No argument ignites patriotic pronouncements from Pakistanis as much as privatising state-owned entities, especially the national carrier, PIA. The airline was once a source of immense pride but has become an embarrassment. And while it may no longer be a golden goose for the government, it still needs to be managed. There is simply no escaping it.

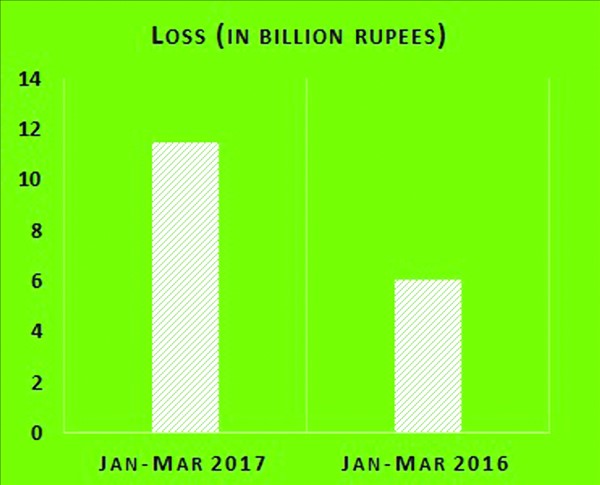

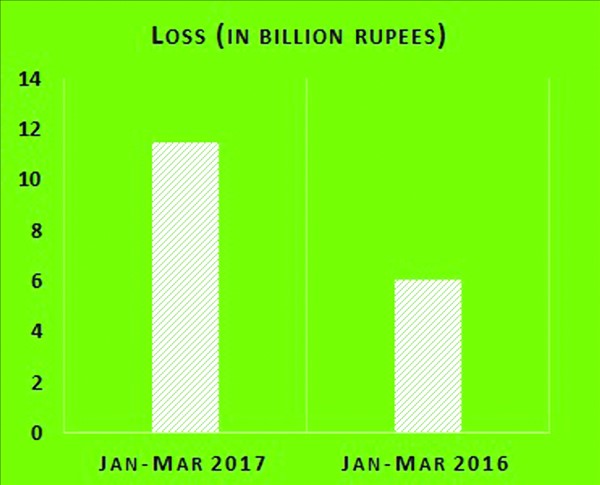

The once-mighty PIA helped set up Emirates, lent its crew and aircraft, and established what it would be its competition in years to come. Today its accumulated losses have gone beyond Rs319 billion. Its loss in the three-month period from January to March of 2017 alone was Rs11.5 billion, up a massive 90% year-on-year. Things don’t look good.

Why not sell the asset when you can find buyers? Apparently, according to a recent news report of The Express Tribune, Etihad Airways and Emirates—oh the irony of it— expressed interest in acquiring the stake. Following the report, privatisation minister, Daniyal Aziz, said the government was looking to sell its stake before the general elections. An unrealistic timeline and a mountain of a goal, to say the least.

In the Economic Survey 2016-17, the latest issue available, PIA is described as “passing through dire financial state”. Never mind the poor grammar, the government states, in the survey that “efforts are underway to improve the financial health of the Corporation by reducing its losses through various means and modes. Stringent action is being taken against corruption and mismanagement. It is worth mentioning that despite facing difficulties, PIAC has been able to improve upon its performance with reduction to losses.”

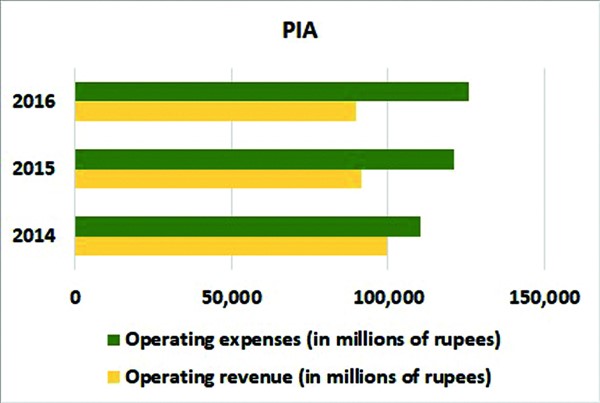

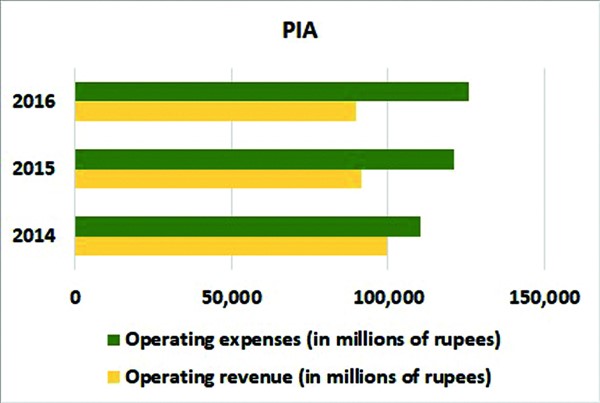

The divergent lines, denoting a bigger gap between expenses and revenue, suggest otherwise. Despite enjoying lower fuel prices, for which the government takes credit, PIA incurred a much higher loss during the current fiscal year. So how come an entity, apparently on the government’s priority list, continues to haemorrhage money and weigh down on fiscal operations? The answer lies in the manner in which it is operated, managed and misused.

Similarly, Pakistan Steel Mills, once an able entity that was able to generate profits for its owner, is now languishing in isolation, in a destitute state, and waiting to be rescued. The Economic Coordination Committee, staffed by high-ranking government officials with expertise in economic policymaking, meets every now and then to approve billions in a bailout to pay off its employees. But other than that there is very little talk on its revival.

Pakistan Railways was allocated Rs40 billion in 2017-18 “to meet its losses”, yet its minister keeps touting its higher earnings. This amount was Rs37 billion in the previous year. Obviously, the government thinks it needs more loans to operate.

The less said about Pakistan Post the better.

There are a raft of issues with how Pakistan manages its assets and loss-making state-owned entities are just a few of them.

Never mind the argument in favour of or against privatisation, it’s the government’s inaction that sets to a boil the blood of those who feel some sympathy for the country and its taxpayers. When news floats about the privatisation of any state-owned organisation, many seethe in anger.

Perhaps, they are right. PIA was profitable up until a few years ago. It was once a dominant force. And all that happened while it was still in the hands of the government. So why can’t all that happen now?

Overstaffing, inefficient aircraft, poorly managed schedules and an inhospitable crew are some hurdles in turning the airline around. But one issue that rarely makes its way into the discussion is competition. Through its liberal open skies policy, Pakistan paved the way for other airlines to snatch PIA’s market share.

Emirates, Etihad, Qatar are just some of the air carriers Pakistanis prefer to travel on as their air travel increases amid higher disposable incomes and lower fuel prices. SaudiGulf Airlines, which announced beginning operations in four Pakistani cities earlier this month, is expanding its international routes ahead of Hajj flights. PIA is sure to lose out, even if it does so negligibly.

What kind of strategy means reviving your national carrier and increasing its competition at the same time? Pakistan’s policymakers may not be experts on the economy, but any person with a basic understanding of free-market dynamics will tell you that this will not go in PIA’s favour. At the same time, the government doles out billions to revive an airline whose losses are caused by the very same people who offer the helping hand.

Privatising the same airlines may not be the ideal choice. PIA remains one of very few strategic assets the government has, and offers many services free of cost that other airlines would charge exorbitant sums for. But it’s a loss-making burden on Pakistan’s fiscal operations.

Does it have potential to be a profit-maker? Of course. But it won’t happen until the government’s strategies are in sync. You cannot say you want to revive an airline, and kill it by letting others make millions off its misery.

Privatisation or no privatisation, Pakistan can ill-afford losses on its burgeoning balance sheet. Its debt obligations are increasing and so are its expenses amid ambitious infrastructure projects. Economic growth can only keep pace so much, and sooner or later, these expenditures will take their toll.

The writer is a senior business editor based in Karachi

The once-mighty PIA helped set up Emirates, lent its crew and aircraft, and established what it would be its competition in years to come. Today its accumulated losses have gone beyond Rs319 billion. Its loss in the three-month period from January to March of 2017 alone was Rs11.5 billion, up a massive 90% year-on-year. Things don’t look good.

One issue that rarely makes its way into the discussion is competition. Through its liberal open skies policy, Pakistan paved the way for other airlines to snatch PIA's market share

Why not sell the asset when you can find buyers? Apparently, according to a recent news report of The Express Tribune, Etihad Airways and Emirates—oh the irony of it— expressed interest in acquiring the stake. Following the report, privatisation minister, Daniyal Aziz, said the government was looking to sell its stake before the general elections. An unrealistic timeline and a mountain of a goal, to say the least.

In the Economic Survey 2016-17, the latest issue available, PIA is described as “passing through dire financial state”. Never mind the poor grammar, the government states, in the survey that “efforts are underway to improve the financial health of the Corporation by reducing its losses through various means and modes. Stringent action is being taken against corruption and mismanagement. It is worth mentioning that despite facing difficulties, PIAC has been able to improve upon its performance with reduction to losses.”

The divergent lines, denoting a bigger gap between expenses and revenue, suggest otherwise. Despite enjoying lower fuel prices, for which the government takes credit, PIA incurred a much higher loss during the current fiscal year. So how come an entity, apparently on the government’s priority list, continues to haemorrhage money and weigh down on fiscal operations? The answer lies in the manner in which it is operated, managed and misused.

Similarly, Pakistan Steel Mills, once an able entity that was able to generate profits for its owner, is now languishing in isolation, in a destitute state, and waiting to be rescued. The Economic Coordination Committee, staffed by high-ranking government officials with expertise in economic policymaking, meets every now and then to approve billions in a bailout to pay off its employees. But other than that there is very little talk on its revival.

Pakistan Railways was allocated Rs40 billion in 2017-18 “to meet its losses”, yet its minister keeps touting its higher earnings. This amount was Rs37 billion in the previous year. Obviously, the government thinks it needs more loans to operate.

The less said about Pakistan Post the better.

There are a raft of issues with how Pakistan manages its assets and loss-making state-owned entities are just a few of them.

Never mind the argument in favour of or against privatisation, it’s the government’s inaction that sets to a boil the blood of those who feel some sympathy for the country and its taxpayers. When news floats about the privatisation of any state-owned organisation, many seethe in anger.

Perhaps, they are right. PIA was profitable up until a few years ago. It was once a dominant force. And all that happened while it was still in the hands of the government. So why can’t all that happen now?

Overstaffing, inefficient aircraft, poorly managed schedules and an inhospitable crew are some hurdles in turning the airline around. But one issue that rarely makes its way into the discussion is competition. Through its liberal open skies policy, Pakistan paved the way for other airlines to snatch PIA’s market share.

Emirates, Etihad, Qatar are just some of the air carriers Pakistanis prefer to travel on as their air travel increases amid higher disposable incomes and lower fuel prices. SaudiGulf Airlines, which announced beginning operations in four Pakistani cities earlier this month, is expanding its international routes ahead of Hajj flights. PIA is sure to lose out, even if it does so negligibly.

What kind of strategy means reviving your national carrier and increasing its competition at the same time? Pakistan’s policymakers may not be experts on the economy, but any person with a basic understanding of free-market dynamics will tell you that this will not go in PIA’s favour. At the same time, the government doles out billions to revive an airline whose losses are caused by the very same people who offer the helping hand.

Privatising the same airlines may not be the ideal choice. PIA remains one of very few strategic assets the government has, and offers many services free of cost that other airlines would charge exorbitant sums for. But it’s a loss-making burden on Pakistan’s fiscal operations.

Does it have potential to be a profit-maker? Of course. But it won’t happen until the government’s strategies are in sync. You cannot say you want to revive an airline, and kill it by letting others make millions off its misery.

Privatisation or no privatisation, Pakistan can ill-afford losses on its burgeoning balance sheet. Its debt obligations are increasing and so are its expenses amid ambitious infrastructure projects. Economic growth can only keep pace so much, and sooner or later, these expenditures will take their toll.

The writer is a senior business editor based in Karachi