After slow inflation in the last few years, Pakistan is now bracing for higher prices. The Consumer Price Index, inflation in other words, increased by 4.57% in December. Loosely translated, the basket of goods became expensive by 4.6 percentage points. Of course, this is not how the free market works, and prices don’t rise in this simplistic fashion.

But this data enables analysts and market followers set a benchmark to judge the pace of inflation, while also giving policymakers a yardstick to set the interest rate.

Pakistan has reaped the benefits of the global plunge in crude prices, which dropped close to 75% since the middle of 2014 up until the start of 2016, helping oil-importing countries such as ours, manage their import bills. As a result, Pakistan managed to shore up its foreign exchange reserves, deal with a slower pace of inflation that led to historically low interest rates, keep its currency strong against the US dollar, all the while as China promised billions of dollars in investment and loans to boost the economy.

Nothing could be rosier for the PML-N government. In response, cement and steel targeted expansion, while auto companies—buoyed by higher consumer lending due to low interest rates and greater purchasing power—saw sales numbers reach a record high. The government announced its auto policy and new players targeted entry into a growing middle class with greater money in their pockets. At the same time, new power projects looked to address the issue of energy shortages, and an Army operation promised to rid the country of terrorism.

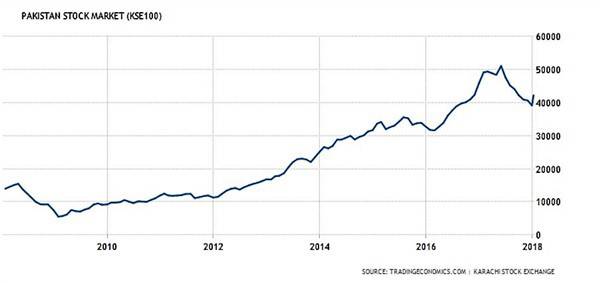

If this were not enough, the Pakistan Stock Exchange’s (PSX) benchmark-100 index ended up as Asia’s top performer and fourth in the world. It was like an economic dream come true.

Come 2017, everything changed. It started off with an innocent probe into the Sharif family’s offshore wealth and many believed it to be an exercise in futility given Pakistan’s history of justice. But it made a difference.

In the subsequent months, Nawaz Sharif would no longer be the prime minister and his trusted aide, finance minister Ishaq Dar, would also make an ungraceful exit. At the same time, pressure would mount on Pakistan’s foreign exchange reserves given lenient import policies and a strong currency. Free from the Dar-sian shackles, the rupee would find home much lower against the dollar and that would be the start.

The KSE-100, under pressure already due to several reasons, including rising political tensions, would turn out its worst performance since the 2008 financial crisis. Statements praising the economy would be fewer for two reasons; priorities changed to saving the seat and winning the elections this year and secondly, there wasn’t much to gloat about.

With a rising current account deficit and piling debt added over the years, Pakistan’s economy started to show signs of being under duress. The end of the IMF programme meant there was no oversight on expenditure or economic measures. The PML-N was free to do what it wanted and it chose to do nothing. Focus was laid on politics and the economy was thrown out the window with the eventual plan to pick it up somewhere down the road.

Meanwhile, CPEC continued to attract controversy as well, and China’s demands would get louder. Tensions with the Trump-led US administration would increase and what Pakistan got was a mixture of problem, both self-created and unfortunate.

Rupee depreciation would come much later than it ought to, and the imposition of regulatory duty would pile on the increase in prices.

The start of 2018 would see another increase in petrol rates, and now, the effect is here to stay.

Pakistan is now at the crossroads of economic growth and piling debt. With the pressure on the rupee likely to stay, it is only a matter of time before the decision is re-evaluated and the currency is let loose again.

Oil is set to then become even more expensive and the luxury of having change left over after you fill up a tank with a Rs5,000 note would be taken away. Additionally, all currencies are set to become expensive and foreign trips are set to become costlier.

What is the government doing about any of this? The answer is CPEC. If one were to concede that the $60-billion corridor will improve Pakistan’s economic growth, the effects will only be seen in years to come. Meanwhile, pressure on the current account and, in turn, the rupee would be felt much before. There is no doubt that Pakistan was late in allowing the rupee to find its ground. The move should have come a lot earlier.

It is now so late that a meager 5% won’t cut it. At the same time, rising inflation is set to take a toll on Pakistan’s economy. In an election year, governments are not known to be good with money. This is that kind of year.

If one now adds any kind of political uncertainty to an already complicated situation, the effect would be catastrophic. Foreign investors would be turned away, and Pakistani consumers are likely to become conservative in spending. Given the country’s tax is largely met on consumption, it can ill-afford to push people to save. Its only hope, and Pakistan’s, is that the political climate remains calm and there is a smooth transition of power.

In its 70-year history, there has been only one smooth shift and that has been Pakistan’s biggest issue.

The writer is a senior business editor based in Karachi

But this data enables analysts and market followers set a benchmark to judge the pace of inflation, while also giving policymakers a yardstick to set the interest rate.

Pakistan has reaped the benefits of the global plunge in crude prices, which dropped close to 75% since the middle of 2014 up until the start of 2016, helping oil-importing countries such as ours, manage their import bills. As a result, Pakistan managed to shore up its foreign exchange reserves, deal with a slower pace of inflation that led to historically low interest rates, keep its currency strong against the US dollar, all the while as China promised billions of dollars in investment and loans to boost the economy.

Oil is set to then become even more expensive and the luxury of having change left over after you fill up a tank with a Rs5,000 note would be taken away. Additionally, all currencies are set to become expensive and foreign trips are set to become costlier

Nothing could be rosier for the PML-N government. In response, cement and steel targeted expansion, while auto companies—buoyed by higher consumer lending due to low interest rates and greater purchasing power—saw sales numbers reach a record high. The government announced its auto policy and new players targeted entry into a growing middle class with greater money in their pockets. At the same time, new power projects looked to address the issue of energy shortages, and an Army operation promised to rid the country of terrorism.

If this were not enough, the Pakistan Stock Exchange’s (PSX) benchmark-100 index ended up as Asia’s top performer and fourth in the world. It was like an economic dream come true.

Come 2017, everything changed. It started off with an innocent probe into the Sharif family’s offshore wealth and many believed it to be an exercise in futility given Pakistan’s history of justice. But it made a difference.

In the subsequent months, Nawaz Sharif would no longer be the prime minister and his trusted aide, finance minister Ishaq Dar, would also make an ungraceful exit. At the same time, pressure would mount on Pakistan’s foreign exchange reserves given lenient import policies and a strong currency. Free from the Dar-sian shackles, the rupee would find home much lower against the dollar and that would be the start.

The KSE-100, under pressure already due to several reasons, including rising political tensions, would turn out its worst performance since the 2008 financial crisis. Statements praising the economy would be fewer for two reasons; priorities changed to saving the seat and winning the elections this year and secondly, there wasn’t much to gloat about.

With a rising current account deficit and piling debt added over the years, Pakistan’s economy started to show signs of being under duress. The end of the IMF programme meant there was no oversight on expenditure or economic measures. The PML-N was free to do what it wanted and it chose to do nothing. Focus was laid on politics and the economy was thrown out the window with the eventual plan to pick it up somewhere down the road.

It is now so late that a meager 5% won't cut it. At the same time, rising inflation is set to take a toll on Pakistan's economy. In an election year, governments are not known to be good with money. This is that kind of year

Meanwhile, CPEC continued to attract controversy as well, and China’s demands would get louder. Tensions with the Trump-led US administration would increase and what Pakistan got was a mixture of problem, both self-created and unfortunate.

Rupee depreciation would come much later than it ought to, and the imposition of regulatory duty would pile on the increase in prices.

The start of 2018 would see another increase in petrol rates, and now, the effect is here to stay.

Pakistan is now at the crossroads of economic growth and piling debt. With the pressure on the rupee likely to stay, it is only a matter of time before the decision is re-evaluated and the currency is let loose again.

Oil is set to then become even more expensive and the luxury of having change left over after you fill up a tank with a Rs5,000 note would be taken away. Additionally, all currencies are set to become expensive and foreign trips are set to become costlier.

What is the government doing about any of this? The answer is CPEC. If one were to concede that the $60-billion corridor will improve Pakistan’s economic growth, the effects will only be seen in years to come. Meanwhile, pressure on the current account and, in turn, the rupee would be felt much before. There is no doubt that Pakistan was late in allowing the rupee to find its ground. The move should have come a lot earlier.

It is now so late that a meager 5% won’t cut it. At the same time, rising inflation is set to take a toll on Pakistan’s economy. In an election year, governments are not known to be good with money. This is that kind of year.

If one now adds any kind of political uncertainty to an already complicated situation, the effect would be catastrophic. Foreign investors would be turned away, and Pakistani consumers are likely to become conservative in spending. Given the country’s tax is largely met on consumption, it can ill-afford to push people to save. Its only hope, and Pakistan’s, is that the political climate remains calm and there is a smooth transition of power.

In its 70-year history, there has been only one smooth shift and that has been Pakistan’s biggest issue.

The writer is a senior business editor based in Karachi