When the Supreme Court announced on April 20 that Prime Minister Nawaz Sharif would keep his seat, the market went into a frenzy. For those few minutes after 2pm no one cared about anything else in the world other than the fact that Pakistan’s stock market was slated for inclusion in the MSCI Emerging Markets Index.

The trading floor cheered and investors hopped on their seats like children at arcade games to play the next round. Thousands of buy orders missed the mark as prices soared, returning to earth only when followers realised that the Panama case was still ongoing and a joint investigation team had been formed.

But there was still time before the JIT line-up would be finalised, and proceedings would get underway. So the bullish run began again, and would continue for a while.

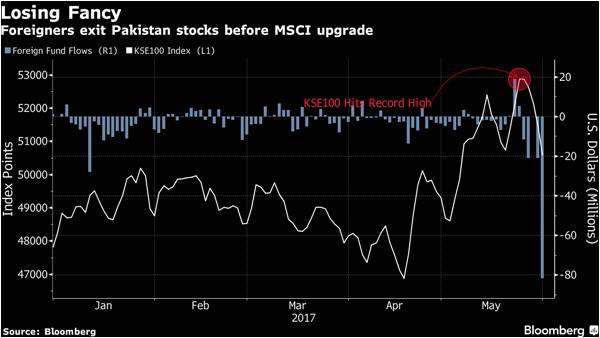

Between the start of April 20 and until the last week of May, the index trekked from 47,603.48 points to an intra-day high of 53,127.24 on May 25. It closed lower that day as profit-taking ahead of the federal budget announcement put investors in caution mode, but not before the KSE-100 Index (a benchmark for market performance) gave a phenomenal 11.6% return in just over a month. Market capitalisation crossed Rs100 trillion and the KSE-100 touched fresh highs more times than one could keep track.

Even Finance Minister Ishaq Dar did not want to let go of this opportunity and, like a proud father would do, ensured his peers in the National Assembly heard of the achievements.

What happened after is a completely different story.

The budget announcement did not go down well with stock market investors. An increase in Capital Gains Tax rates when officials of the Pakistan Stock Exchange (PSX) were negotiating otherwise sent investors reaching for the panic button. For the following week, the index retreated and went near the 48,500 level.

But what transpired on June 1, the day Pakistan officially became part of MSCI Emerging Markets Index, sent everyone into shock. After a year of patience, the reclassification day saw a bloodbath. Stocks hit their lower limits (a maximum decrease of 5% before prices are stopped from going further down to avoid a crash) and investors ran for cover.

Foreign inflows, which were eagerly awaited, had arrived to the tune of half a billion dollars. It was pretty much what the market was expecting. But the outflow by foreign investors who offloaded their shares more than outmatched the buying and the KSE-100 Index, with all its valour, could not withstand the pressure.

It collapsed by over 2,200 points on June 1 for the largest drops in PSX history in terms of points, before settling 1,800 lower. Close to 4% were shaved off on one day and that was just the benchmark. Many investors would have lost close to 5% as well. In context, if you lose close to 5% of your savings in six hours, that is saying something.

What were the reasons behind the sea of red that day? We knew that foreign investors who track frontier markets would pull out since Pakistan moved to the emerging markets index. We knew that some profit-taking was bound to happen as euphoria over the reclassification settled. We knew that the budget announcement did not please the market too much. So why the surprise?

Because, like all money matters, no matter how much you prepare and plan, you can never be sure how everyone else would react. An associate professor at Stanford discovered in 2004 that “trading stocks tweaked the same part of the human brain that was associated with sexual lust and drug abuse”, says Investopedia. It also means that sometimes the thrill of seeking money can override rationality.

Is that what happened? In hindsight, the market was overbought prior to MSCI inclusion day.

Investors did not take into account selling of frontier market funds and overpriced Pakistani companies. Additionally, the inflow did not match the outflow. Given Pakistan’s meagre weight of 0.14% in the MSCI Emerging Markets Index, it made sense that selling would occur.

But apart from all this, there has been one more major development that has cornered stock market investors with billions in their hands. It’s the fear over the future of PM Nawaz and JIT investigations. Many believed that the JIT formation was only on paper and nothing substantial would ever come of those investigations.

But the day it summoned the prime minister, a sitting, able and popular man within the party one at that, it sent shock waves across the country. While many took it as a positive, the stock market and investors’ brains froze. The market collapsed like a deck of cards and suffered another 1,855-point fall.

It did not see this coming. What does this mean for the future of the government? Will PM Nawaz be disqualified? Will these investigations result in mid-term elections? What about investment plans of companies? Will the China-Pakistan Economic Corridor (CPEC) be affected?

There was no time to ponder these questions and find answers. Investors sold and left. They were okay with some losses. They just did not want to wait till the PM was shown the door. Is that a real possibility? Perhaps. Will that mark the end of PML-N’s government? Maybe not.

Investors didn’t have time for that and neither did the market. It was just better to be safe than sorry. It was okay if some money got wiped off. Inclusion in MSCI Emerging Markets may have been a positive trigger for a year running up to the actual reclassification, but it sparked profit-taking as soon as it took effect. The budget wasn’t really a positive one for the PSX and despite Dar clarifying that the new CGT regime would kick in after July 1, not affecting shares bought before the date, the market panicked. Why shouldn’t it? Dar only happened to clarify the tax regime on the day the National Assembly approved the budget, which was almost three weeks after he made the announcement.

Trading would have, and will probably, return to being based on company fundamentals and economic outlook if the political situation were calmer and quieter. But, in Pakistan, that is really not the case for too long. If it isn’t terrorism we are fighting or power utilities, there are demons within us that ensure we are never at peace. Maybe we don’t get it because we don’t want it. Maybe we like the noise and chaos – even in happiness we celebrate through pointless aerial firing.

The writer is a business reporter based in Karachi

The trading floor cheered and investors hopped on their seats like children at arcade games to play the next round. Thousands of buy orders missed the mark as prices soared, returning to earth only when followers realised that the Panama case was still ongoing and a joint investigation team had been formed.

But there was still time before the JIT line-up would be finalised, and proceedings would get underway. So the bullish run began again, and would continue for a while.

Between the start of April 20 and until the last week of May, the index trekked from 47,603.48 points to an intra-day high of 53,127.24 on May 25. It closed lower that day as profit-taking ahead of the federal budget announcement put investors in caution mode, but not before the KSE-100 Index (a benchmark for market performance) gave a phenomenal 11.6% return in just over a month. Market capitalisation crossed Rs100 trillion and the KSE-100 touched fresh highs more times than one could keep track.

It collapsed by over 2,200 points on June 1 for the largest drops in PSX history in terms of points, before settling 1,800 lower. Close to 4% were shaved off on one day and that was just the benchmark. Many investors would have lost close to 5% as well

Even Finance Minister Ishaq Dar did not want to let go of this opportunity and, like a proud father would do, ensured his peers in the National Assembly heard of the achievements.

What happened after is a completely different story.

The budget announcement did not go down well with stock market investors. An increase in Capital Gains Tax rates when officials of the Pakistan Stock Exchange (PSX) were negotiating otherwise sent investors reaching for the panic button. For the following week, the index retreated and went near the 48,500 level.

But what transpired on June 1, the day Pakistan officially became part of MSCI Emerging Markets Index, sent everyone into shock. After a year of patience, the reclassification day saw a bloodbath. Stocks hit their lower limits (a maximum decrease of 5% before prices are stopped from going further down to avoid a crash) and investors ran for cover.

Foreign inflows, which were eagerly awaited, had arrived to the tune of half a billion dollars. It was pretty much what the market was expecting. But the outflow by foreign investors who offloaded their shares more than outmatched the buying and the KSE-100 Index, with all its valour, could not withstand the pressure.

It collapsed by over 2,200 points on June 1 for the largest drops in PSX history in terms of points, before settling 1,800 lower. Close to 4% were shaved off on one day and that was just the benchmark. Many investors would have lost close to 5% as well. In context, if you lose close to 5% of your savings in six hours, that is saying something.

What were the reasons behind the sea of red that day? We knew that foreign investors who track frontier markets would pull out since Pakistan moved to the emerging markets index. We knew that some profit-taking was bound to happen as euphoria over the reclassification settled. We knew that the budget announcement did not please the market too much. So why the surprise?

Because, like all money matters, no matter how much you prepare and plan, you can never be sure how everyone else would react. An associate professor at Stanford discovered in 2004 that “trading stocks tweaked the same part of the human brain that was associated with sexual lust and drug abuse”, says Investopedia. It also means that sometimes the thrill of seeking money can override rationality.

Is that what happened? In hindsight, the market was overbought prior to MSCI inclusion day.

Investors did not take into account selling of frontier market funds and overpriced Pakistani companies. Additionally, the inflow did not match the outflow. Given Pakistan’s meagre weight of 0.14% in the MSCI Emerging Markets Index, it made sense that selling would occur.

But apart from all this, there has been one more major development that has cornered stock market investors with billions in their hands. It’s the fear over the future of PM Nawaz and JIT investigations. Many believed that the JIT formation was only on paper and nothing substantial would ever come of those investigations.

But the day it summoned the prime minister, a sitting, able and popular man within the party one at that, it sent shock waves across the country. While many took it as a positive, the stock market and investors’ brains froze. The market collapsed like a deck of cards and suffered another 1,855-point fall.

It did not see this coming. What does this mean for the future of the government? Will PM Nawaz be disqualified? Will these investigations result in mid-term elections? What about investment plans of companies? Will the China-Pakistan Economic Corridor (CPEC) be affected?

There was no time to ponder these questions and find answers. Investors sold and left. They were okay with some losses. They just did not want to wait till the PM was shown the door. Is that a real possibility? Perhaps. Will that mark the end of PML-N’s government? Maybe not.

Investors didn’t have time for that and neither did the market. It was just better to be safe than sorry. It was okay if some money got wiped off. Inclusion in MSCI Emerging Markets may have been a positive trigger for a year running up to the actual reclassification, but it sparked profit-taking as soon as it took effect. The budget wasn’t really a positive one for the PSX and despite Dar clarifying that the new CGT regime would kick in after July 1, not affecting shares bought before the date, the market panicked. Why shouldn’t it? Dar only happened to clarify the tax regime on the day the National Assembly approved the budget, which was almost three weeks after he made the announcement.

Trading would have, and will probably, return to being based on company fundamentals and economic outlook if the political situation were calmer and quieter. But, in Pakistan, that is really not the case for too long. If it isn’t terrorism we are fighting or power utilities, there are demons within us that ensure we are never at peace. Maybe we don’t get it because we don’t want it. Maybe we like the noise and chaos – even in happiness we celebrate through pointless aerial firing.

The writer is a business reporter based in Karachi