Reko Diq area is located in the ‘Tethyan Magmatic Arc’, home to not only huge mineral deposits, but also (estimated) of ‘rare earth minerals’. Its copper ore tonnage is not only four times larger than Saindak, but also bigger than Sarchashmeh mine (Iran) and Escondida (Chile).

In 1993, Balochistan Development Authority (BDA) enters into a joint venture (JV) with BHP Billiton, a US entity, with agreement based on the provincial ‘Mining Concessions Act 1970’. Three interesting clauses of the JV must be noted:

These, in hindsight, are what caused the damage to Pakistan in the end. The agreement was harried in very dubious circumstances, something that Iftikhar Chaudhry-led Supreme Court later cited when rejecting the JV. The equity (and profit) shares were set at 75:25, between BHP and Government of Balochistan (GOB) respectively.

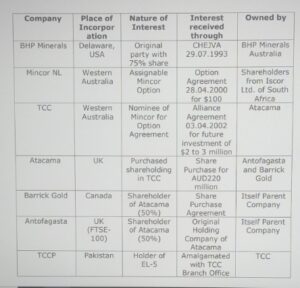

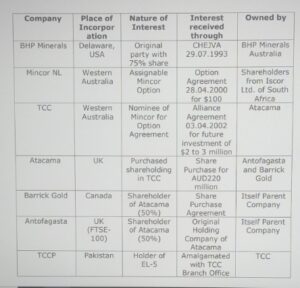

Since GOB didn’t have the money, BHP agreed to lend it the 25% at LIBOR+2%. Tethyan (TCC) later buys a 75% stake in BHP. The concessions awarded to the firm by GOB beggars belief. Anyway, in 2006, Antofagasta (a Chilean entity) bought all of Tethyan’s shares. Little later, Barrick gold (a Canadian entity) buys 50% of Antofagasta’s share.

In between this, another questionable development arises: new Mineral Rules (2000) gave TCC even more concessions; turns out that the rules were prepared by same law firm that had earlier represented BHP. By the time the first case was lodged in Balochistan High Court (BHC) against the joint venture in 2006, BHP had completed its survey. Consequently, it relinquished all licenses except one, for a 13,000 sq km area designated 'EL-5' (probably because major reserves are located there).

The BHC dismissed petition against JV, only for the SC to overturn BHC decision in 2013, declaring the JV illegal. Amongst other things, it found the adding of an ‘addendum’ document suspicious. TCC went to ICSID and ICC, where it stakes claim under Pakistan-Australia Bilateral Investment Treaty. In 2015, the GOB agreed to an out-of-court settlement given the legal complications (so PTI wasn’t the first in proposing this settlement).

Now to some puzzling aspects. The relations between GOB and BHP/TCC remain cordial from 1993-2007, until case reaches SC. In 2011, SC asks GOB to decide TCC's license renewal, which GOB rejects, leading TCC to approach international arbitration.

In 2006, when petition was lodged in BHC, the GOB sided with TCC, in favor of the joint venture. Within a year, as the case landed in the Supreme Court, the GOB took a stance against JV. Why this sudden change?

We do know that the SC was handed a ‘confidential’ report of geological studies containing estimates of minerals (which has yet to be made public!) so as SC took up the petition, an American firm (Benway) voluntarily approached the court to make it a party against TCC. Benway was already in Pakistan, with 8 licenses (including 2 in Chagai). It accused TCC of hiding real geological data which may have indicated higher than estimated quantities of gold and copper plus sought after ‘rare earth’ minerals. But it wasn’t the only one!

There was another actor in the game: China-based MCC, which has been running the Saindak copper and gold project, just 50 km away from Reko Diq. It too entered the fray.

The game gets even more interesting with the entry of one Pakistan’s most mercurial character of its clandestine world, nuclear scientist Dr. Samar Mubarakmand. When TCC went to ICSID, he makes his first appearance, arguing against TCC and asking permission to carry mining work in a specific location, a 3 km mining reserve called H-4 ‘Tanjeel’. This area was not part of TCCs request for license renewal so ICSID allowed GOB to prospect and mine in that location. By 2015, it was closed because not much could be retrieved. Estimates about huge reserves there turned out to be false. But by that time, billions of taxpayers’ money was wasted; not the first time that Dr. Samar ended up costing the national exchequer dearly, as he did the same in Thar coal gasification project. But of course, he remains untouchable (and we all know why).

Then there is the mysterious Maulvi Abdul Haq who, out of nowhere, lodged a case against the JV in 2006, and then took his case to the SC. In investigating this story, I tried searching for information on him but nothing substantial turned up. I called up few sources, and finally got in touch with a retired administrator who served in Balochistan. Upon asking about Abdul Haq, I was met with a lengthy silence, followed by this advice: "don’t get yourself into trouble by asking such questions". Classic spy thriller type situation, isn’t it?

Instead of concrete answers, this puzzle has raised the following questions (so far):

In discussing the recent SC verdict and new investment law, most commentators are miffed at the way the apex court gave the decision. But in hindsight, what choice did they have? Yes, their track record is pathetic (with some exceptions) but nobody wants their name associated with a $10 billion penalty that’ll literally kill Pakistan’s economy. Many observers took serious umbrage at two issues: on provinces surrendering their rights to the federation, and the SC giving its approval to the new investment law.

In reality, provinces surrendering rights is not as easy as it seems. And it has happened before, as in the case of DRAP when provinces voluntarily asked Centre to run things because the provinces didn’t have the capacity. Second, in giving their nod to new Investment law, their lordships cleverly left a way open to repeal it later through the Parliament (read paragraph 10(iii) of the SC judgement).

Besides, and more importantly, we have to look at things from an investors’ perspective too. Given Pakistan's track record, who would come to our country unless there are some iron-clad guarantees? The new law has been termed as aiming to turn Pakistan into a colony, given the kinds of concessions it envisages and the powers it grants to the federal government.

Balochistan, where this whole debate originated, has been run as a colony since 1947 with only brief respite. Everyone knows who really runs Balochistan, especially after the 1999 coup. Similarly, many commentators are underestimating the tricks up our administrators’ sleeves. For instance, the Reforms Act of 1992 could not prevent freezing of dollar accounts after the 1998 nuclear tests, or Saif-ur-Rehman's Ehtesab Bureau hounding investors and freezing their accounts. Similarly, and as rightly observed by the court, concessions are nothing new as they have historically been part and parcel of the economy; they have been utilized for Gwadar, CPEC's Special Economic Zones (SEZs), independent power producers (IPPs), and other cases.

In 1993, Balochistan Development Authority (BDA) enters into a joint venture (JV) with BHP Billiton, a US entity, with agreement based on the provincial ‘Mining Concessions Act 1970’. Three interesting clauses of the JV must be noted:

- 15.4.3: Arbitration outside Pakistan (i.e. in London);

- 15.4.6: Both parties waive ‘sovereign immunity’ in relation to any arbitration award; and

- 15.4.8: If ‘Centre’ rejects arbitration, issue to be decided under International Chamber of Commerce (ICC) rules by a sole arbiter.

These, in hindsight, are what caused the damage to Pakistan in the end. The agreement was harried in very dubious circumstances, something that Iftikhar Chaudhry-led Supreme Court later cited when rejecting the JV. The equity (and profit) shares were set at 75:25, between BHP and Government of Balochistan (GOB) respectively.

Since GOB didn’t have the money, BHP agreed to lend it the 25% at LIBOR+2%. Tethyan (TCC) later buys a 75% stake in BHP. The concessions awarded to the firm by GOB beggars belief. Anyway, in 2006, Antofagasta (a Chilean entity) bought all of Tethyan’s shares. Little later, Barrick gold (a Canadian entity) buys 50% of Antofagasta’s share.

In between this, another questionable development arises: new Mineral Rules (2000) gave TCC even more concessions; turns out that the rules were prepared by same law firm that had earlier represented BHP. By the time the first case was lodged in Balochistan High Court (BHC) against the joint venture in 2006, BHP had completed its survey. Consequently, it relinquished all licenses except one, for a 13,000 sq km area designated 'EL-5' (probably because major reserves are located there).

The BHC dismissed petition against JV, only for the SC to overturn BHC decision in 2013, declaring the JV illegal. Amongst other things, it found the adding of an ‘addendum’ document suspicious. TCC went to ICSID and ICC, where it stakes claim under Pakistan-Australia Bilateral Investment Treaty. In 2015, the GOB agreed to an out-of-court settlement given the legal complications (so PTI wasn’t the first in proposing this settlement).

Now to some puzzling aspects. The relations between GOB and BHP/TCC remain cordial from 1993-2007, until case reaches SC. In 2011, SC asks GOB to decide TCC's license renewal, which GOB rejects, leading TCC to approach international arbitration.

So what happened that led the Government of Balochistan to take a complete U-turn?

In 2006, when petition was lodged in BHC, the GOB sided with TCC, in favor of the joint venture. Within a year, as the case landed in the Supreme Court, the GOB took a stance against JV. Why this sudden change?

We do know that the SC was handed a ‘confidential’ report of geological studies containing estimates of minerals (which has yet to be made public!) so as SC took up the petition, an American firm (Benway) voluntarily approached the court to make it a party against TCC. Benway was already in Pakistan, with 8 licenses (including 2 in Chagai). It accused TCC of hiding real geological data which may have indicated higher than estimated quantities of gold and copper plus sought after ‘rare earth’ minerals. But it wasn’t the only one!

There was another actor in the game: China-based MCC, which has been running the Saindak copper and gold project, just 50 km away from Reko Diq. It too entered the fray.

The game gets even more interesting with the entry of one Pakistan’s most mercurial character of its clandestine world, nuclear scientist Dr. Samar Mubarakmand. When TCC went to ICSID, he makes his first appearance, arguing against TCC and asking permission to carry mining work in a specific location, a 3 km mining reserve called H-4 ‘Tanjeel’. This area was not part of TCCs request for license renewal so ICSID allowed GOB to prospect and mine in that location. By 2015, it was closed because not much could be retrieved. Estimates about huge reserves there turned out to be false. But by that time, billions of taxpayers’ money was wasted; not the first time that Dr. Samar ended up costing the national exchequer dearly, as he did the same in Thar coal gasification project. But of course, he remains untouchable (and we all know why).

Then there is the mysterious Maulvi Abdul Haq who, out of nowhere, lodged a case against the JV in 2006, and then took his case to the SC. In investigating this story, I tried searching for information on him but nothing substantial turned up. I called up few sources, and finally got in touch with a retired administrator who served in Balochistan. Upon asking about Abdul Haq, I was met with a lengthy silence, followed by this advice: "don’t get yourself into trouble by asking such questions". Classic spy thriller type situation, isn’t it?

Instead of concrete answers, this puzzle has raised the following questions (so far):

- What was the motive of BDA to form a JV when it didn’t have financial resources or the capacity?

- What made GOB go against TCC in SC when it supported it in BHC?

- What is the motivation or force behind bringing in Dr. Samar, the dubious role of Maulvi Abdul Haq, and the role of Army’s ‘Special Projects’ division?

- Where did Dr. Samar get estimates for H-4 Tanjeel, which in the end proved a failure?

- Why are the reports on Reko Diq’s mineral estimates still confidential?

In discussing the recent SC verdict and new investment law, most commentators are miffed at the way the apex court gave the decision. But in hindsight, what choice did they have? Yes, their track record is pathetic (with some exceptions) but nobody wants their name associated with a $10 billion penalty that’ll literally kill Pakistan’s economy. Many observers took serious umbrage at two issues: on provinces surrendering their rights to the federation, and the SC giving its approval to the new investment law.

In reality, provinces surrendering rights is not as easy as it seems. And it has happened before, as in the case of DRAP when provinces voluntarily asked Centre to run things because the provinces didn’t have the capacity. Second, in giving their nod to new Investment law, their lordships cleverly left a way open to repeal it later through the Parliament (read paragraph 10(iii) of the SC judgement).

Besides, and more importantly, we have to look at things from an investors’ perspective too. Given Pakistan's track record, who would come to our country unless there are some iron-clad guarantees? The new law has been termed as aiming to turn Pakistan into a colony, given the kinds of concessions it envisages and the powers it grants to the federal government.

But let’s ask ourselves: what really is our sovereignty anyway?

Balochistan, where this whole debate originated, has been run as a colony since 1947 with only brief respite. Everyone knows who really runs Balochistan, especially after the 1999 coup. Similarly, many commentators are underestimating the tricks up our administrators’ sleeves. For instance, the Reforms Act of 1992 could not prevent freezing of dollar accounts after the 1998 nuclear tests, or Saif-ur-Rehman's Ehtesab Bureau hounding investors and freezing their accounts. Similarly, and as rightly observed by the court, concessions are nothing new as they have historically been part and parcel of the economy; they have been utilized for Gwadar, CPEC's Special Economic Zones (SEZs), independent power producers (IPPs), and other cases.