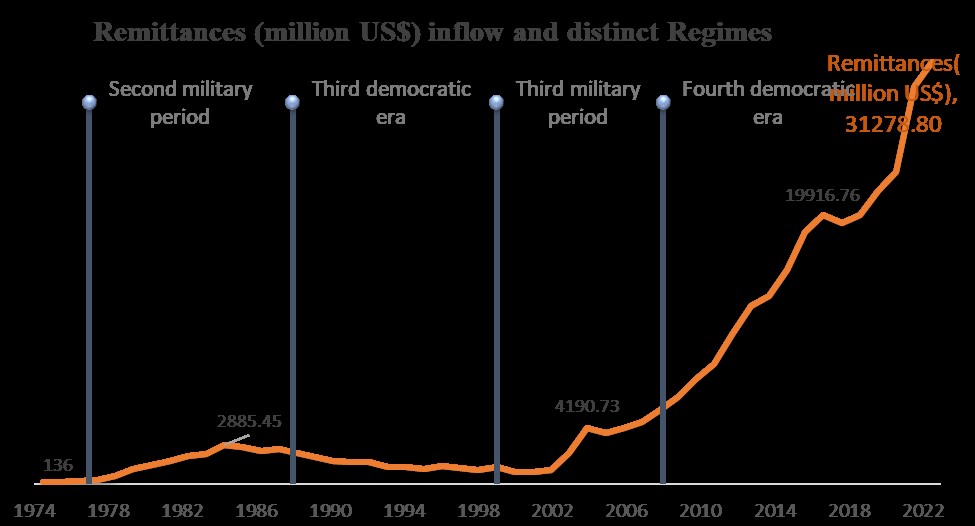

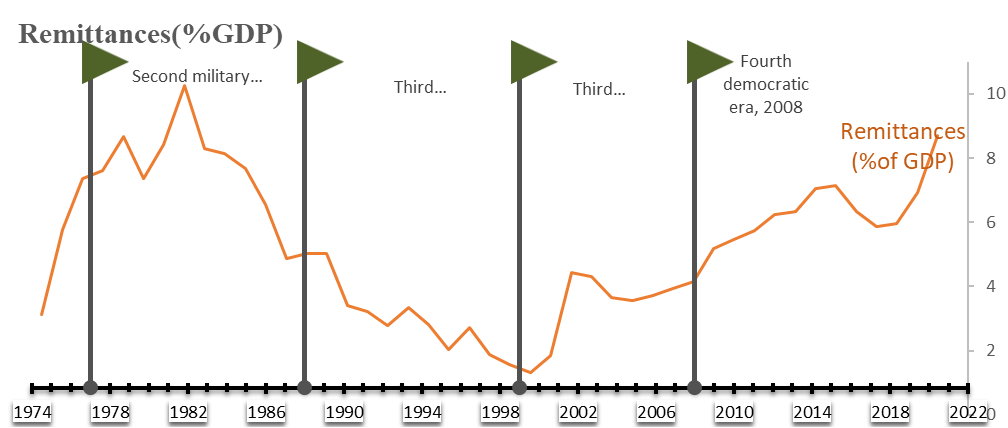

The inflow of remittances started increasing between mid-1970s and mid-1980s. Thereafter, it followed a downward trend till 2000 but then it started increasing to date. The third democratic era was a chaotic period where Pakistan saw no stable government – the country faced sanctions in response of nuclear tests that hurt functioning of usual banks, and caused a downward trend of inflow of remittances. Historic inflows of workers’ remittances in Pakistan indicate an overall increasing trend with varying volatility.

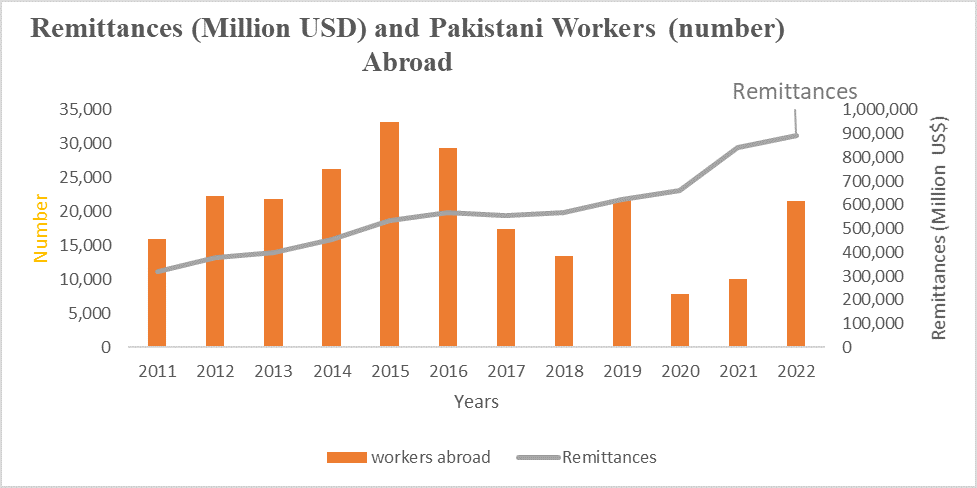

The upward trend generally remained unaffected across various political regimes. However, there was a sharp rise post-2008 when remittances quadrupled -- with an increase of about $24829.96 million and reached $31278.80 million in 2022 (Figure.1). Post-2008 all hypothesized factors, that is policy initiatives and population bulge, worked well and resulted in increased inflow of remittances.

Figure.1

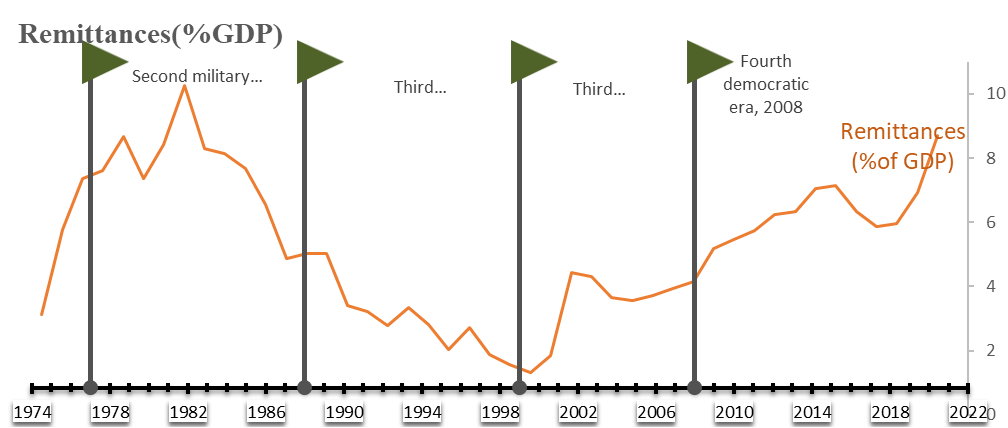

Over the last two decades the contribution of remittances to GNP has increased significantly in Pakistan. It supports the belief that remittances have substantial impact on the economy’s growth. Though the historic pattern of remittances to GDP ratio does not follow monotonic trend, but since 1999 the ratio has shown an increasing trend. Despite the fact that volume of GDP has increased manifold in recent decades, the contribution of remittances has increased only recently (Figure.2).

Figure.2

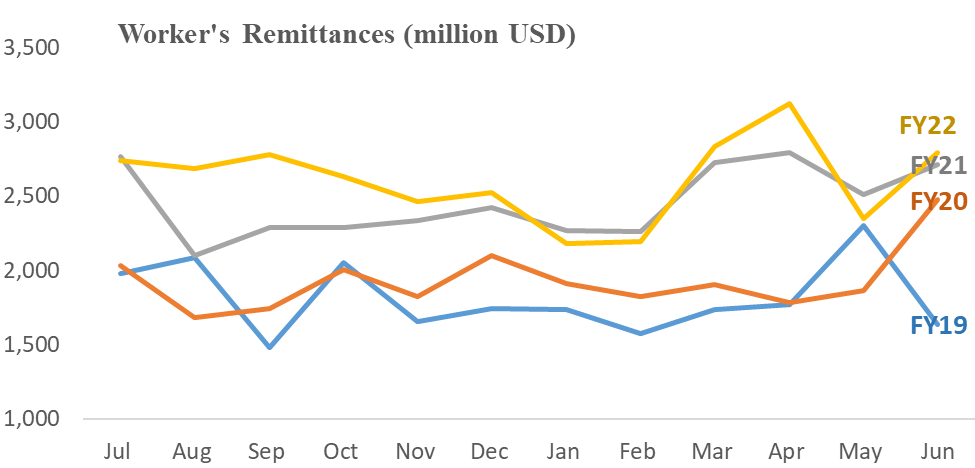

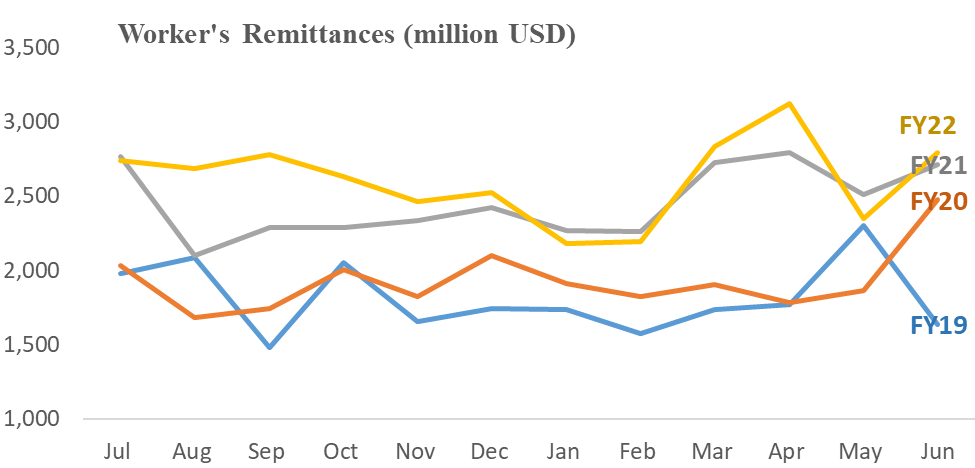

During the Covid-19 pandemic, many migrants flew back to the native countries due to unemployment and unfavourable economic conditions in host countries. In Pakistan, the volume of remittances declined between fiscal years 2019 and 2020. As soon as the economic conditions become stable in host countries, the remittances showed an upward trend in the following years. The volume of remittances increased more in FY2021 and FY2022 as compared to FY2019 and FY2020 (Figure.3).

During the Covid-19 pandemic, many migrants flew back to the native countries due to unemployment and unfavourable economic conditions in host countries. In Pakistan, the volume of remittances declined between fiscal years 2019 and 2020. As soon as the economic conditions become stable in host countries, the remittances showed an upward trend in the following years. The volume of remittances increased more in FY2021 and FY2022 as compared to FY2019 and FY2020 (Figure.3).

Figure.3

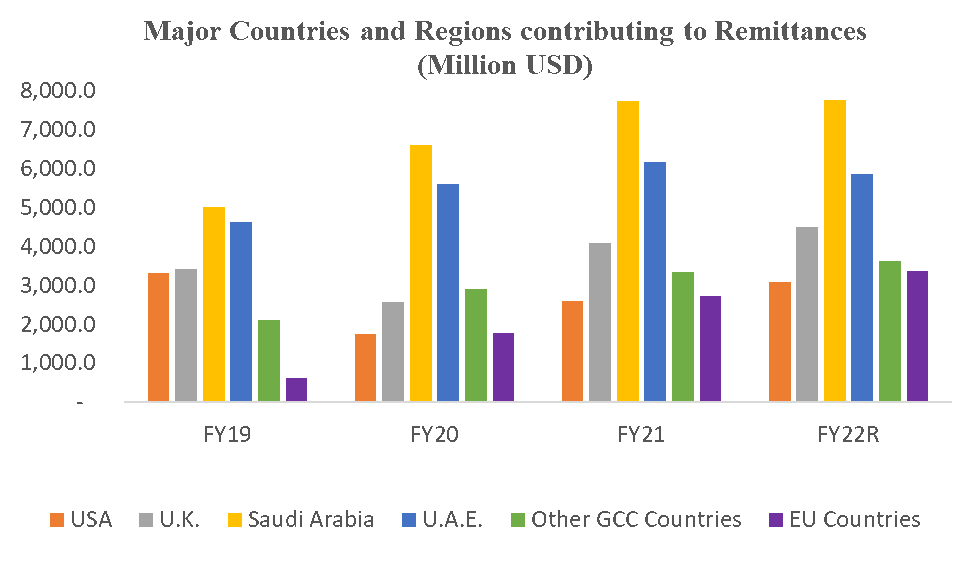

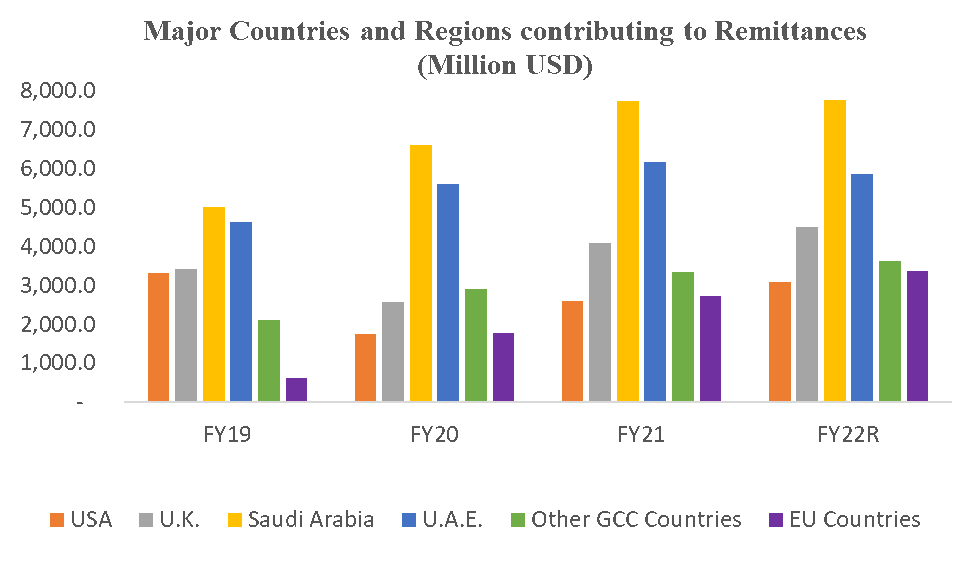

Remittances depend on needs of migrants’ extended families living in Pakistan. During the last four fiscal years, Saudi Arabia (KSA) and United Arab Emirates (UAE) have remained the main contributors of remittances in Pakistan. Remittances from the European Union grew more than five folds during the same period. The rise in remittances from the United Kingdom and other Gulf countries is also remarkable. Remittance from the UK faced a sharp decline during FY20 maybe due to Covid and related externalities, though it recovered later. Remittances from the US that dropped during the pandemic are now on a recovery path (Figure.4).

Migrants, permanently settled abroad with immediate families, have less amount left to send to the homeland. Immigration rules and habitation policies of the Gulf region are very constricted for permanent residents in the region. Thus workers send more to native country. Also workers from KSA and UAE send substantial portion of their earnings to the native country.

Figure.4

Source of remittances

Pakistan produces a variety of workforce from unskilled to highly qualified individuals. In the last decade, Pakistan has developed the capacity and capability to compete for demand in workforce abroad in almost all fields.

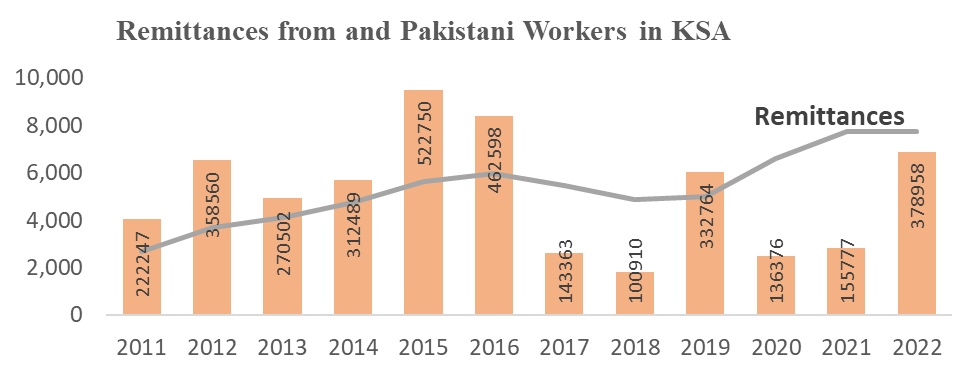

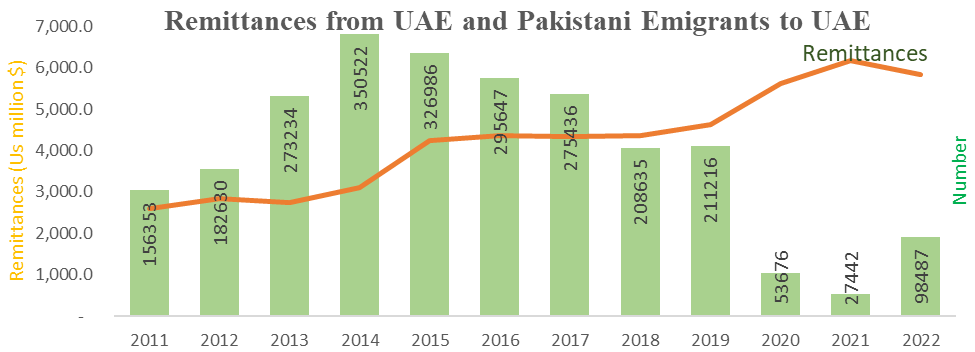

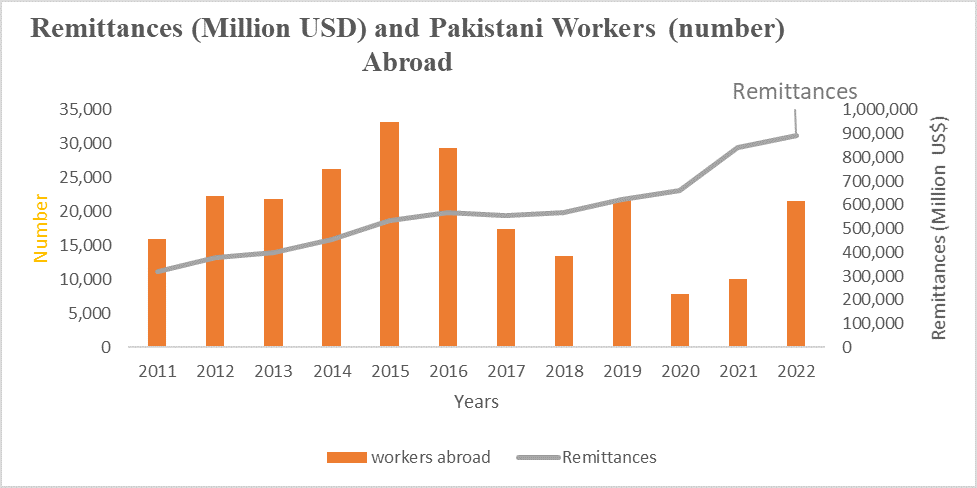

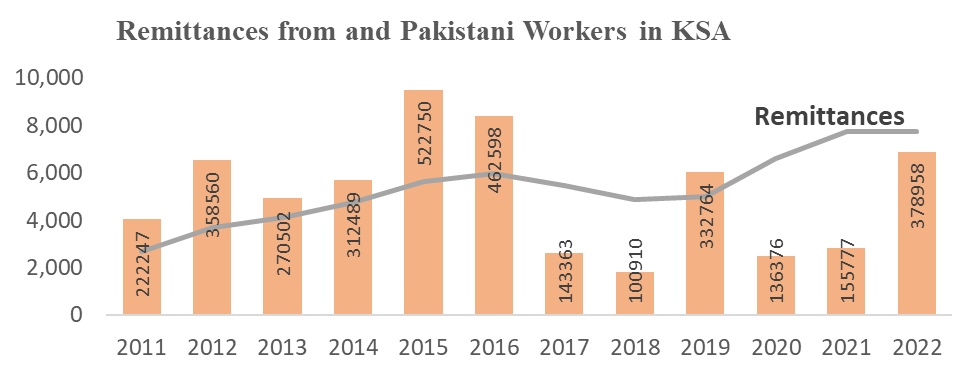

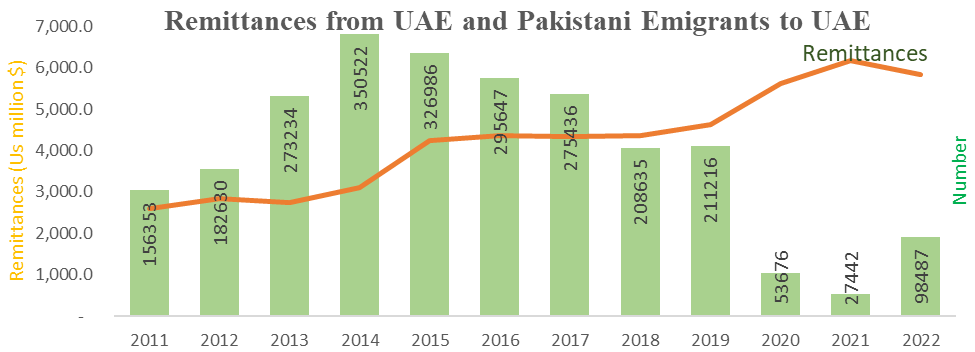

But recently the overall remittances from Saudi Arabia and UAE increased but the number of migrants decreased (Figure.5). However, remittances from the EU, US and UK increased as the number of migrants increased.

The number of workers dropped in 2017 and 2018 because the Saudi government imposed a tax, titled ‘expat levy’, in July 2017 with charges of up to SR800 per migrant. It hurt them heavily and many workers shifted their families to hometown, as a result the number of migrants decreased and remittances sent to families increased.

Figure.5

Figure.6. a

Figure.6. a

Figure.6. b

Types of workers abroad

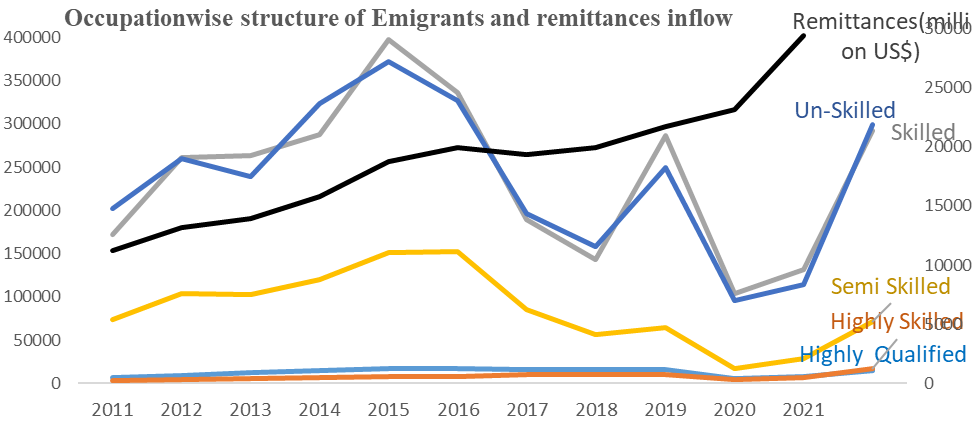

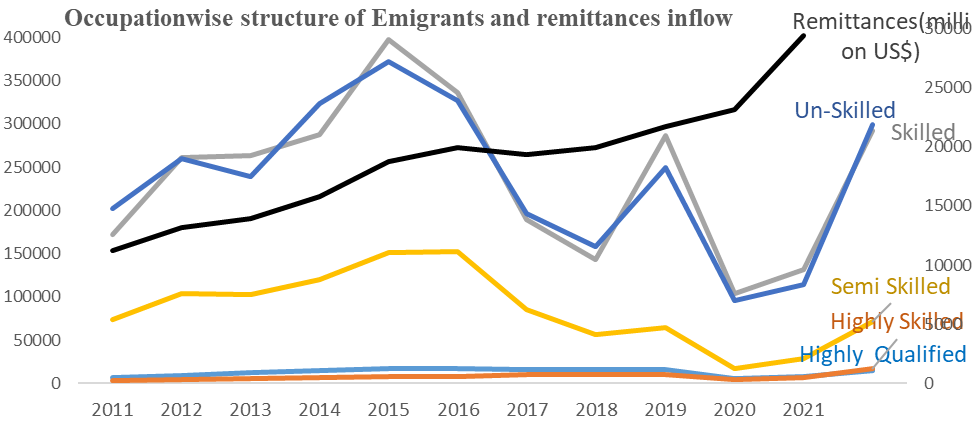

The recent inverse association between remittances and number of Pakistani migrant workers could be due to changes in skills of workers – that is, the highly skilled worker could earn more compare to unskilled or under skilled ones.

Over the last decade, it has been observed that unskilled and skilled workers have dominated the number of workers abroad, followed by semi-skilled workers. The semi-skilled workforce faces less competition in the country and enjoys a reasonably good lifestyle abroad. The number of highly-qualified and highly-skilled migrant workers is small because their demand is high in the country and are able to enjoy a good living.

From 2011 to 2016 the remittance inflow increased with the number of worker, later the association is negative (Figure.7). After Covid-19 pandemic outflow of workers from all five categories increased significantly, resulting in increased remittances.

Figure.7

Aid to Economy

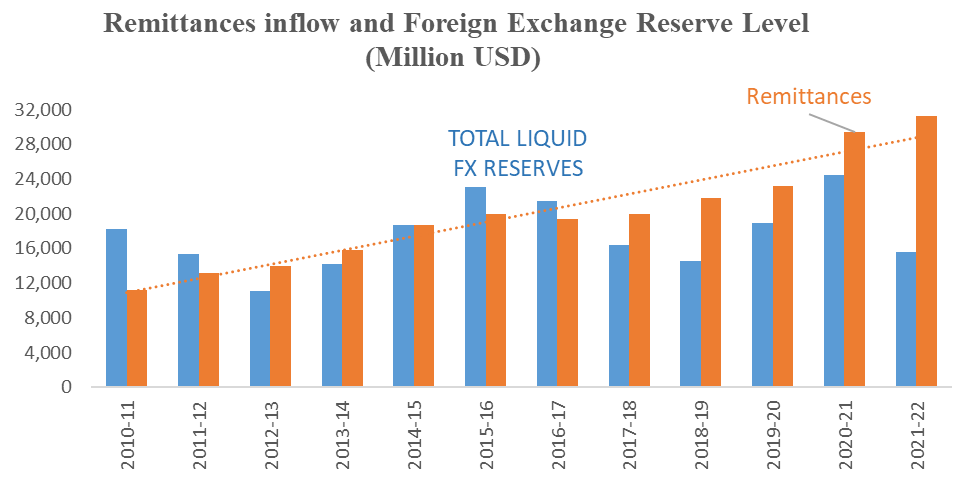

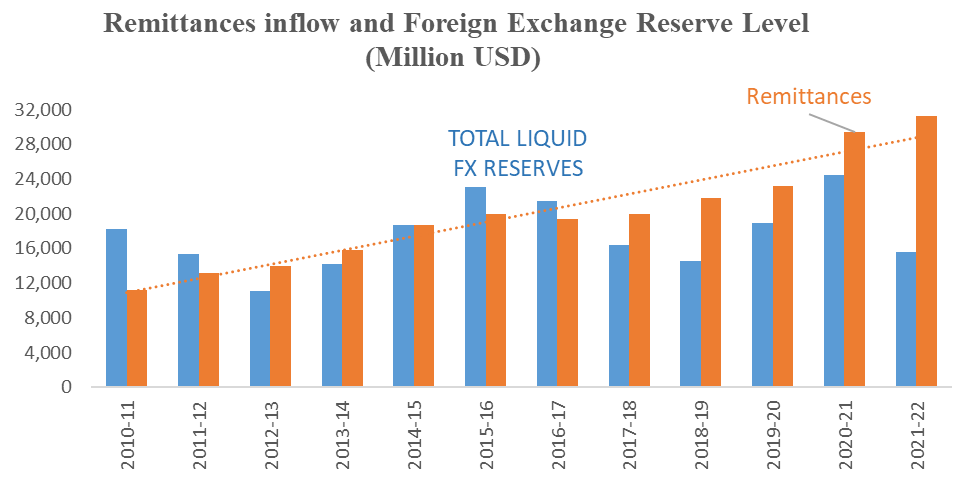

Remittances are good source of foreign currency for a developing economy like Pakistan. Over the last decade the remittances have been a growing source of foreign reserves but the reserves still do not follow a specific trend. Recently remittances exceeded the total liquid reserves (Figure.8).

An undervalued exchange rate discourages the route to official intermediaries and less remittances will is reflected in the economy. In the prevailing economic situation, the market-based exchange rate may attract more remittances but it might distort the balance of payments. Keeping in mind that Pakistan has no exports surplus, the exchange rate could be the solution to prevailing chaotic economic conditions.

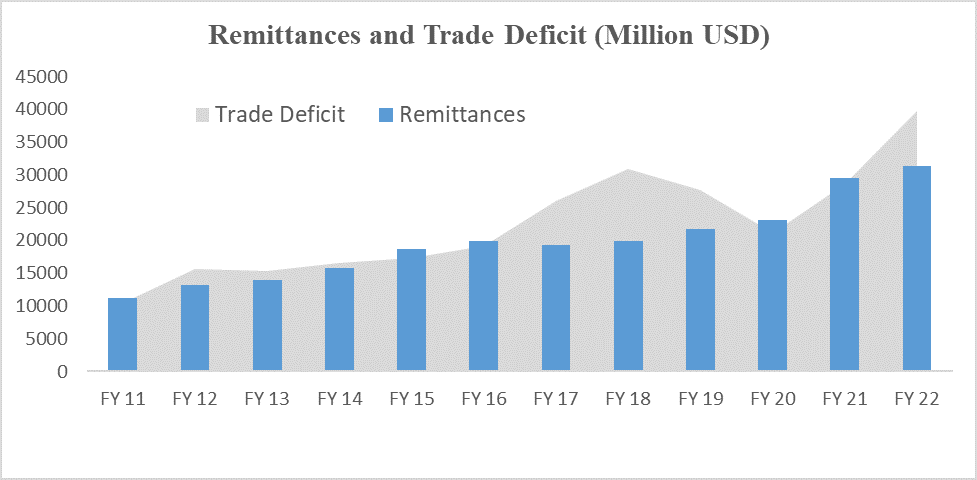

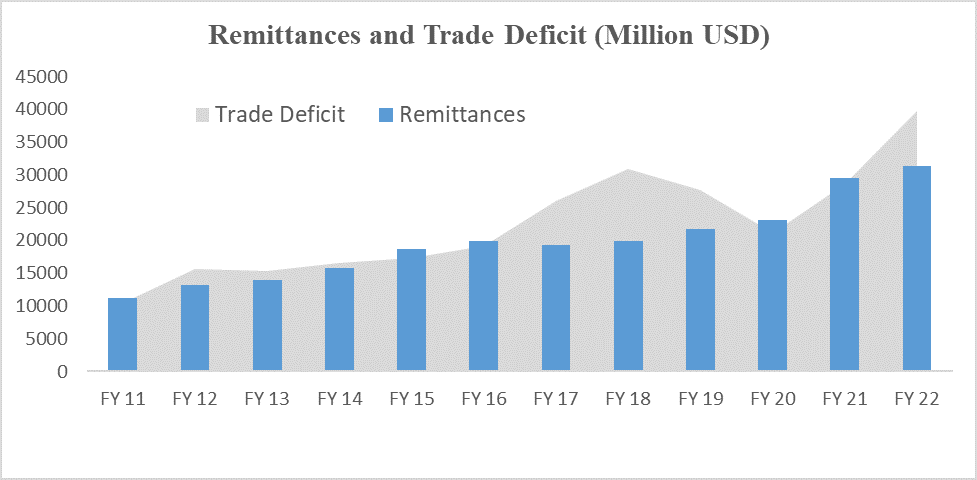

In the presence of relatively huge import size, remittances can play a positive role in balance of payments. The historic pattern confirms the role of remittances in lessening trade deficit (Figure.9).

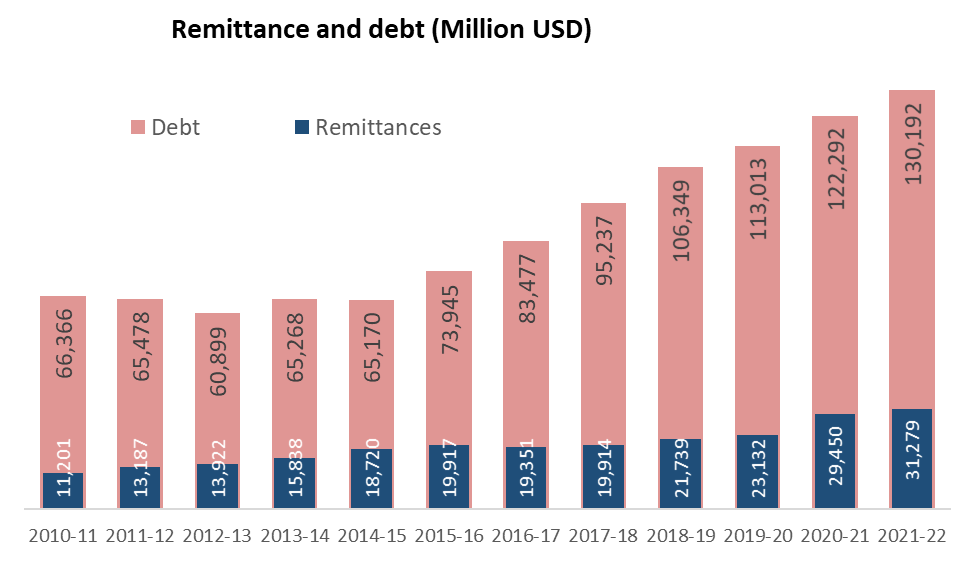

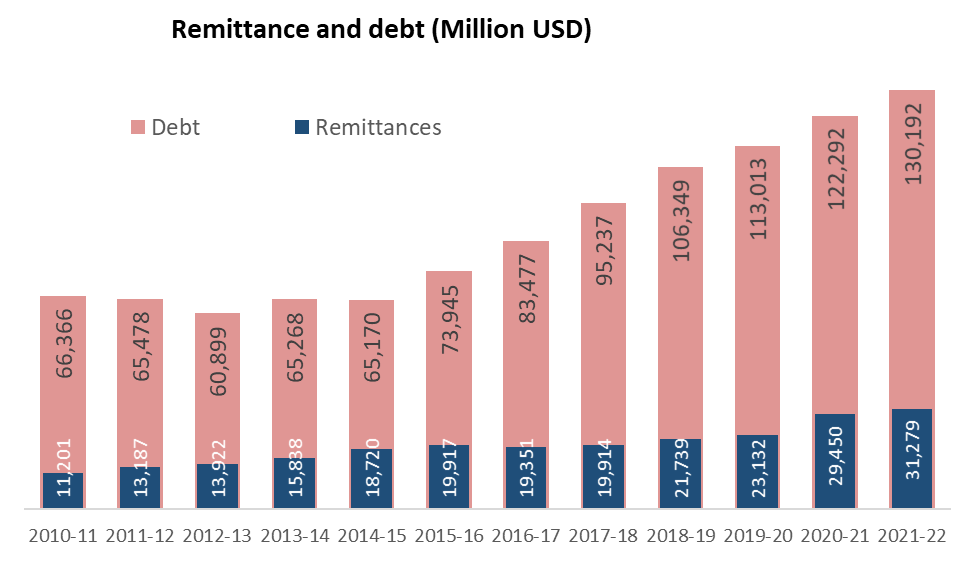

The biggest problem of Pakistan economy is ever growing debt. In the presence of strangling export receipts, remittances can rescue the economy. But remittances cannot be utilized for debt repayments or servicing. Over the last decade, the total remittances are less than one-fourth of the debt volume (Figure.10).

Figure.8

Figure.9

Figure.10

Remittances can play a balancing role in dire economic situations but they cannot completely offset the trade deficit or help debt repayments. Pakistani workers are in demand globally and are a good source of remittances therefore there is a need to improve workers’ skills to make them more competitive. Also there is a need of improved and easy to employ funds transferring products. Official financial intermediaries should be encouraged to take steps in this direction. Remittances truly are windfall gain to the struggling Pakistan economy.

The writers are faculty members at the Pakistan Institute of Development Economics PIDE, Islamabad.

Recently, remittances have contributed significantly to the gross national product (GNP) in many developing countries, including India, Mexico, Philippines and Egypt. India has remained the largest recipient of remittances inflows since 2008 (Migration Data Portal 2022).

Globally, the ever-changing demographic and political scenarios encourage migration for better financial resources and good lifestyle, and the attachment to birthplace as well as the extended family has resulted in inflow of remittances to the source country.

Policy changes have stimulated workers’ migration and inflow of remittances into Pakistan. The 1973 constitution of Pakistan ensures basic rights to general public, including easy access to passport and other travelling facilities. This encourages migration of skilled and unskilled workforce. With the inception of Pakistan Higher Education Commission (HEC) on 11 September 2002, a substantial investment was allocated for advanced education in distinct fields of sciences and engineering. This investment helped in the development of highly-educated individuals, triggered the supply of qualified workforce, and increased the inflow of remittances.

A continuous population growth scars the available resources and competing workforce decides to migrate. It can be re-hypothesized that policies and population growth cause migration of workforce and increase remittances.

The big picture

The inflow of remittances started increasing between mid-1970s and mid-1980s. Thereafter, it followed a downward trend till 2000 but then it started increasing to date. The third democratic era was a chaotic period where Pakistan saw no stable government – the country faced sanctions in response of nuclear tests that hurt functioning of usual banks, and caused a downward trend of inflow of remittances. Historic inflows of workers’ remittances in Pakistan indicate an overall increasing trend with varying volatility.

The upward trend generally remained unaffected across various political regimes. However, there was a sharp rise post-2008 when remittances quadrupled -- with an increase of about $24829.96 million and reached $31278.80 million in 2022 (Figure.1). Post-2008 all hypothesized factors, that is policy initiatives and population bulge, worked well and resulted in increased inflow of remittances.

Figure.1

Over the last two decades the contribution of remittances to GNP has increased significantly in Pakistan. It supports the belief that remittances have substantial impact on the economy’s growth. Though the historic pattern of remittances to GDP ratio does not follow monotonic trend, but since 1999 the ratio has shown an increasing trend. Despite the fact that volume of GDP has increased manifold in recent decades, the contribution of remittances has increased only recently (Figure.2).

Figure.2

During the Covid-19 pandemic, many migrants flew back to the native countries due to unemployment and unfavourable economic conditions in host countries. In Pakistan, the volume of remittances declined between fiscal years 2019 and 2020. As soon as the economic conditions become stable in host countries, the remittances showed an upward trend in the following years. The volume of remittances increased more in FY2021 and FY2022 as compared to FY2019 and FY2020 (Figure.3).

During the Covid-19 pandemic, many migrants flew back to the native countries due to unemployment and unfavourable economic conditions in host countries. In Pakistan, the volume of remittances declined between fiscal years 2019 and 2020. As soon as the economic conditions become stable in host countries, the remittances showed an upward trend in the following years. The volume of remittances increased more in FY2021 and FY2022 as compared to FY2019 and FY2020 (Figure.3).Figure.3

Remittances depend on needs of migrants’ extended families living in Pakistan. During the last four fiscal years, Saudi Arabia (KSA) and United Arab Emirates (UAE) have remained the main contributors of remittances in Pakistan. Remittances from the European Union grew more than five folds during the same period. The rise in remittances from the United Kingdom and other Gulf countries is also remarkable. Remittance from the UK faced a sharp decline during FY20 maybe due to Covid and related externalities, though it recovered later. Remittances from the US that dropped during the pandemic are now on a recovery path (Figure.4).

Migrants, permanently settled abroad with immediate families, have less amount left to send to the homeland. Immigration rules and habitation policies of the Gulf region are very constricted for permanent residents in the region. Thus workers send more to native country. Also workers from KSA and UAE send substantial portion of their earnings to the native country.

Figure.4

Source of remittances

Pakistan produces a variety of workforce from unskilled to highly qualified individuals. In the last decade, Pakistan has developed the capacity and capability to compete for demand in workforce abroad in almost all fields.

But recently the overall remittances from Saudi Arabia and UAE increased but the number of migrants decreased (Figure.5). However, remittances from the EU, US and UK increased as the number of migrants increased.

The number of workers dropped in 2017 and 2018 because the Saudi government imposed a tax, titled ‘expat levy’, in July 2017 with charges of up to SR800 per migrant. It hurt them heavily and many workers shifted their families to hometown, as a result the number of migrants decreased and remittances sent to families increased.

Figure.5

Figure.6. a

Figure.6. a

Figure.6. b

Types of workers abroad

The recent inverse association between remittances and number of Pakistani migrant workers could be due to changes in skills of workers – that is, the highly skilled worker could earn more compare to unskilled or under skilled ones.

Over the last decade, it has been observed that unskilled and skilled workers have dominated the number of workers abroad, followed by semi-skilled workers. The semi-skilled workforce faces less competition in the country and enjoys a reasonably good lifestyle abroad. The number of highly-qualified and highly-skilled migrant workers is small because their demand is high in the country and are able to enjoy a good living.

From 2011 to 2016 the remittance inflow increased with the number of worker, later the association is negative (Figure.7). After Covid-19 pandemic outflow of workers from all five categories increased significantly, resulting in increased remittances.

Figure.7

Aid to Economy

Remittances are good source of foreign currency for a developing economy like Pakistan. Over the last decade the remittances have been a growing source of foreign reserves but the reserves still do not follow a specific trend. Recently remittances exceeded the total liquid reserves (Figure.8).

An undervalued exchange rate discourages the route to official intermediaries and less remittances will is reflected in the economy. In the prevailing economic situation, the market-based exchange rate may attract more remittances but it might distort the balance of payments. Keeping in mind that Pakistan has no exports surplus, the exchange rate could be the solution to prevailing chaotic economic conditions.

In the presence of relatively huge import size, remittances can play a positive role in balance of payments. The historic pattern confirms the role of remittances in lessening trade deficit (Figure.9).

The biggest problem of Pakistan economy is ever growing debt. In the presence of strangling export receipts, remittances can rescue the economy. But remittances cannot be utilized for debt repayments or servicing. Over the last decade, the total remittances are less than one-fourth of the debt volume (Figure.10).

Figure.8

Figure.9

Figure.10

Remittances can play a balancing role in dire economic situations but they cannot completely offset the trade deficit or help debt repayments. Pakistani workers are in demand globally and are a good source of remittances therefore there is a need to improve workers’ skills to make them more competitive. Also there is a need of improved and easy to employ funds transferring products. Official financial intermediaries should be encouraged to take steps in this direction. Remittances truly are windfall gain to the struggling Pakistan economy.

The writers are faculty members at the Pakistan Institute of Development Economics PIDE, Islamabad.