Why should we be worried about a widening trade deficit, in which our imports outstrip our exports? Pakistan’s exports fell 9% to $4.68 billion in the first quarter from $5.14 billion in the same period last fiscal year. The imports went up 10.7% to $11.74 billion from $10.61 billion, according the Pakistan Bureau of Statistics. This meant that we could not take advantage of any potentials savings from the plunge in global oil prices because exports declined and non-oil imports rose. It seems like macro-economic reforms and trade and investment policies pledged by the government have been missing from its political agenda.

When we assess a political economy, we see trade balance as a pivotal target of development policy whenever a government takes over. A deficit is often viewed as an indicator of policy failure because it exacerbates problems in shaping the macroeconomy and constrains savings and investment. This is reflected in the overall economic planning of Pakistan that has been moving towards more foreign aid and dependence. Paradoxically, our government’s target to get back on track for economic growth has failed to factor in a constant decline of exports (mostly due to non-oil imports and passive demand internationally particularly after Brexit).

Pakistan was a pioneer from among South Asian economies as it liberalized its economy for diversification through an import substitution policy with the intention of arresting its deteriorating macroeconomic performance in the 1990s. The economic theory of trade liberalization posits that outward-looking trade policies are one of the keys to development as they allow countries to exploit their comparative advantage. Unfortunately, comparative advantages have not been achieved by Pakistan except in textiles where now we have another competitor i.e. Bangladesh. No measures have been taken to harness the benefits of trade liberalization which requires infrastructure and social mechanisms of transferring knowledge and technology, learning by doing, human capital formation.

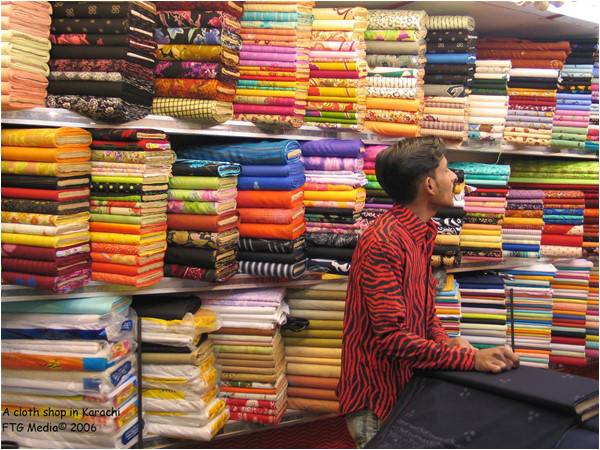

Pakistan should take advantage of the fact that China is no longer competing in the global textile market due to rising labour costs. Our textile industry has been a major source of earnings with the lion’s share of our readymade garments, bed linen etc. going to the US, EU, Canada and Japan. In Japan and Canada, Pakistan faces some restrictions in the shape of quotas but the EU offered us trading opportunities under Generalized Schemes of Preferences (GSP) from January 2014. This means almost zero duties on two-thirds of all product categories, aimed at helping Pakistan with sustainable development. This did require Pakistan to ratify and implement 27 core international conventions on human and labour rights, environmental protection and good governance. But we were restricted by the regulatory environment, high costs of doing business, high utility costs, power shortages and complex regulation with infrastructure bottlenecks. We could not exploit the GSP facilitation. Economic managers were indifferent. Textiles declined 15% this financial year. Textiles and clothing account for 75% of Pakistan’s exports to the EU, but relying on just one sector of the economy is risky. GSP should have been used to push diversification.

According to the State Bank of Pakistan, foreign direct investment for the first three months of the current fiscal year (July-Sept) has declined 38%. This runs contrary to the government’s claim that $46 billion will pour in for the China-Pakistan Economic Corridor, which will depend on prerequisites for external investment set by the Chinese. As a matter of fact, this comes as a concern in the latest IMF review, which advises the government to take policy measures on the cost of production as well as bring an overvalued rupee to market value.

The answer to fixing declining trade and investment lies in strategic trade policy. According to it, domestic firms should integrate with international firms that are equipped with the latest technology and train their workers. Strategic trade requires state intervention for industries with a focus on innovation and sophistication of products. This would mark a transition from “factor driven” to “efficiency driven” based on research and technology.

For diversification and increase in trade volume, Pakistan has to have a strategic trade policy in place if it intends to meet the huge target of export volume of $35 billion annually, which has been revised to $50 billion for 2018.

The Ministry of Commerce has developed a Strategic Trade Policy Framework (2015-2018) whose key enablers include competitiveness, compliance to standards, policy environment, market access. This looks like a smart vision but will not be enough to expand trade and attract FDI without an enabling environment that promotes entrepreneurship and innovation. Its success has already been contained by excluding the business community. They are irked over being ignored when the policy was framed. The government apparently failed to conduct an in-depth analysis on the need for strategic trade in different sectors.

Of course, a small economy like Pakistan will have great difficulty reaching the world market despite its potential because of its size. Boosting exports amid plummeting demand due to a global slowdown is a huge task. This merits a pragmatic approach with a liberalized regime that supports diversification. Incentives need to be given and a domestic business climate should be nurtured to allow for rapid exports other than those from traditional sectors. Focusing on the information gap and removing cost obstacles can exploit the potential to diversify. Higher duties, taxes and levies are also drawbacks as they work in favour of big business whereas more support is needed by infant and emerging industries. Despite tall claims, multiple sectors such as pharmaceuticals, leather and fisheries, surgical goods and cutlery etc. cannot compete in the international market. As far as the subsidy or tariff protection of the agriculture sector or manufacturing industry, is concerned, indirectly it adds to the burden on the growth of other sectors of the economy.

A fundamental rethinking in our economic approach is required. Expanding services relative to exports is critically needed. Though the endogenous growth model was initially developed for advanced countries with technological advancements and a strategic approach to trade, it is equally adoptable by a developing country like Pakistan.

The diversification of trade, which rarely attracts our policy makers’ attention, and development led by services exports such as tourism are key to diversification not only within the tourism industry but outside this sector as we have a lot of natural endowments to capitalize on. We need to consider the promotion of services-driven diversification for our economic growth with the building an appropriate domestic regulatory framework, so that the private sector can be encouraged.

Dr. Noor Fatima is the author of ‘Debt Dependence’ and an assistant professor at the Department of International Relations and Political Science, International Islamic University

When we assess a political economy, we see trade balance as a pivotal target of development policy whenever a government takes over. A deficit is often viewed as an indicator of policy failure because it exacerbates problems in shaping the macroeconomy and constrains savings and investment. This is reflected in the overall economic planning of Pakistan that has been moving towards more foreign aid and dependence. Paradoxically, our government’s target to get back on track for economic growth has failed to factor in a constant decline of exports (mostly due to non-oil imports and passive demand internationally particularly after Brexit).

Pakistan was a pioneer from among South Asian economies as it liberalized its economy for diversification through an import substitution policy with the intention of arresting its deteriorating macroeconomic performance in the 1990s. The economic theory of trade liberalization posits that outward-looking trade policies are one of the keys to development as they allow countries to exploit their comparative advantage. Unfortunately, comparative advantages have not been achieved by Pakistan except in textiles where now we have another competitor i.e. Bangladesh. No measures have been taken to harness the benefits of trade liberalization which requires infrastructure and social mechanisms of transferring knowledge and technology, learning by doing, human capital formation.

Why textile exports dropped this year

Pakistan should take advantage of the fact that China is no longer competing in the global textile market due to rising labour costs. Our textile industry has been a major source of earnings with the lion’s share of our readymade garments, bed linen etc. going to the US, EU, Canada and Japan. In Japan and Canada, Pakistan faces some restrictions in the shape of quotas but the EU offered us trading opportunities under Generalized Schemes of Preferences (GSP) from January 2014. This means almost zero duties on two-thirds of all product categories, aimed at helping Pakistan with sustainable development. This did require Pakistan to ratify and implement 27 core international conventions on human and labour rights, environmental protection and good governance. But we were restricted by the regulatory environment, high costs of doing business, high utility costs, power shortages and complex regulation with infrastructure bottlenecks. We could not exploit the GSP facilitation. Economic managers were indifferent. Textiles declined 15% this financial year. Textiles and clothing account for 75% of Pakistan’s exports to the EU, but relying on just one sector of the economy is risky. GSP should have been used to push diversification.

According to the State Bank of Pakistan, foreign direct investment for the first three months of the current fiscal year (July-Sept) has declined 38%. This runs contrary to the government’s claim that $46 billion will pour in for the China-Pakistan Economic Corridor, which will depend on prerequisites for external investment set by the Chinese. As a matter of fact, this comes as a concern in the latest IMF review, which advises the government to take policy measures on the cost of production as well as bring an overvalued rupee to market value.

The answer to fixing declining trade and investment lies in strategic trade policy. According to it, domestic firms should integrate with international firms that are equipped with the latest technology and train their workers. Strategic trade requires state intervention for industries with a focus on innovation and sophistication of products. This would mark a transition from “factor driven” to “efficiency driven” based on research and technology.

For diversification and increase in trade volume, Pakistan has to have a strategic trade policy in place if it intends to meet the huge target of export volume of $35 billion annually, which has been revised to $50 billion for 2018.

The Ministry of Commerce has developed a Strategic Trade Policy Framework (2015-2018) whose key enablers include competitiveness, compliance to standards, policy environment, market access. This looks like a smart vision but will not be enough to expand trade and attract FDI without an enabling environment that promotes entrepreneurship and innovation. Its success has already been contained by excluding the business community. They are irked over being ignored when the policy was framed. The government apparently failed to conduct an in-depth analysis on the need for strategic trade in different sectors.

Of course, a small economy like Pakistan will have great difficulty reaching the world market despite its potential because of its size. Boosting exports amid plummeting demand due to a global slowdown is a huge task. This merits a pragmatic approach with a liberalized regime that supports diversification. Incentives need to be given and a domestic business climate should be nurtured to allow for rapid exports other than those from traditional sectors. Focusing on the information gap and removing cost obstacles can exploit the potential to diversify. Higher duties, taxes and levies are also drawbacks as they work in favour of big business whereas more support is needed by infant and emerging industries. Despite tall claims, multiple sectors such as pharmaceuticals, leather and fisheries, surgical goods and cutlery etc. cannot compete in the international market. As far as the subsidy or tariff protection of the agriculture sector or manufacturing industry, is concerned, indirectly it adds to the burden on the growth of other sectors of the economy.

A fundamental rethinking in our economic approach is required. Expanding services relative to exports is critically needed. Though the endogenous growth model was initially developed for advanced countries with technological advancements and a strategic approach to trade, it is equally adoptable by a developing country like Pakistan.

The diversification of trade, which rarely attracts our policy makers’ attention, and development led by services exports such as tourism are key to diversification not only within the tourism industry but outside this sector as we have a lot of natural endowments to capitalize on. We need to consider the promotion of services-driven diversification for our economic growth with the building an appropriate domestic regulatory framework, so that the private sector can be encouraged.

Dr. Noor Fatima is the author of ‘Debt Dependence’ and an assistant professor at the Department of International Relations and Political Science, International Islamic University