The State Bank of Pakistan recently announced remittance figures for December 2022 and the results are far from encouraging.

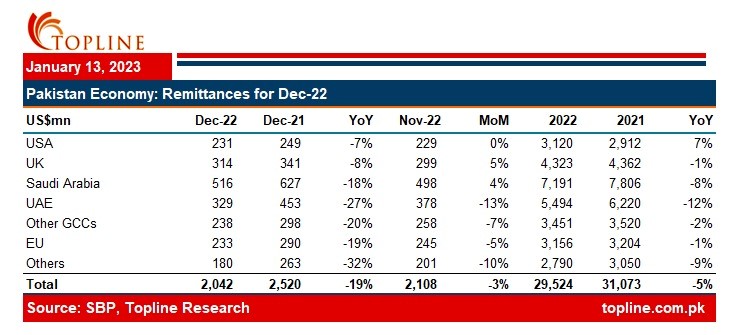

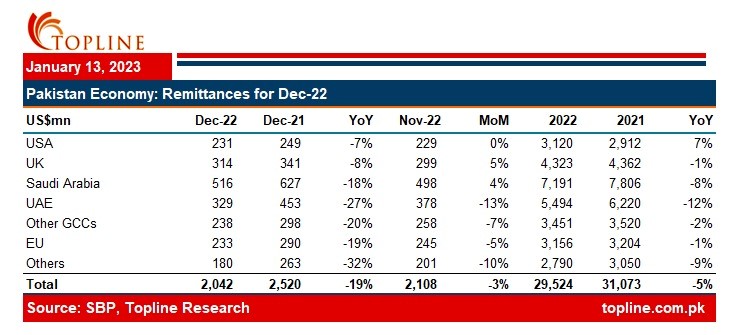

The overall inflows from worker remittances in December clocked in at $2 billion, a decrease of 19% year on year.

Further, the first half of the fiscal year 2023 saw a drop of 11% in remittances when compared to the same period last year.

What explains this trend is probably the global economic slowdown, but more importantly for Pakistan, the currency management and the emergence of a parallel market have diverted flows from the official channels.

(Read more: The Government Has Guarded Currency Enough. It’s Time To Let It Go)

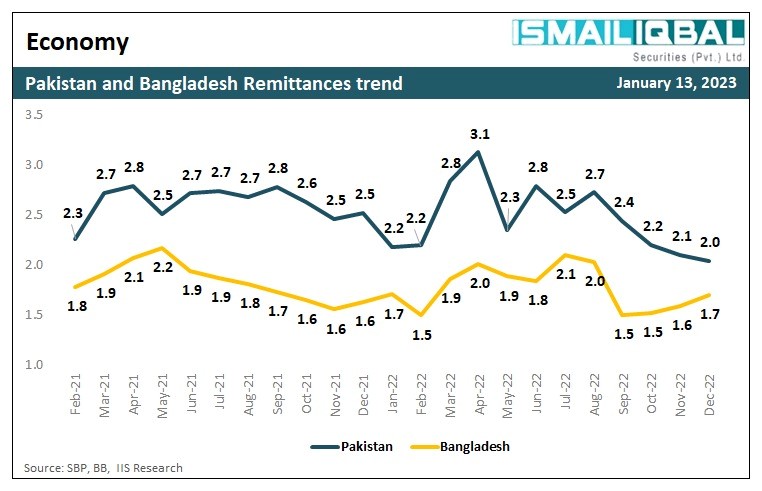

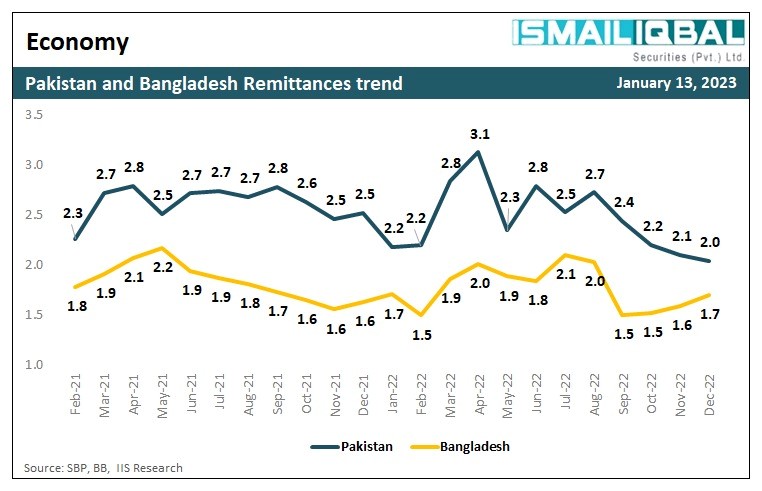

Head of Equity Research at Ismail Iqbal Securities, Fahad Rauf tweeted, “Bangladesh also witnessed a sharp fall in remittances, when the gap between the open market and the official rate rose to 15 Taka per dollar. They increased the exchange rate for remittances, and impact has been positive.”

A detailed analysis of the data shows that the Gulf countries continue to be the largest source of worker revenues for Pakistan. Remittances received from Saudi Arabia and UAE aggregated to $516 million and $329 million in December respectively.

Source: Topline Securities

Foreign remittances act as an anchor for Pakistan’s economy and the country heavily relies on these inflows to curtail its ever-growing balance of payments deficit.

As per a World Bank study remittances can significantly reduce poverty across low-medium income countries due to the direct impact of inflows on standards of living and development through investments. Yet, the benefits extracted from these inflows largely depend on the policy framework in the recipient country for channelling them towards productive sectors.

Unfortunately, Pakistan is losing out on capitalising on a rather robust source of inflows as those at the helm of affairs are adamant about intervening in the currency markets.

“The significant reduction in remittances is directly attributable to administrative failure and imprudent policies of the PDM government. The interbank exchange rate (currently $1: Rs 227) is not reflective of open market dynamics where an American dollar fetches around Rs 260. This difference of around 15 percent is making official channels unattractive. Resultantly, an informal open exchange market is flourishing,” wrote Dr. Ikramul Haq, facility member at LUMS, in an article for The News.

This doesn’t only highlight flawed policymaking, but also institutional failure to curb illegal activities. As per an article in Zawya, “The UAE dirham and US dollar are trading much higher in the open market in Pakistan and this is reflected in the hawala system as well. The rupee was trading at 68.5 against the UAE dirham or 236.25 against the US dollar through the hawala system.”

“The UAE continues to launch public awareness campaigns about hawala as violators could face hefty penalties for not adhering to the local laws,” the article further added.

Zafar Paracha, General Secretary of the Exchange Companies Association of Pakistan (ECAP) suggested a three-tier exchange as a solution to the parallel dollar market problem. What that means is charging different rates for imports, exports and remittances to incentivise the usage of official channels for forex transactions.

However, implementation of such a measure would require a lot of deliberation and groundwork to identify loopholes and ascertain the feasibility of any such mechanism. Thus, it can be a long-term policy measure rather than a short-term fix.

Therefore, by artificially keeping the currency appreciated the government is only buying time before the inevitable devaluation takes place.

As per a report by Ismail Iqbal Securities, “Precarious reserves position and thriving black market has created a big gap of over 10% between interbank and informal market. To address this, govt is likely to let REER depreciate to encourage exports and remittances, disincentivize imports and use of alternate channels. We expect USD/PKR to reach 250 by FY23 end.”

Further, there are precedents to support the argument that remittance through official channels can be boosted with basic policy measures.

As per the World Bank’s Migration and Development Brief 2020, “In both Pakistan and Bangladesh, the negative impact of the COVID-19–induced global economic slowdown has been somewhat countered by the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions as well as the incentives to transfer remittances.”

The perilous state of the global economy makes it even more important to prevent the leakage of valuable dollar reserves. Economist, Dr. Aqdas Afzal, in an article for this publication wrote, “As the sun sets on 2022, Pakistan will remain stuck in the midst of the ongoing economic maelstrom. Pakistan’s exports and remittances will go down, widening the current account deficit, primarily because of the recent floods and recession in the US, Eurozone and now in China.”

We can also take a hint from our neighbour which is going above and beyond basic measures to attract inflows from its diaspora population, “Non-Resident Indians (NRIs) will soon be able to make payments in Unified Payments Interface (UPI) without having to get an Indian mobile number. The National Payments Corporation of India (NPCI) has allowed NRIs in 10 countries to digitally transfer funds using the UPI platform from NRE/NRO accounts,” read an article in The Mint.

The overall inflows from worker remittances in December clocked in at $2 billion, a decrease of 19% year on year.

Further, the first half of the fiscal year 2023 saw a drop of 11% in remittances when compared to the same period last year.

What explains this trend is probably the global economic slowdown, but more importantly for Pakistan, the currency management and the emergence of a parallel market have diverted flows from the official channels.

(Read more: The Government Has Guarded Currency Enough. It’s Time To Let It Go)

Head of Equity Research at Ismail Iqbal Securities, Fahad Rauf tweeted, “Bangladesh also witnessed a sharp fall in remittances, when the gap between the open market and the official rate rose to 15 Taka per dollar. They increased the exchange rate for remittances, and impact has been positive.”

A detailed analysis of the data shows that the Gulf countries continue to be the largest source of worker revenues for Pakistan. Remittances received from Saudi Arabia and UAE aggregated to $516 million and $329 million in December respectively.

Source: Topline Securities

Foreign remittances act as an anchor for Pakistan’s economy and the country heavily relies on these inflows to curtail its ever-growing balance of payments deficit.

As per a World Bank study remittances can significantly reduce poverty across low-medium income countries due to the direct impact of inflows on standards of living and development through investments. Yet, the benefits extracted from these inflows largely depend on the policy framework in the recipient country for channelling them towards productive sectors.

Unfortunately, Pakistan is losing out on capitalising on a rather robust source of inflows as those at the helm of affairs are adamant about intervening in the currency markets.

“The significant reduction in remittances is directly attributable to administrative failure and imprudent policies of the PDM government. The interbank exchange rate (currently $1: Rs 227) is not reflective of open market dynamics where an American dollar fetches around Rs 260. This difference of around 15 percent is making official channels unattractive. Resultantly, an informal open exchange market is flourishing,” wrote Dr. Ikramul Haq, facility member at LUMS, in an article for The News.

This doesn’t only highlight flawed policymaking, but also institutional failure to curb illegal activities. As per an article in Zawya, “The UAE dirham and US dollar are trading much higher in the open market in Pakistan and this is reflected in the hawala system as well. The rupee was trading at 68.5 against the UAE dirham or 236.25 against the US dollar through the hawala system.”

“The UAE continues to launch public awareness campaigns about hawala as violators could face hefty penalties for not adhering to the local laws,” the article further added.

Zafar Paracha, General Secretary of the Exchange Companies Association of Pakistan (ECAP) suggested a three-tier exchange as a solution to the parallel dollar market problem. What that means is charging different rates for imports, exports and remittances to incentivise the usage of official channels for forex transactions.

However, implementation of such a measure would require a lot of deliberation and groundwork to identify loopholes and ascertain the feasibility of any such mechanism. Thus, it can be a long-term policy measure rather than a short-term fix.

Therefore, by artificially keeping the currency appreciated the government is only buying time before the inevitable devaluation takes place.

As per a report by Ismail Iqbal Securities, “Precarious reserves position and thriving black market has created a big gap of over 10% between interbank and informal market. To address this, govt is likely to let REER depreciate to encourage exports and remittances, disincentivize imports and use of alternate channels. We expect USD/PKR to reach 250 by FY23 end.”

Further, there are precedents to support the argument that remittance through official channels can be boosted with basic policy measures.

As per the World Bank’s Migration and Development Brief 2020, “In both Pakistan and Bangladesh, the negative impact of the COVID-19–induced global economic slowdown has been somewhat countered by the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions as well as the incentives to transfer remittances.”

The perilous state of the global economy makes it even more important to prevent the leakage of valuable dollar reserves. Economist, Dr. Aqdas Afzal, in an article for this publication wrote, “As the sun sets on 2022, Pakistan will remain stuck in the midst of the ongoing economic maelstrom. Pakistan’s exports and remittances will go down, widening the current account deficit, primarily because of the recent floods and recession in the US, Eurozone and now in China.”

We can also take a hint from our neighbour which is going above and beyond basic measures to attract inflows from its diaspora population, “Non-Resident Indians (NRIs) will soon be able to make payments in Unified Payments Interface (UPI) without having to get an Indian mobile number. The National Payments Corporation of India (NPCI) has allowed NRIs in 10 countries to digitally transfer funds using the UPI platform from NRE/NRO accounts,” read an article in The Mint.